Join Our Telegram channel to stay up to date on breaking news coverage

Bitcoin halving in July 2016 led to an increase in the number of Bitcoin wallets containing less than 1 BTC. According to data from Glassnode, the number of such accounts has increased by 100%.

More smaller wallets

Glassnode suggests that the number of Bitcoin addresses with a balance of less than 0.01 BTC has increased by 235% after the third halving when compared with the second halving. The value of 0.01 BTC is approximate $86 at this time and the numbers have exceeded by at least ten million. The addresses with a balance between 0.01 BTC and 0.01 BTC increased by 204%. The value of these holdings is between $86 and $860. The number of Bitcoin wallets with over 0.1 BTC but less than 1 BTC has also increased by 142%.

However, the number of whales has also increased in the meanwhile. Addresses holding over 1,000 BTC increased by 13.2%. The value of these accounts is around $8.6 million. The number of wallets between 100-1000 BTC, valued at $860,000, has also increased by 6.3%.

Are crypto HODLers still in the game?

In March, during the crypto crash, many speculated that the long-term BTC HODLers could be leading to a downturn in the industry. CoinTelegraph also reported that the transactions involving coins stored for less than six months may have driven the initial bull run and then the March selloff in 2020. This means that long term HODLers are still in the game and sticking to their guns.

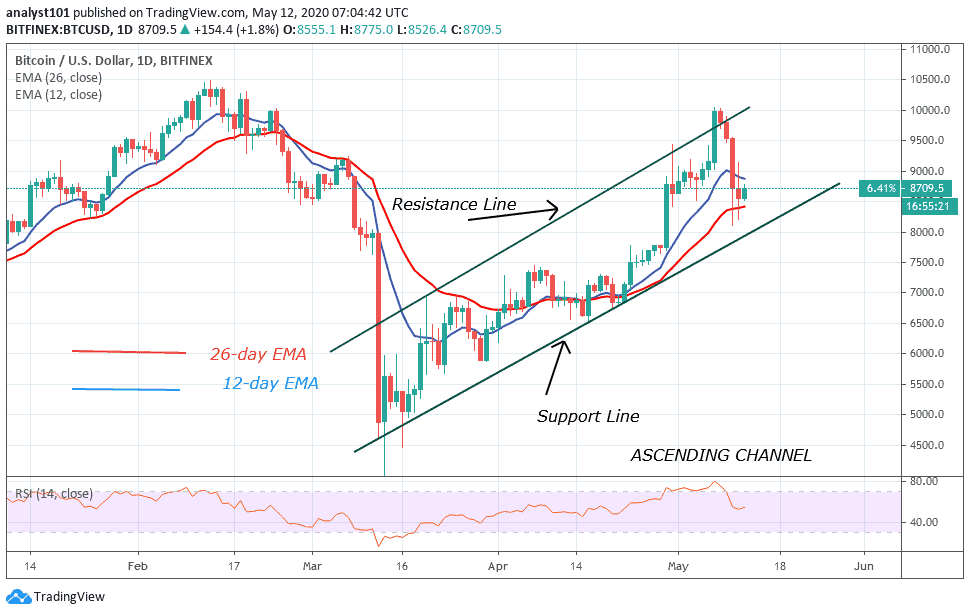

Bitcoin’s most recent halving occurred on Monday, May 11. Now, miner rewards have been reduced from 12.5 BTC to 6.25 BTC. This event is expected to boost the price of the coin. The next halving for the block rewards will occur somewhere in 2024 when they will be further reduced to 3.125 BTC.

Join Our Telegram channel to stay up to date on breaking news coverage