Join Our Telegram channel to stay up to date on breaking news coverage

In a short while, MicroStrategy became a darling of the cryptocurrency industry after it committed hundreds of millions to the asset. The decision appears to be paying off as the company has benefited from the decision thus far.

Bitcoin Boosts Q3 Results

Earlier this week, the provider of cloud-based business solutions published its financial results for Q3 2020. The firm reported strong fundamentals, backed in no small part by its decision to move to the Bitcoin standard.

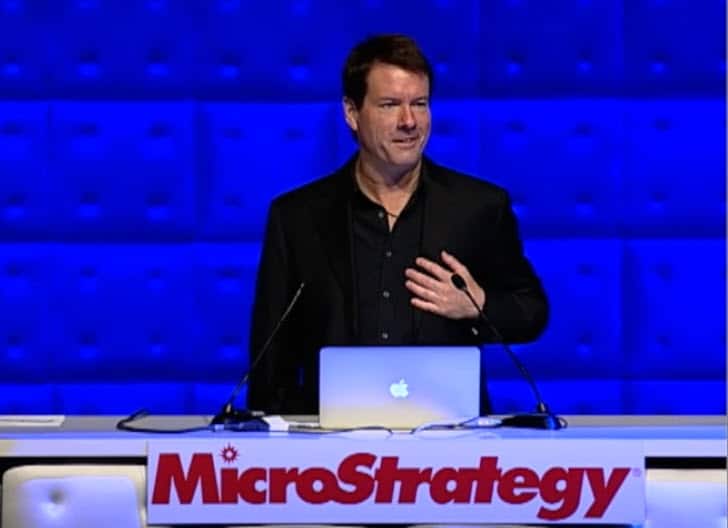

Company chief executive Michael Saylor called the results some of the best in a decade, as earnings per share hit $2.06 – much higher than the Wall Street analysts’ forecast of $0.04. The company also saw significant growth in its core business, as deferred subscription revenue and product licenses grew. The same could be said about its non-GAAP operating margin.

As expected, the elephant in the room was the firm’s decision to switch its reserves to Bitcoin, which it announced back in August. At the time, MicroStrategy stated that it was purchasing 21,454 BTC for $250 million. Days later, Saylor confirmed in a tweet that they had doubled down and bought a further $17,000 tokens, bringing their Bitcoin commitment to $425 million.

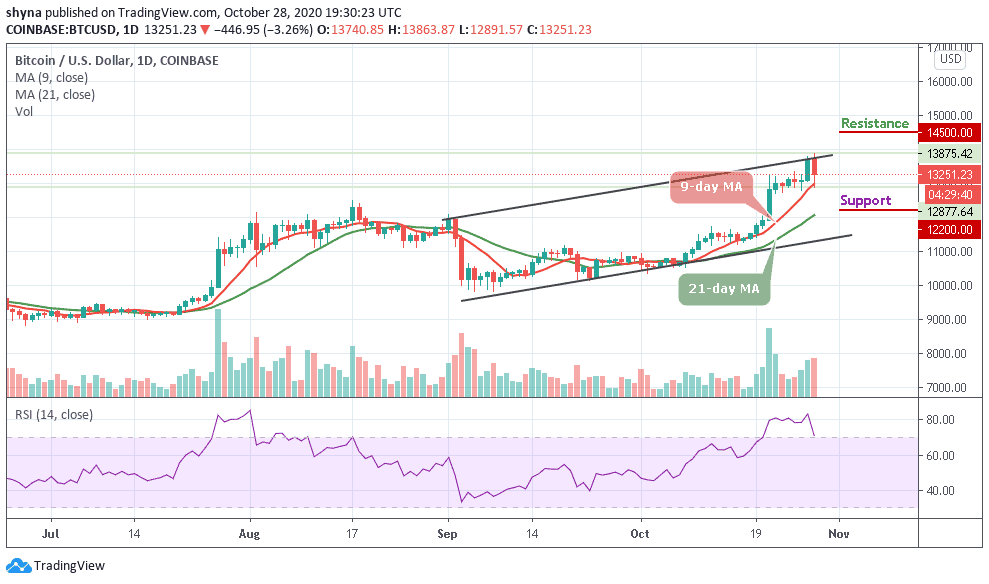

While MicroStrategy reported an impairment loss of $44.2 million from the Bitcoin investment, the fourth quarter is hot off the races already. The Bitcoin price rebounded significantly last week, buoyed primarily by top payment processor PayPal’s planned incorporation of the asset into its core business from 2021.

The Perfect Time to Move to Bitcoin

Bitcoin sits comfortably above the $13,000 mark. Given that the asset was worth about $11,500 when the company moved its reserves, it has rebounded pretty well and is now in the black.

In a statement, Saylor explained that Bitcoin is part of the company’s push to deliver long-term value to investors. He explained:

“The purchase of $425 million of bitcoin during the quarter offers the possibility of greater return potential for investors than holding such balances in cash and has increased the overall visibility of MicroStrategy in the market.”

Saylor has always shared a pragmatic approach to Bitcoin. Last month, he explained to Bloomberg that he had seen the asset’s long-term potential While he is no Bitcoin bull, he’s merely looking to capitalize on it. The CEO also shrugged off any volatility fears, explaining to the news source that he could liquidate his Bitcoin holdings at any point if he felt that the asset was standing on shaky ground.

With how well Bitcoin has performed, there’s a low likelihood that the company will liquidate anytime soon.

The Bitcoin benefits also appear to transcend just this year. Per data from independent crypto researcher Kevin Rooke, MicroStrategy has earned more from its Bitcoin investment than it did from its core business over the past three years. Rooke’s data showed that the recent price surge had moved MicroStrategy’s Bitcoin holdings to a $525 million value. In contrast, the firm’s core business has only earned it $78 million in net income since Q1 2017.

Join Our Telegram channel to stay up to date on breaking news coverage