Join Our Telegram channel to stay up to date on breaking news coverage

The general outlook in the crypto market has returned to being optimistic. Despite the brief recovery of crypto assets, many traders are still pessimistic about the future of cryptocurrencies. Some traders speculate that the bull market’s top would likely come in after the halving.

Next Cryptocurrency To Explode

Nevertheless, identifying the next cryptocurrencies to explode is the priority. With the impact of the market downturn still influencing the trends in the market, identifying the next cryptocurrencies to explode may be technical. Thus, the analysis presented below considers several metrics.

Similarly, it summarizes Slothana’s presale offering, the meme coin project that made headlines after it raised over $500k within hours of the presale launch. Its presale performance contrasts the project with the market trends. Hence, the article explores the project’s fundamentals and other critical facts behind its famed success.

1. Wormhole (W)

Wormhole (W) Wormhole’s dramatic price dump took investors by surprise as investors watched the asset’s price fall from over $1 to $5. The value dump results from the overall performance of the crypto market, which made it easy for the new cryptocurrency to make an impressive comeback.

In the last 24 hours, Wormhole has recovered over 10% of its price, and the trading volume of the asset is gradually returning to where it was. Technical data for W’s chart also indicate further upsides ahead of Wormhole.

At the time of writing, Wormhole has a neutral Relative strength index value, which may be interpreted as the asset finding fair value. As the force of demand and supply exchange hands, the asset may end up on the price ladder. W presently has an intraday high of $0.723, suggesting a chance for a further upside.

Besides promising technical indicators, the fundamentals of the project may also contribute to its upside. Assets in the interoperability space have seen an impressive bounce back from the market decline. Wormhole is a cross-chain bridge provider allowing blockchains to seamlessly move assets across the crypto ecosystem. The project has seen increased use cases, which validates its long-term viability.

Wormhole, by the numbers.

➡️ 1B+ messages sent

Wormhole is ranked #1 by total activity among all interoperability protocols!

Read more for the data. pic.twitter.com/qem3McX4nL

— Wormhole (@wormhole) April 11, 2024

As Wormhole increases its adoption, it will see a complementary increase in the value of its native cryptocurrency, W. However, investors can exploit the recovery trend as it regains its lost grounds. Taking a position on the way up can provide an opportunity to earn short-term ROI

2. Aevo (AEVO)

Aevo holds a reputation as one of the most popular cryptocurrencies of Q1, as it topped the trading list on CoinMarketCap for several weeks. It was also one of the most mentioned cryptos on social media as influencers jumped on the trend to push its visibility.

After an impressive run that took the asset’s price from $1.39 to $4.46, Aevo has encountered a momentary pullback. The price dump in the crypto market and the retrace removes 40% from Aevo’s year-to-date high.

Notwithstanding, the token’s charts show the potential for a recovery. While the period it’ll take Aevo to return to its ATH value is unpredictable, the probability for a consistent uptrend move is relatively high. Thus, investors should keep an eye on the asset’s price action. More importantly, Aevo is addressing a unique need in the crypto market, which may contribute immensely to its future value.

Aevo's Pre-Launch Market Stats https://t.co/K5KOKk6Qyz

— Aevo (@aevoxyz) April 11, 2024

Today, Aevo posted gains of over 15%, which has helped it recoup the bulk of the value drained over the previous 48 hours. Impressively, technical analysis of the assets signals a high chance of more bullish prospects. As the declining ADI value indicates, Aevo’s current trend is weakening significantly. It also has an RSI reading that shows the asset is mainly oversold.

Even though most moving averages lead to the current price, investors can expect a crossover in the coming days. Nevertheless, it’s best to research the token further before buying. The short-term pullback is ongoing and might result in overall price fluctuation as it climbs into a consolidation phase.

3. Slothana (SLOTH)

Slothana is getting ready to drop the official launch date. The platform’s social media update indicates that the community is finally ready to hit the market and earn returns on the capital committed to the project.

🚀 Hold onto your branches, Slothana faithful! 🌿 We're gearing up to drop some major news: the official launch date is on the horizon! ⏰ Get ready to mark your calendars and set your alarms, because a countdown timer will soon grace our site. Let the hype for the Slothana…

— Slothana (@SlothanaCoin) April 14, 2024

The timing of Solana gives investors a chance to participate in a potential meme coin rally. It particularly favors investors who missed out on earlier meme coin booms that pushed the prices of meme cryptos by nearly 500%. The return of the meme culture may be triggered by the confluence of Doge Day and the halving event.

The presale offering is still open, and investors can purchase 10,000 SLOTH at 1 SOL. The best part is that the crypto market is at an overall discount since prices of assets are down by over 20%. The market will return on track in the coming weeks, and prices will fall again.

Hence, buying presents the best bet for degen investors considering taking positions in the meme coin sector ahead of the incoming rally. Updates about the Sothana and new developments are often posted on its official Twitter handle. Similarly, the presale page offers information about how to participate in the presale offering.

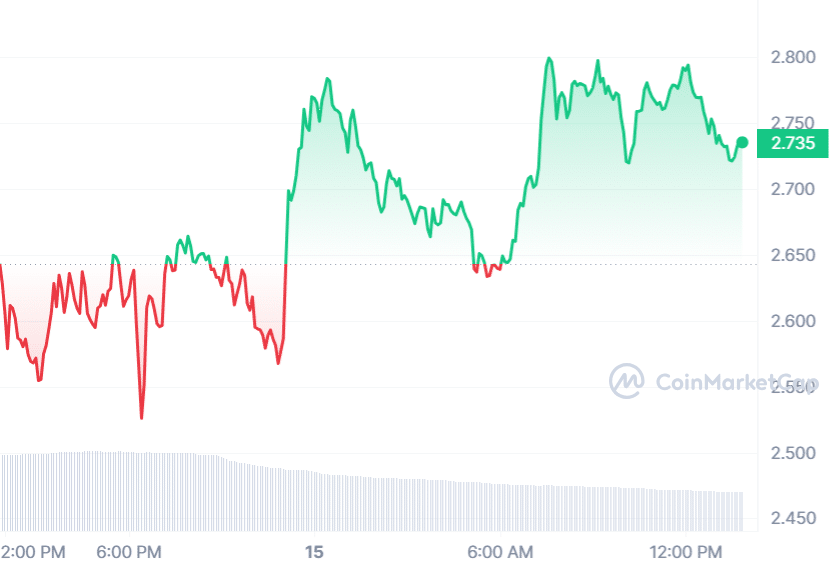

4. Stacks (STX)

Bitcoin recovery has paved the way for assets in its ecosystem. Stacks lost over 20% of its value to the recent market downturn. It suffered a price dump that brought its value from ATh of $3.18 down to $2.19. However, STX is recovering, with its price climbing towards the $3 range. The chance of crossing above the $3 level depends on the performance of BTC in the coming days.

Nonetheless, technical indicators suggest a short-term price decline, potentially leading to further bullish momentum later in the month. STX’s short-term moving averages are below its current price.

The lagging moving averages suggest the bears may force another pullback in the coming days. On the other hand, STX has MA200, which is below the current price and indicates that STX bulls can maintain the upper hand in the long run.

The Stacks Nakamoto Upgrade to become a true Bitcoin L2 🧡

– @NorthRockLP Stacks Thesis created December 1st, 2023

More about North Rock Digital 👇 pic.twitter.com/G1bQhWKgSk

— stacks.btc (@Stacks) April 14, 2024

Furthermore, the Stacks Nakamoto upgrade is on the way, and it’s another catalyst that might propel Stacks to its true identity as the layer two platform for Bitcoin. There are claims that the upgrade would incentivize users to explore applications within the STX ecosystem. Ultimately, the upgrade would shift the value of STX permanently above the $3 range.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage