Join Our Telegram channel to stay up to date on breaking news coverage

LTC Price Prediction – February 7

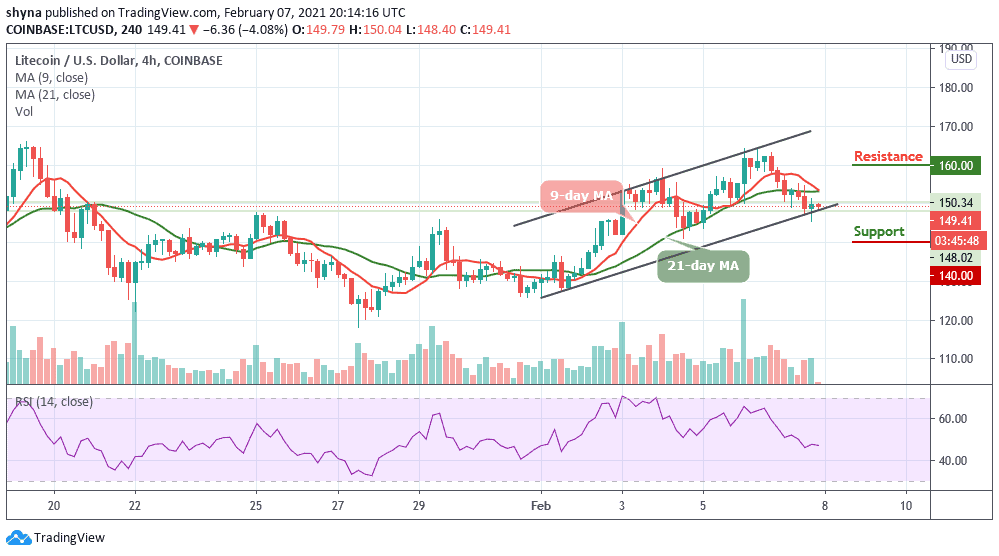

LTC/USD is currently fighting to reclaim the $160 resistance level.

LTC/USD Market

Key Levels:

Resistance levels: $160, $165, $170

Support levels: $140, $135, $130

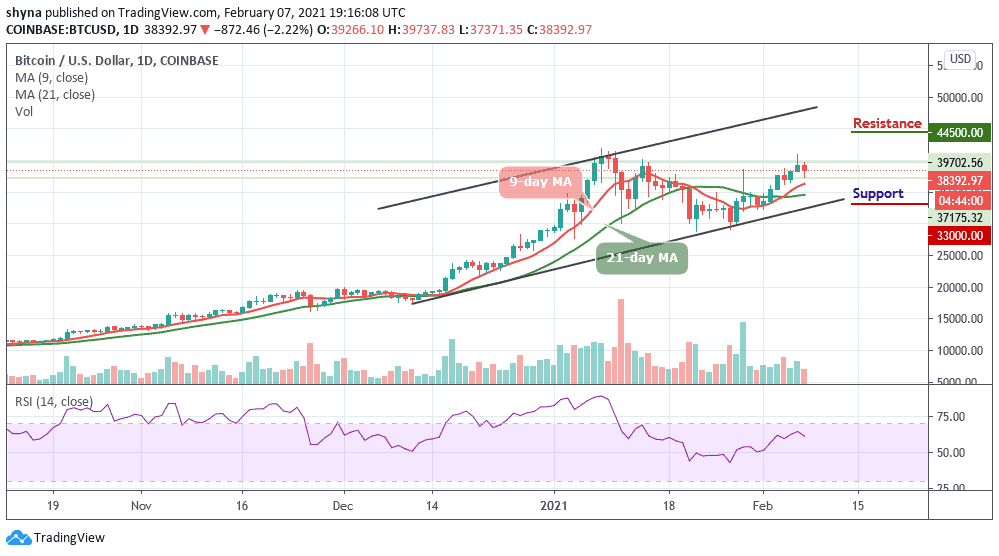

At the moment, LTC/USD is hovering at $149 following a 4.08% loss on the day. Meanwhile, the market is currently in the red, with most cryptos having succumbed to downward pressure. Bitcoin (BTC), for example, is inching closer to $39,000 support after failing to hold above $40,000. Similarly, there is a possibility of retracement towards $155 may occur before the coin gathers the strength to zoom toward the resistance of $160, $165, and $170.

What to Expect from Litecoin (LTC)

If the sellers push LTC beneath $145, the next support lies below the lower boundary of the channel. However, a further downside may come to play out within the market. Moreover, if $145 breaks, further support lies at $140, $135, and $130 levels.

According to the chart, the technical indicator RSI (14) is moving below 50-level, and if it continues to fall, the increased bearish pressure may likely drive the Litecoin price toward the lower boundary of the channel. Moreover, the signal line could drop more and may look primed for another bearish crossover signal.

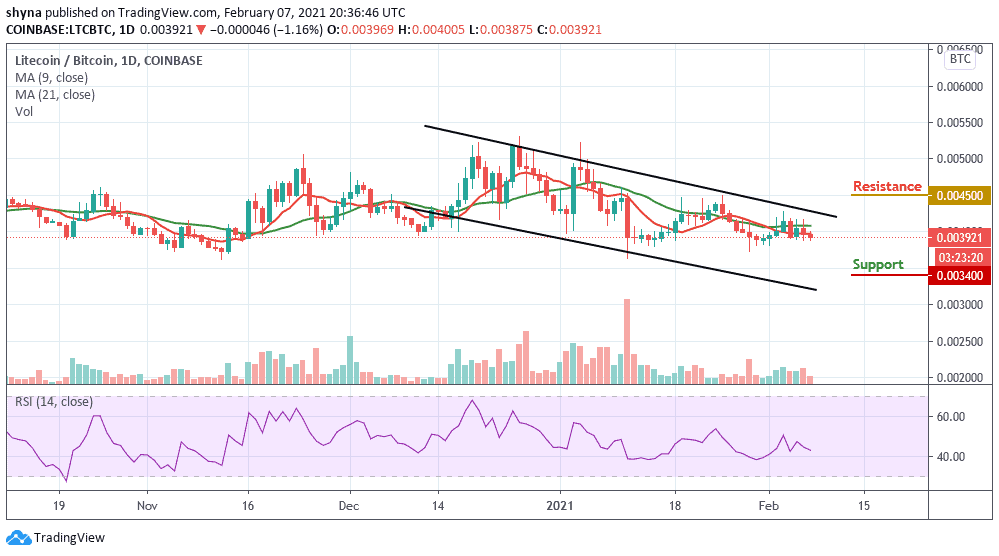

Against Bitcoin, we can see that Litecoin is following a downward trend. As the price falls, sellers are posing an additional threat for buyers to reach the support level of 0.037 BTC where the nearest target is located. However, an eventual break below the lower boundary of the channel may cause Litecoin to collapse.

Furthermore, the continuation of the downtrend could hit the main support at 0.036 BTC before falling to 0.034 BTC and below. More so, the buyers may likely push the market above the 9-day and 21-day moving averages to reach the potential resistance at 0.045 BTC and above if a rebound plays out. The RSI (14) is still focusing on the downside, indicating that the sellers are in control.

Join Our Telegram channel to stay up to date on breaking news coverage