Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market opened the week with a minor price uptick as new cryptocurrency releases, listings, & presales today witnessed increased investor attention. The global crypto market cap increased by 0.67% over the past 24 hours, reaching $2.45T. The total crypto market volume grew by 44.48% in the same time frame to $71.57B.

InsideBitcoins provides an overview of new digital assets assets fit for consideration in the current market outlook. This article curates details on their features, utilities, and market outlook.

New Cryptocurrency Releases, Listings, and Presales Today

Drift is a decentralized exchange (DEX) operating on the Solana blockchain, which facilitates trading in both perpetual and spot markets. Meanwhile, BounceBit is in the process of developing a BTC restaking infrastructure to establish a foundational layer for a variety of restaking products. On another front, the Venom blockchain is designed to address key issues that have impeded the widespread adoption of decentralized applications, such as slow transaction confirmations, high fees, and limited scalability.

Following WienerAI’s launch in mid-April, the project raised over $7.5 million, highlighting investor optimism regarding the WAI token’s potential growth. Besides, Bitcoin and Ethereum have remained stable, while Dogecoin experienced a spike after Biden decided to bow out of the presidential race.

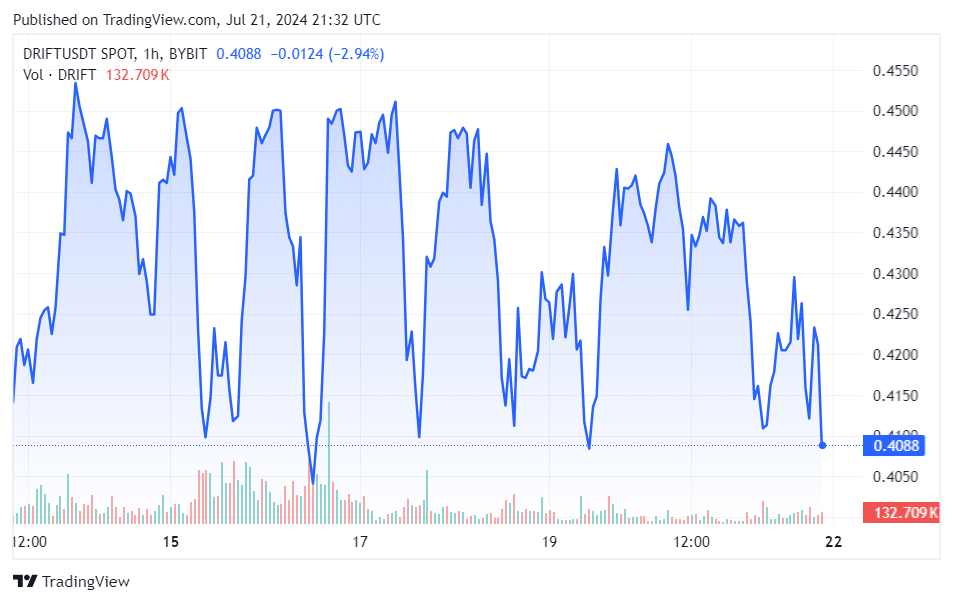

1. Drift (DRIFT)

Drift is a decentralized exchange (DEX) operating on the Solana blockchain. It facilitates trading in perpetual and spot markets, offering leverage up to 10x. The platform supports trading in both pre-launch markets and established tokens, thereby enhancing capital efficiency by allowing a variety of assets to be used as collateral.

Drift provides several tools to manage positions efficiently. For instance, users can trade markets with up to 10x leverage for perpetual futures and swaps. Similarly, spot trading allows trading assets with up to 5x leverage, and token swaps enable swapping any pair with up to 5x leverage.

Furthermore, Drift aims to balance capital efficiency and asset protection through a sophisticated cross-margined risk engine. This includes using collateral for perpetual futures and spot trading, earning through lending deposited tokens, which also serve as collateral for swaps, and restricting borrowing to ensure borrowers have adequate collateral, with multiple safety measures in place.

Additionally, users can generate yield through several options. For example, lending and borrowing allow users to earn yield on deposits. On the other hand, insurance fund staking lets users stake assets in a vault to earn from exchange fees. Moreover, market maker rewards offer an opt-in market-making Alpha Program, while backstop AMM liquidity (BAL) provides leveraged liquidity to earn yield.

Pre-market valuation puts $CLOUD at $0.3287 ☁️

What will the price be an hour after launch? 👀

Best prediction gets 99 DRIFT 👇

— Drift Protocol (@DriftProtocol) July 16, 2024

Drift has formed several strategic partnerships. For example, Ondo Finance integrates real-world assets into Solana DeFi using tokenized treasury bills as collateral. Additionally, Circuit Trading introduces Market Maker Vaults on Drift, allowing users to utilize advanced market-making strategies.

Drift aims to provide a capital-efficient trading platform while ensuring asset protection. It supports diverse earning opportunities and offers robust tools for developers. Consequently, its strategic partnerships further enhance its capabilities in the decentralized finance ecosystem.

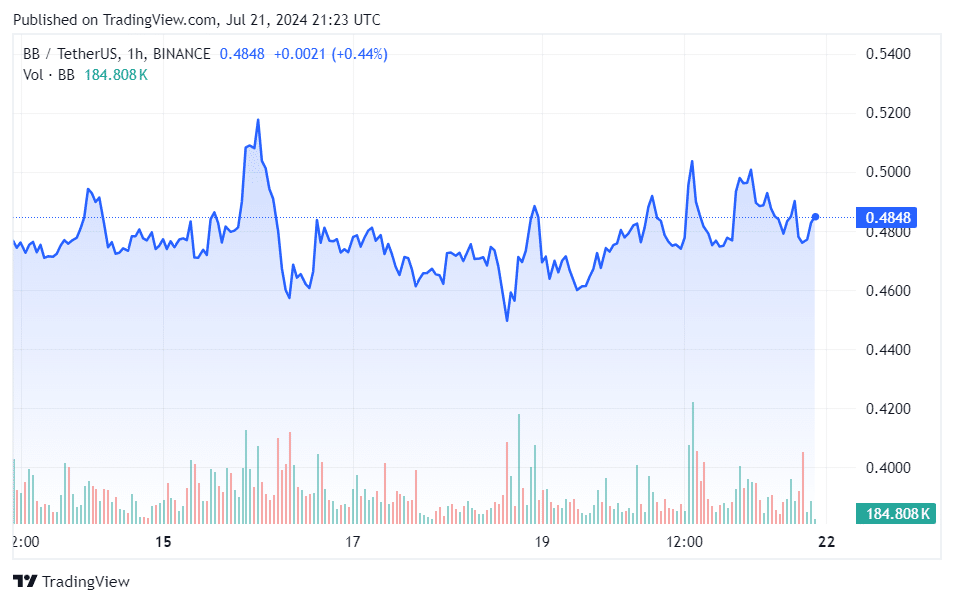

2. BounceBit (BB)

BounceBit is developing a BTC restaking infrastructure to provide a foundational layer for various restaking products. This system, secured by the regulated custody of Mainnet Digital and Ceffu, showcases a Proof-of-Stake Layer 1 network within the BounceBit ecosystem.

It utilizes a dual-token system where validators stake BTC and BounceBit’s native token, combining native Bitcoin security with full EVM compatibility. Moreover, essential infrastructure, such as bridges and oracles, is secured through restaked BTC. By integrating CeFi and DeFi frameworks, BounceBit enables BTC holders to earn yield across multiple networks.

BounceBit has actively partnered with several key players to enhance its offerings. For instance, with PolyhedraZK, BounceBit will integrate zkBridge and the Bitcoin Messaging & Token Swap protocol, which is expected to accelerate liquidity growth. This integration will facilitate the trustless bridging of assets to and from BounceBit, benefiting users by enhancing asset mobility.

In addition, the partnership with fafafa_io focuses on unlocking yield opportunities through the Telegram app, particularly in USDT. This collaboration aims to simplify access to yield generation within the Telegram platform.

The partnership with @doubler_pro will bring a new angle to strategic yield on BounceBit.

Doubler is an asset yield rights separation protocol. It captures returns via martingale strategy & distributes returns based on tokenized yield rights.

Expect more details soon. https://t.co/cvC3o52cUM pic.twitter.com/Zyl4CtfV0b

— BounceBit (@bounce_bit) July 19, 2024

Furthermore, BounceBit has formed a strategic alliance with Block Vision, a leading infrastructure provider in both the Move and EVM ecosystems. Blockvisionhq will contribute by developing the BBScan explorer and offering node, validator, and indexing services, thus strengthening BounceBit’s infrastructure.

Finally, the collaboration with doubler_pro introduces a unique approach to strategic yield on BounceBit. These partnerships demonstrate BounceBit’s commitment to actively enhancing its infrastructure and providing innovative solutions for yield generation and asset mobility.

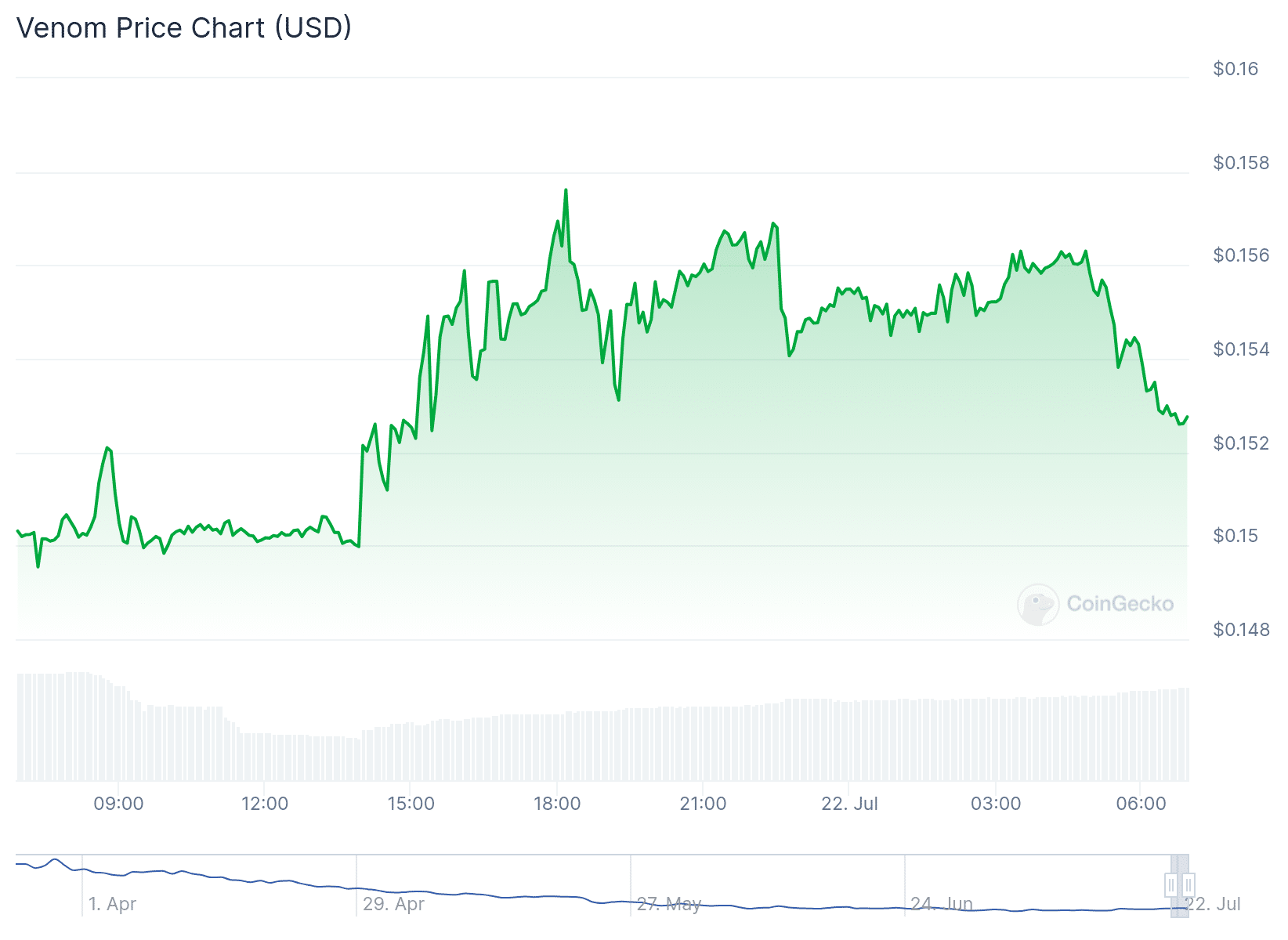

3. Venom (VENOM)

The Venom blockchain addresses key issues that hinder the widespread adoption of decentralized applications, such as slow transaction confirmations, high fees, and limited scalability. Its design aims to improve user experience and enable broader use.

One major challenge for blockchain technology is processing a high volume of transactions per second. This is especially important for public blockchains like Venom, which must simultaneously handle transactions from many users. Traditional blockchain systems often need help with this demand.

Venom addresses this with its Dynamic Sharding Protocol, which enhances performance by adjusting the network’s structure based on the load. This protocol allows for the splitting or merging of shard chains to increase transaction throughput. Each shard chain handles a specific set of contract addresses and transactions, enabling parallel processing by different validator groups.

Additionally, Venom utilizes Workchains, which are specialized blockchains for various applications. This approach supports horizontal scalability by distributing tasks across multiple blockchains, each with its validators, thereby improving overall efficiency and transaction speed.

$VENOM/USDT spot trading is now live on @deepcoin_news, reaching 10 million new users and expanding our global footprint! 🌏

🔗 Trade now!https://t.co/2glpaObCCo

Also, get ready for the upcoming VENOM/USDT Perpetual trading launch this Wednesday, July 17th at 17:00 (UTC+8). 📅 https://t.co/WGPWSCxGZB pic.twitter.com/RGtjHgDBsi

— Venom Foundation (@VenomFoundation) July 15, 2024

In terms of security, Venom strongly focuses on decentralization and protection. The blockchain employs the Venom Consensus Protocol, which combines Proof-of-Stake (PoS) with a Byzantine fault-tolerant algorithm. This setup ensures that the network can achieve consensus even if some participants are malicious, thus preserving blockchain integrity.

Rigorous auditing of smart contracts is also integral to maintaining security and trust. Hence, Venom partners with leading audit firms and provides resources for engineers to review smart contract codes. Venom’s partnerships with Choise.ai, KuCoin Ventures, United Network, and Gate Labs aim to enhance its ecosystem’s growth and innovation and support and strengthen Venom’s impact across various industries and global markets.

4. WienerAI (WAI)

WienerAI ($WAI) market entry seeks to offer crypto trading solutions by combining artificial intelligence, AI tokens, and a trading bot. This integration aims to simplify cryptocurrency trading for beginners through predictive technology.

Following the project’s launch in mid-April, it raised over $7.5 million, reflecting investor optimism about the potential growth of the WAI token. Despite bearish market conditions, the demand for WAI reflects increasing interest in the project. Importantly, the tokenomics plan, which incentivizes early investors and promotes sustainable development, supports this interest.

A major draw for investors is WienerAI’s staking rewards. During the presale, the platform offered an Annual Percentage Yield (APY) of 146% for staking WAI tokens. This has led to over 7 billion WAI tokens being staked, indicating strong investor confidence.

We raised $7.5M! This is your last chance to join before we launch 🌭🤖 pic.twitter.com/BFbbgVys3o

— WienerAI (@WienerDogAI) July 17, 2024

Moreover, WienerAI’s focus on transparency and security has earned the trust of the investor community. Besides, WAI’s technological features also enhance its attractiveness, particularly the AI-driven trading interface, which predicts market movements and provides clear analyses.

In addition, WienerAI allows seamless swaps across decentralized exchanges without fees, aligning with a decentralized philosophy. It also offers protection against Miner Extractable Value (MEV) bots, ensuring secure trading. With its presale ending in the next nine days, investors can capitalize on the token price of $0.00073 for potential future returns.

Read More

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage