Join Our Telegram channel to stay up to date on breaking news coverage

XMR Price Analysis – September 5

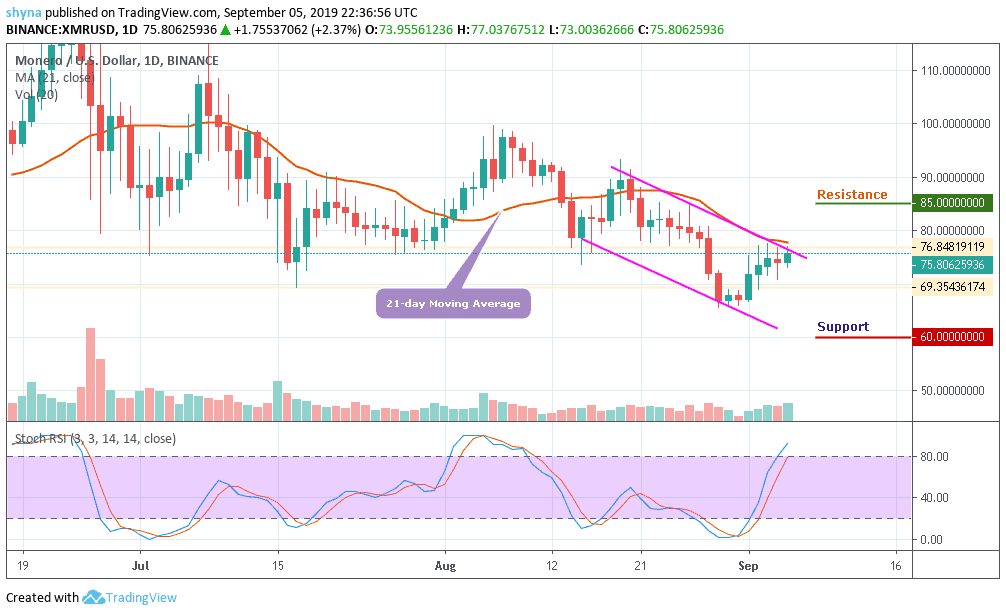

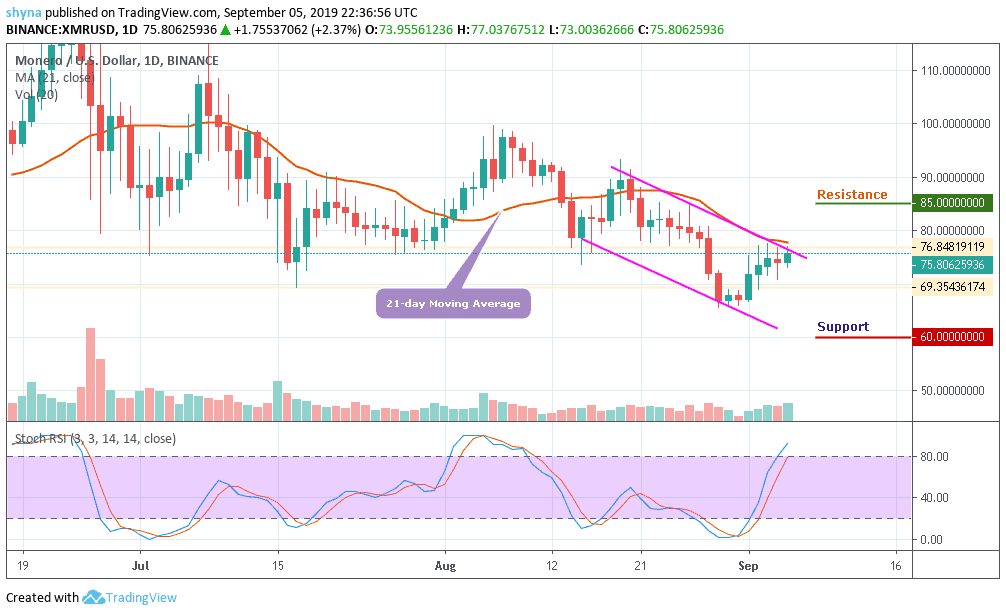

XMR/USD retreats from intraday high but stays on a green territory. The strong support is located on the approach to $65

XMR/USD Market

Key Levels:

Supply levels: $85, $90, $95

Demand levels: $60, $55, $50

Monero (XMR) is in the green zone, gaining over 3.3% of its value in recent 24 hours. Monero, now the 10th largest digital asset with the current market value of $1.3 billion is changing hands at $75.80 at the time of writing, and the intraday high registered at $76.84.

As suggested in the daily Stochastic RSI, a potential fall could hit the next key support at $60 level, touching the lower trend line. If the rally continues downward, the token could make a bottom at $55 and $50 respectively. A long position, however, may possibly shoot a price at $85 resistance level and beyond.

Most time, this wedge pattern is commonly followed by a bullish continuation. Any time from now, a bullish breakout is expected to initiate the bulls back to position. Otherwise, the bearish rally could continue.

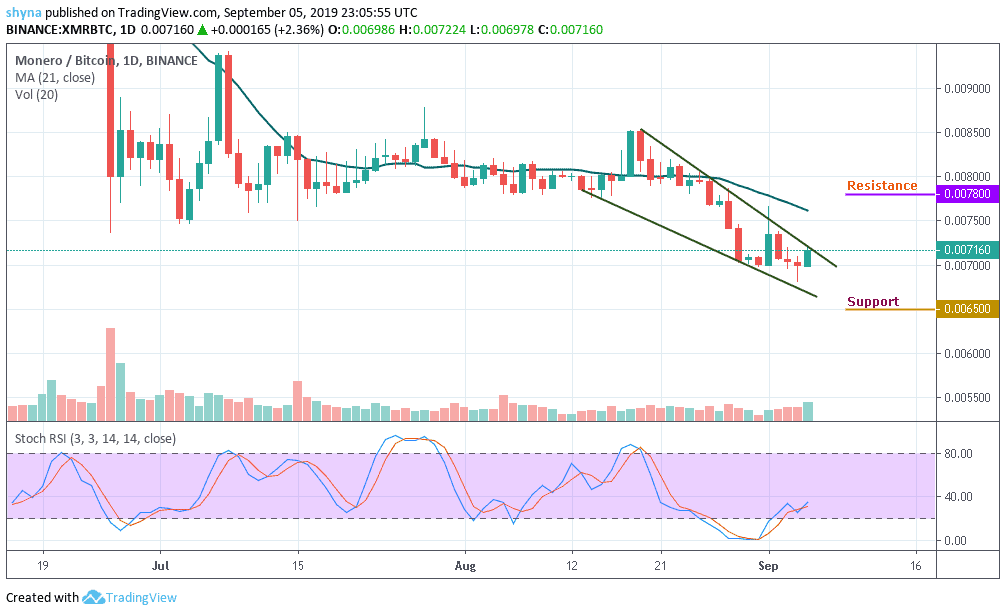

XMR/BTC Market

Against Bitcoin, XMRBTC market has been subdued with a low volatile appearance for the past 4days of trading. Currently, buying pressure is gradually heading towards 7800SAT resistance level; revealing the bulls are currently in control of the market. On the daily Stochastic RSI, buying pressure just recovered from the oversold and moves towards the 40-level; respecting the bullish movement.

However, following the downtrend, a bullish reversal is likely to visit support levels at 6500SAT, 6300SAT and 6100SAT respectively. By then, the Stochastic RSI should oscillate above the descending trend line. More so, If the price cross down the lower trend line, Monero may experience a significant drop; creating new support. At the moment, XMR is following a descending channel.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage