Join Our Telegram channel to stay up to date on breaking news coverage

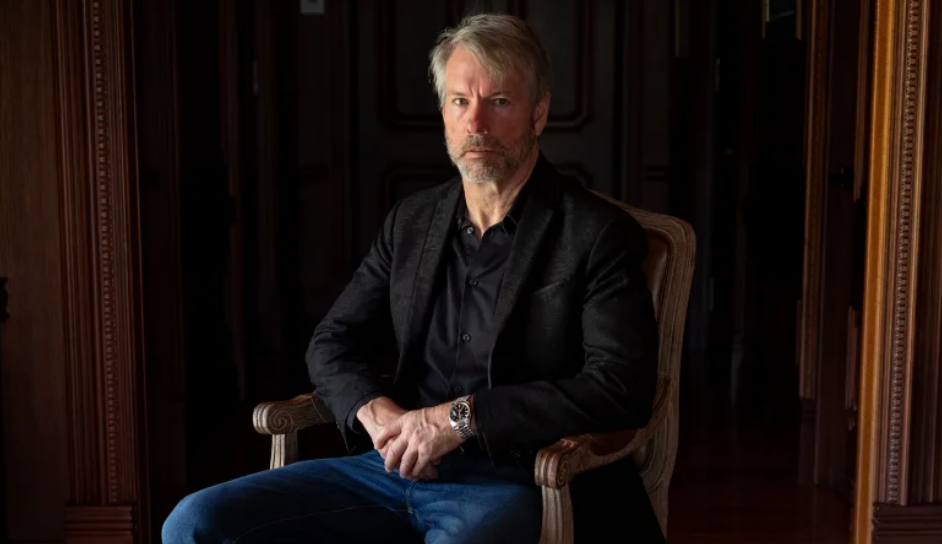

MicroStrategy co-founder Michael Saylor backtracked on comments about crypto self-custody after Ethereum’s Vitalik Buterin said he’s ”batshit insane” for suggesting investors holder their crypto with ”too big to fail” banks.

“I support self-custody for those willing and able, the right to self-custody for all, and freedom to choose the form of custody and custodian for individuals and institutions globally,” Saylor said in an Oct. 23 post on X.

Michael Saylor Remarks Triggered A Tsunami Of Criticism From Crypto Community

Saylor’s latest comments come after he advocated that investors hold their Bitcoin with regulated entities such as BlackRock and Fidelity, saying this offers investors a safer and less volatile way for them to custody their digital asset holdings.

Concerns over increased government control and centralization were exaggerated fears that mainly come from “paranoid crypto anarchists,” he said.

This ignited a tsunami of criticism from the online crypto community.

“I’ll happily say that I think Michael Saylor’s comments are batshit insane,” Buterin said in an Oct. 23 post on X.

I probably did more than most to spread the "mountain man" trope (btw I consider those remarks of mine outdated; snarks and AA changed the tradeoff space completely), and I'll happily say that I think @saylor's comments are batshit insane.

He seems to be explicitly arguing for a…

— vitalik.eth (@VitalikButerin) October 22, 2024

Some argue that custody by regulated entities like BlackRock and Fidelity has advantages because it helps crypto’s mainstream adoption.

But Ethereum co-founder Buterin is unconvinced it’s the best way forward.

“There’s plenty of precedent for how this strategy can fail, and for me it’s not what crypto is about,” he said.

Crypto was built to decentralize power, not hand it over to entities like Blackrock or Fidelity, Montana G said in a post on X.

Spot Bitcoin ETFs Gain Momentum

As the online debate around self-custody arises, spot Bitcoin ETFs (exchange-traded funds) resumed their inflow trend following net outflows on Oct. 22.

The outflows brought an end to the funds’ impressive 7-day streak, with over $2.6 billion being poured into the funds between Oct. 11 and Oct. 21, according to Farside Investor data. Yesterday, $192.4 million entered the funds.

BlackRock’s IBIT maintains a comfortable lead over the rest of the US spot Bitcoin ETFs in terms of cumulative inflows, with its total reserves standing at $25.53 billion. Fidelity’s FBTC occupies the second place in cumulative flows with its assets under management totalling $10.319 billion.

Related Articles:

- Crypto All-Stars Hurtles Past $2.6M In Presale As Meme Coin Supercycle Staking Protocol Gets Underway

- Trump McDonald’s Stunt Boosts MAGATRON Over Kamacop In FreeDum Fighters Race As Presale Blasts Past $200K In 4 Days

- Most Searched Cryptocurrencies On GeckoTerminal Today – Ginnan the Cat, Apes, Catwifhat

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage