Join Our Telegram channel to stay up to date on breaking news coverage

LTC Price Prediction – October 22

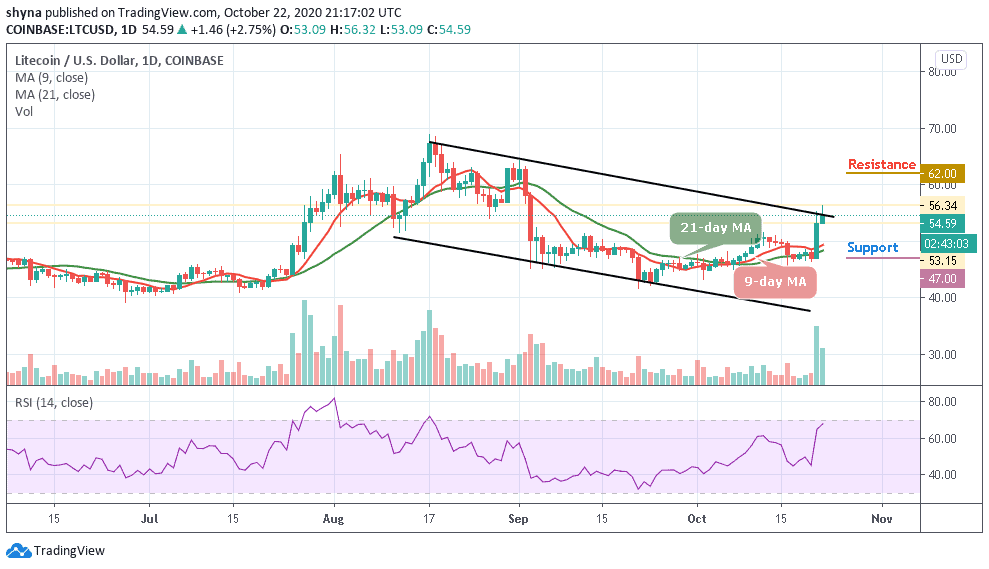

The Litecoin price escalates but a break above $56 is expected to pull Litecoin towards $60 in the coming trading sessions.

LTC/USD Market

Key Levels:

Resistance levels: $51, $52, $54

Support levels: $44, $42, $40

At the time of writing, LTC/USD is seen trading above the hurdle at $54; a move that could easily pave the way for gains above $56 and towards $60. However, of interest to the bulls is the upward-pointing technical indicator RSI (14). Therefore, if the RSI (14) keeps moving north, it may show that the bullish grip is getting stronger.

What to Expect from Litecoin (LTC)

The Litecoin (LTC) is currently holding the ground at above the 9-day and 21-day moving averages after a major recovery from $46.96. This shows that buyers have the upper hand and they could easily push the coin towards the potential resistance of $62, $64, and $66. Moreover, if the buying action fails to break above $58, then LTC/USD could instead settle for consolidation.

However, the breakout above the moving averages is still having an impact on the price. More so, it is about time that the buyers increase their confidence in the recovery because $60 is still achievable. If the bulls push the coin above the upper boundary of the channel, the resistance levels of $62, $64, and $66 could be visited.

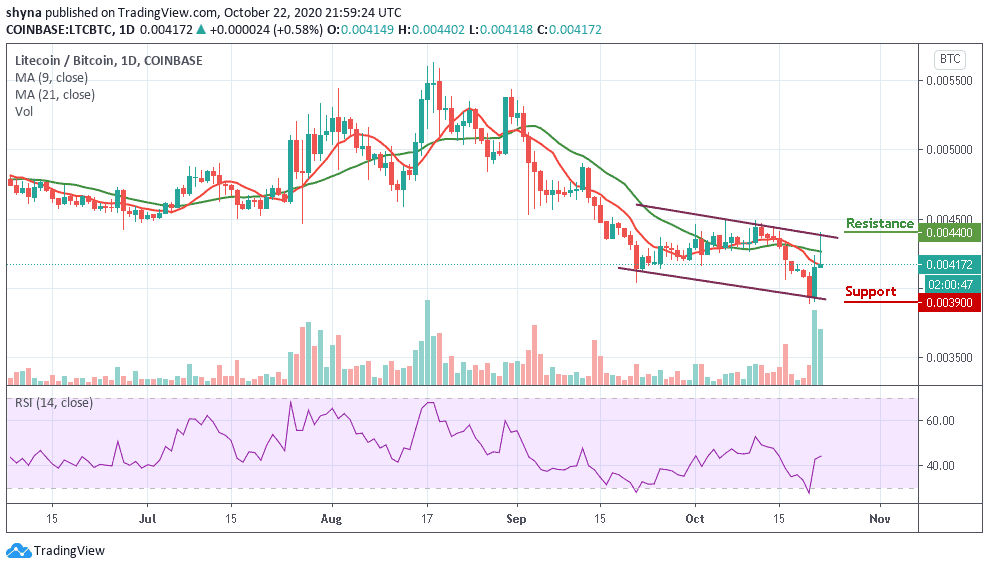

Against Bitcoin, LTC is making an attempt to cross the upper boundary of the channel in other to retest the resistance at 4400 SAT. Unless this resistance is effectively exceeded and the price eventually closes above it, there might not be any reason to expect the long-term bullish reversal.

However, trading below the 9-day and 21-day moving averages could refresh lows below 4100 SAT and a possible bearish continuation may likely meet the major support at 4000 SAT before falling to 3900 SAT and below while the buyers may push the market to the critical potential resistances at 4400 SAT and above as the RSI (14) trades above 45-level to give more bullish signals.

Join Our Telegram channel to stay up to date on breaking news coverage