Join Our Telegram channel to stay up to date on breaking news coverage

Recently, the crypto exchange with integrated NFT Marketplace, Crypto.com has launched the LUNA2/USDC pair in its list of cryptocurrencies allowed for trading.

On 28th May 2022, the LUNA2/USDC trading pair, designed by Terraform Labs’ CEO and co-founder Do Kwon, was launched as an attempt to revive the Terra ecosystem. The CEO plans to transform the ecosystem by using a ‘hard fork’, wherein it is definite that Terra is delinked from the present Terra blockchain but connected to a new one, and the Terra token can be changed to TerraClassic- a stable coin.

The Terra crash is due to the continuous selling on multiple exchange platforms, where tokens such as LUNA and UST have been crashing regularly. The most recent crisis has wiped their collective market cap of close to forty billion dollars.

The airdrop was one of the most anticipated launches, but it was sadly disappointing. The main reason for the Terra and Luna crash can be traced to the tokens being depegged. Pegging is the phenomenon of tying the value of an asset or currency to another currency. Depegging refers to the process of a stablecoin being detached from its original peg. Upon the two coins dipping, there was an unexpected change in the ratio of demand and supply, triggering a crash.

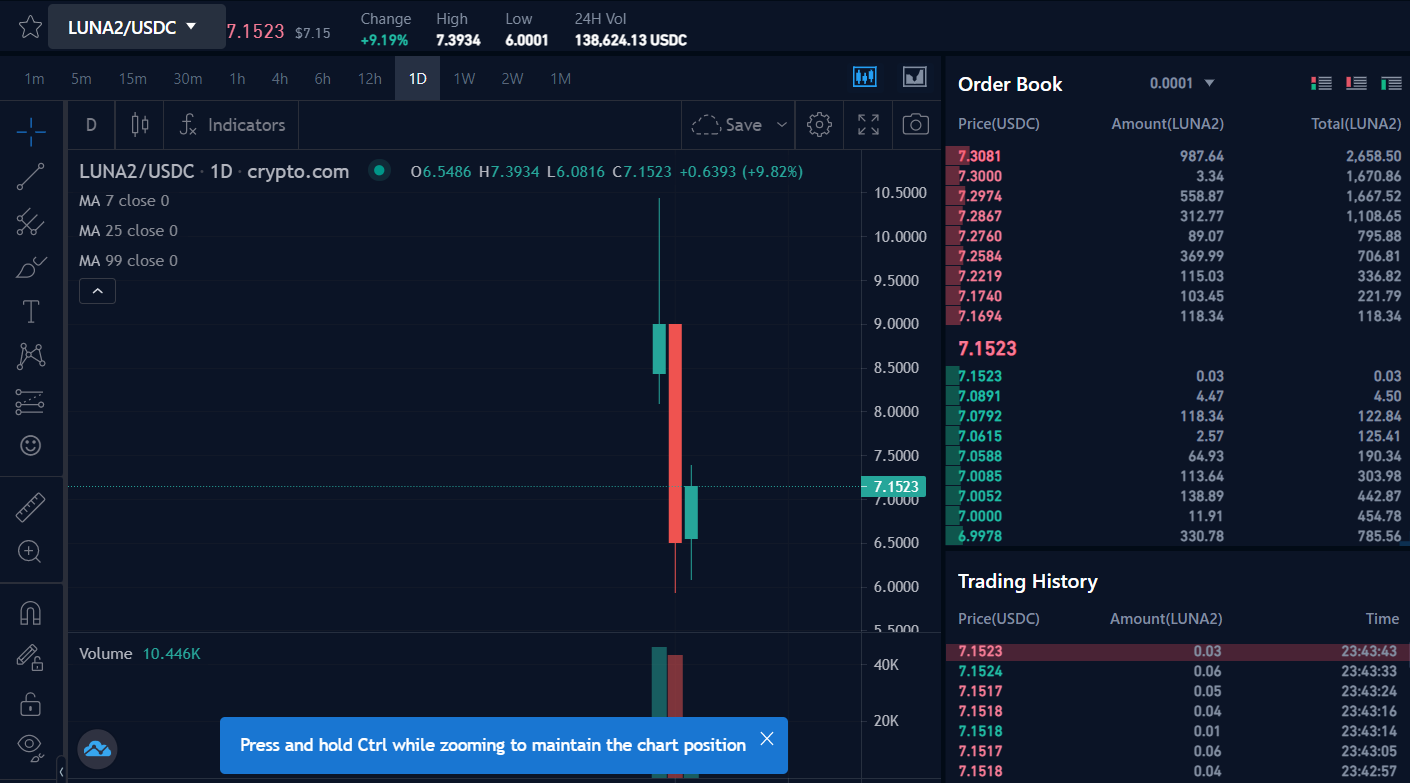

LUNA2/USDC Pair on Crypto.com Exchange

Terra’s UST was a target of depegging which led to extreme volatility in the market and widespread UST dumping. LUNA, the sister coin of UST, was also severely impacted by the UST crash and was also affected by the crisis.

The Terra stablecoin uses the algorithmic method of pegging, i.e., uses smart contracts instead of assets to back it. However, Luna 2.0 will not be using an algorithmically-backed stablecoin.

The token started off its debut with the rate of $17.8, and then gradually, Luna 2.0 reached an upswing high, with a spike close to $19.53. It is now currently priced at a modest $6.41 USD, taking a drop of 65.27%, over its lifetime, as per recent data provided by Crypto.com.

Buy LUNA 2.0 on Crypto.com Now

Your capital is at risk.

The Luna 2.0 was airdropped on Binance as LUNA/USDT and LUNA/BUSD and launched by other exchange platforms such as Crypto.com, Bybit, Kucoin, Kraken and FTX. The token hosted futures, derivatives and spot trading, gaining support from many Wallets as well. It now currently stands at a price of $6.59 on Binance, and Bybit is trading the token at a rate of $6.57. The going rate of Luna 2.0 on most platforms seems to be on similar ranges.

While most traders are hesitant to invest or trade in the token, Binance has listed the Luna 2.0 token in the Innovation Zone, a marketplace solely used for trading volatile and risky digital currencies and assets.

According to CEO Do Kwon, there is a positive outlook for the two tokens. First there will be a shock absorber which will regulate the supply of the stablecoin and prevent it from depegging again. Some remedies that have been suggested are raising capital that is close to $1.5 billion, requesting traders to shift to Anchor Protocol or keep a lock-in time frame for UST trading.

In the hope for recovery the CEO has also announced that the first Terra blockchain will be termed as Terra Classic, while the native coin, Luna will be rebranded as LUNA Classic and displayed as LUNC.

Would LUNA 2.0 Climb Above $10 Mark?

Despite the bearish nature and extreme volatility of LUNA 2.0, most analysts and spectators are expecting the token to take a bullish turn. It is possible that post the control measures are taken, the Terra ecosystem tokens will experience considerable stability and benefit from a market upswing.

It is important that for Luna 2.0 to have bullish prospects that it remains steady at a price of $6.60, otherwise a further fall could enable a correction of $5.20, keeping these factors in mind many experts believe that the token should not be sold off immediately and that it has great potential, and in a short while it may climb to close to $10.50.

Invest in LUNA 2.0 via Crypto.com Now

Your capital is at risk.

Most trade experts advise users to research and then invest in the new token, as they believe it has a brighter future than the older, Luna Classic due to the decentralization in its functioning, in the form of the Terra Luna Foundation Guard.

Read More:

Join Our Telegram channel to stay up to date on breaking news coverage