Join Our Telegram channel to stay up to date on breaking news coverage

The argument between fans of gold and Bitcoin has continued to rage on as time progresses. So far, both sides are not ready to yield to the other in this tussle for supremacy.

Now, in the wake of Bitcoin being touted as a haven for stock trading investors thanks to the instability of traditional markets in recent times, one of the most popular old enthusiasts has come out to deny the notion that the premier crypto-asset could ever live up to such hype.

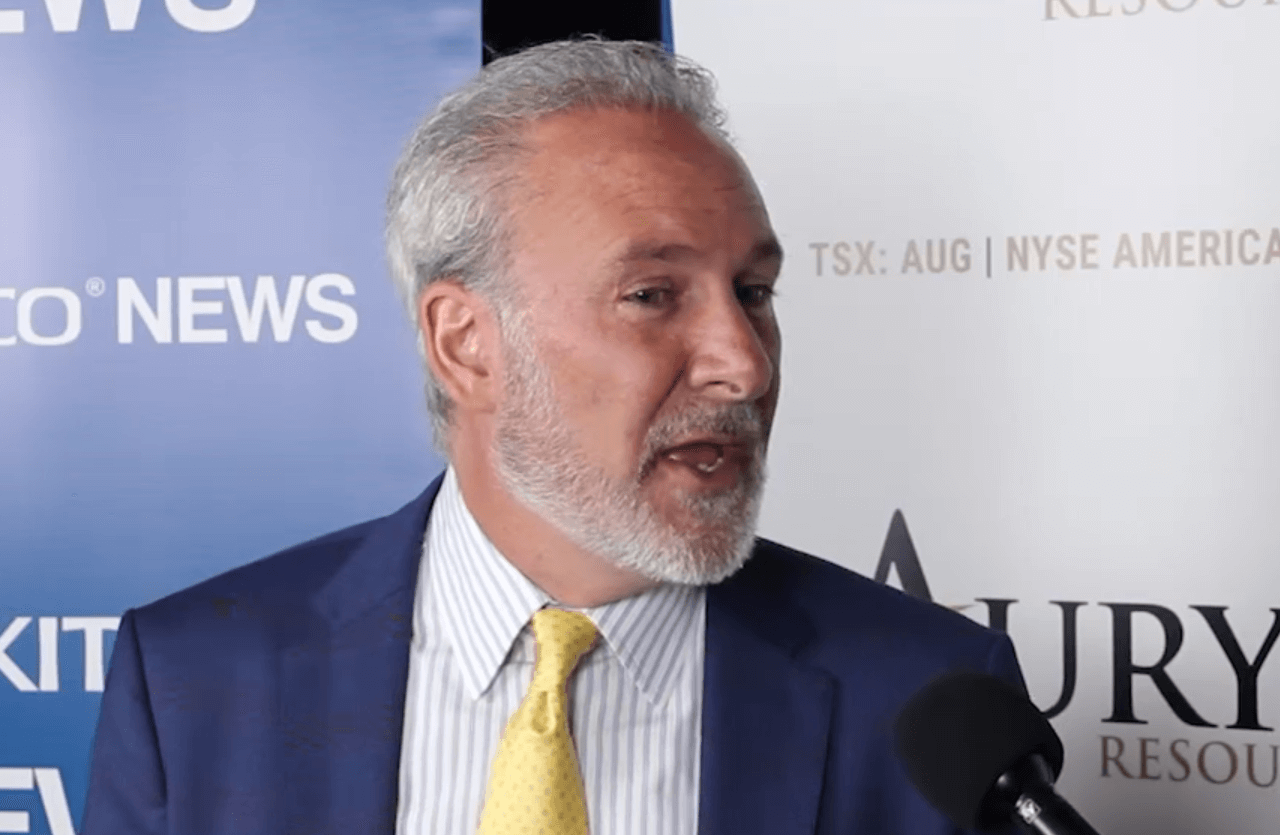

Yesterday, Peter Schiff, the chief executive of brokerage firm Euro Pacific Capital and poplar Bitcoin basher, took to Twitter to declare that Bitcoin has failed in its attempt to prove as a haven for investors. In his tweet, Schiff pointed out that Bitcoin had fallen below the $10,000 again, marking the significant drop as conclusive proof that Bitcoin couldn’t possibly hedge against volatility.

In part, he wrote, “Bitcoin has again failed the safe haven test. On Friday, as escalating trade tensions sent global stock markets plunging, investors sought refuge in monetary safe havens. The Japanese yen, Swiss franc, and especially gold all moved higher. Yet Bitcoin plunged by more than stocks!”

For proper clarity, Schiff was attacking the notion that Bitcoin could help safeguard the assets and interests of investors who were more comfortable with just sitting out the current tensions between the United States and China over tariffs and other economic indexes.

Since last Thursday Bitcoin has lost more value than any of the major stock market indexes, while gold and silver have gone up. You can keeping looking in the rear view mirror while ignoring what's happening right in front of you!

— Peter Schiff (@PeterSchiff) August 28, 2019

For the most part, Bitcoin has actually done a laudable job of keeping its head up. As Forbes reported earlier this week, the volatility in the Bitcoin network has slipped to its lowest point in two months, while its monthly range (the difference between its highest and lowest points in a month) fell to its lowest point since March as well.

The price of Bitcoin has also done rather well, especially in the face of attacks from several institutions and even the White House. Both U.S. President Donald Trump and Treasury Secretary Steve Mnuchin have sounded their disapproval of cryptocurrencies within the past month, but given the redundant nature of their criticisms, Bitcoin’s price merely trudged on.

However, it would seem that Schiff is only concerned about the Bitcoin trading price, and he has been more than happy to harp on this in a bid to prove that the asset isn’t as much a safe haven as other asset classes (of course, including gold).

Schiff’s argument could also be an attempt by a believer to help his beloved asset, as it was recently hit with allegations of fraud and counterfeiting. Earlier this week, Reuters reported that banking giant JPMorgan Chase had discovered fake gold coins in its vaults; a development which sparked criticism from many in the crypto space.

Several crypto enthusiasts have called out gold for being susceptible to counterfeiting, while Bitcoin, on the other hand. Doesn’t need to ever worry about the problem.

This isn’t to say that gold is doing rather badly. The asset reached a trading price of $1,540 this week; its highest point ever against the Euro. So, the tale continues; while both gold and Bitcoin continue to slug it out in the ring (or, in this case, on the charts), the cheerleaders and fans continue to heckle and jeer from the sidelines. Interesting times indeed.

Join Our Telegram channel to stay up to date on breaking news coverage