Join Our Telegram channel to stay up to date on breaking news coverage

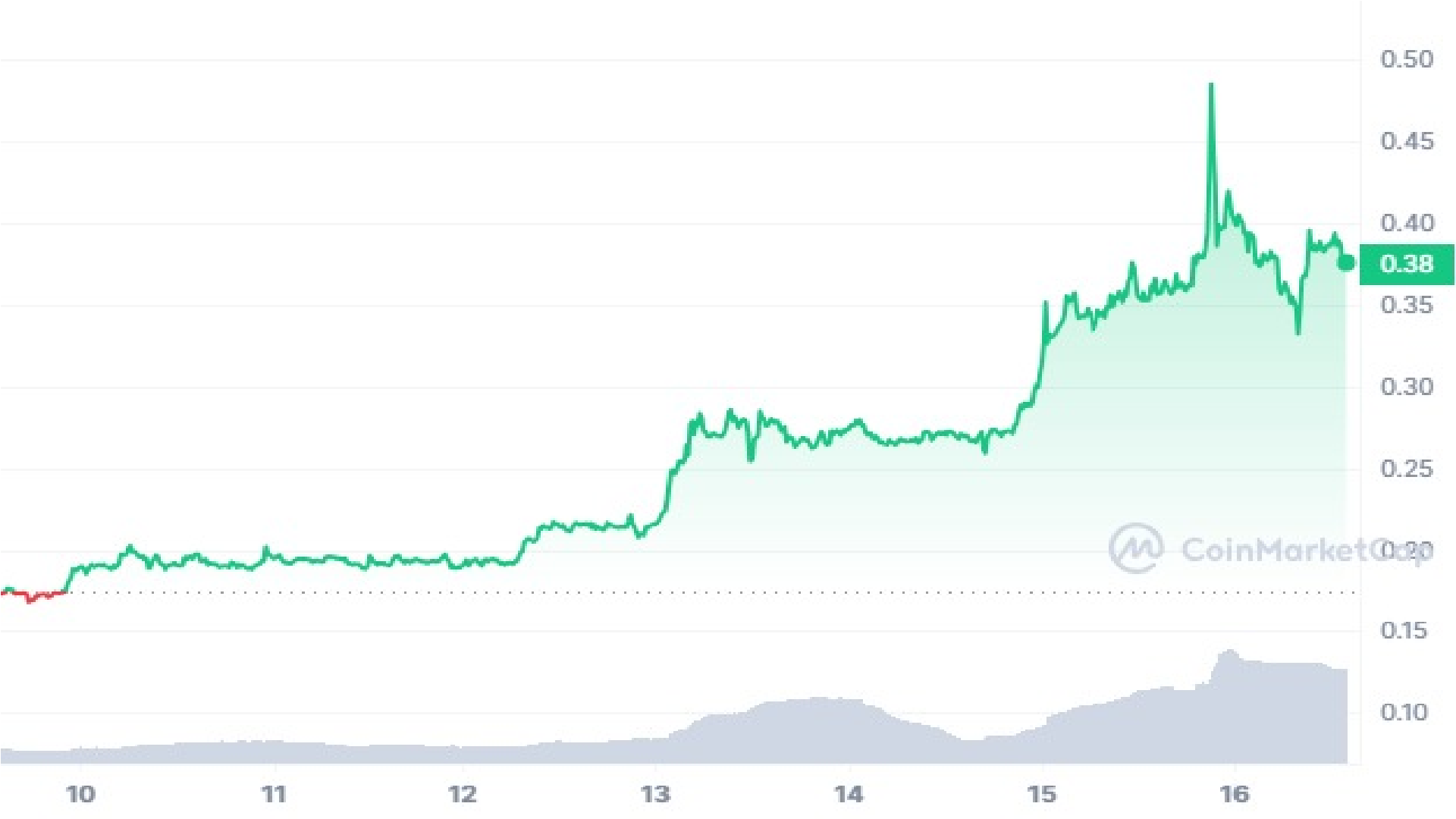

Loom Network (LOOM) has outperformed all other top 100 altcoins in terms of weekly and even daily gains, surging 120% in the last seven days. Although $LOOM remains about 50% lower than its all-time high in 2018, the recent surge in its price has reignited interest in this once-overlooked project.

The recent price increase appears to lack clear announcements, raising questions about whether it’s due to market dynamics or potential manipulation.

In this article, we’ll delve into $LOOM price predictions, provide clarity on the LOOM token supply, and explore a recently launched stake-to-mine crypto project capturing the crypto community’s interest.

Loom Network Brief Overview

Loom Network, established on October 1st, 2017, is a platform-as-a-service built on top of Ethereum, designed to empower developers to operate large-scale decentralized applications (dApps).

Its primary objective is to grant application developers the capability to utilize smart contracts with enhanced computational power on demand or at reduced costs for specific tasks, such as user onboarding trials or applications not necessitating full blockchain security.

Within this framework, users have the capacity to interface with off-chain APIs provided by third-party developers.

Loom Network strives to be the ultimate platform enabling smart contract developers to build applications without the need to shift to another programming language, ensuring easy integration with external interfaces.

The Loom Network is powered by Plasma, a scaling solution that accelerates transaction processing across the network.

LOOM Price Prediction

As of today, October 16, the price of Loom Network is $0.37 with a 24-hour trading volume of $3.57 billion and market cap of $452.71 million. The $LOOM price increased 5.20% in the last 24 hours.

Loom Network has support levels at $0.277, $0.22, with the strongest at $0.15. Similarly, resistance levels for Loom Network are found at $0.39, $0.46, and $0.51. As per the Loom Network price prediction, $LOOM is expected to trade within a range of $0.36 to $0.44 for the current week.

If it reaches the higher target value, Loom Network could see an increase of 20.75%, reaching $0.44 by October 23, 2023. According to technical indicators, Loom Network’s 200-day SMA is anticipated to rise and reach $0.12 by November 15, 2023, while the short-term 50-Day SMA is projected to hit $0.36 by the same date.

The Relative Strength Index (RSI) stands at 88.06, indicating that the $LOOM market is in an overbought position. A significant contributor to this price surge is the suspicion that an Upbit-associated wallet amassed 21.42 million $LOOM ($5.83M) on October 13th, accounting for 53.8% of $LOOM’s entire trading volume.

However, after $LOOM’s price experienced a sharp increase, the wallet believed to be linked with Upbit transferred 36 million $LOOM ($17.7M) out of the wallet. As of now, this wallet holds 617 million $LOOM ($283M), representing 47.5% of the total supply.

Watch the video above for a complete analysis of LOOM crypto price predictions, and subscribe to his YouTube channel for additional crypto-related content. Additionally, Jacob Crypto Bury runs a Discord server with 17,000 members, offering trading tips and insights into upcoming crypto presales.

Understanding the LOOM Token Supply Clarification Across Ethereum and BSC Networks

They’ve noticed some confusion regarding the LOOM token supply on both the Ethereum and BSC networks. The $LOOM token boasts a total supply of 1.3 billion, with approximately 1 billion tokens actively circulating on Ethereum and roughly 130 million in active circulation on BSC.

Given that the token exists on both Ethereum and BSC, they’ve introduced transfer gateways to facilitate a seamless 1:1 swap between ERC-20 $LOOM and BEP-20 $LOOM, depending on the user’s preference.

During this swap, tokens are temporarily locked in a smart contract on one network and subsequently withdrawn from a smart contract on the other network. When users transfer $LOOM BEP-20 tokens from BSC to the Basechain network, the BEP-20 tokens get locked within the gateway smart contract on BSC.

It has come to our attention that there's some confusion about the LOOM token supply across the Ethereum and BSC networks.

The LOOM token has a total supply of 1.3 billion, ~1 billion tokens are in active circulation on Ethereum, ~130 million are in active circulation on BSC.

— Loom Network (@loomnetwork) October 13, 2023

Users can then choose to stake them on the Basechain network or withdraw them as ERC-20 tokens from the gateway smart contract on Ethereum. It’s important to note that the balances of the two gateway contracts on BSC and Ethereum are expected to differ since some tokens are staked on the Basechain.

Approximately 870 million $LOOM BEP-20 tokens in total are locked within their gateway smart contract on BSC and stored in their treasury wallets. Tokens from the treasury are utilized to provide liquidity for the gateway smart contract on BSC.

In total, there are only 1 billion $LOOM BEP-20 tokens (which is 300 million less than $LOOM ERC-20 tokens), leaving approximately 130 million $LOOM BEP-20 tokens actively circulating on exchanges and other platforms.

Loom Network Alternative with Stake-to-Mine Approach

The reason behind the surge in $LOOM’s price remains uncertain, making it a market-sensitive asset despite its recent success. However, cautious traders are mindful of its manipulation potential and are considering shifting their focus to new altcoins like Bitcoin Minetrix.

Bitcoin Minetrix has raised $1.5 million in its presale and presents a unique approach to stake-to-mine cryptocurrencies that lowers the barriers for cloud mining activities. It aims to tokenize cloud mining by allowing users to stake their assets in $BTCMTX, its native cryptocurrency, and generate passive income.

#BitcoinMinetrix is now in Stage 2! 🎉 pic.twitter.com/mT63lX9MRP

— Bitcoinminetrix (@bitcoinminetrix) October 16, 2023

The platform leverages the equipment of cloud mining companies, reducing costs for individual miners. Staking tokens in the ecosystem earns users cloud mining credits, non-tradable ERC-20 tokens that can be used to exchange for Bitcoin cloud mining power.

This approach grants users autonomy and a transparent way to access cloud mining credits, addressing the issues associated with some third-party cloud mining companies. The token presale for $BTCMTX is currently underway, with a total supply of 4 billion tokens distributed evenly across twenty presale rounds.

In the first round, $BTCMTX is priced at just $0.011, with an increase to $0.0129 expected by the 20th and final presale stage. The presale has a hard cap target of $33.46 million, with 42.5% of the presale tokens designated for Bitcoin mining, 7.5% for staking, and 15% reserved for the community.

Related

- Loom Network Price Prediction – Is the LOOM Price Surge Driven by Manipulation?

- Loom Network (LOOM) Price Prediction: Amid Layer 2 Scaling Solutions, is LOOM Set to Hit $0.50, While a Fresh Presale Coin Emerges?

- Bitcoin (BTC) Price Prediction: Bitcoin Price Faces Short-Term Risks As Bitcoin Minetrix Presale Closes On $1.5M

- While Crypto Values Dip, Bitcoin Minetrix Secures $820,000 for Safe Bitcoin Cloud Mining; In Contrast, Rival Coin Falls Short in DEXTools Audit

Join Our Telegram channel to stay up to date on breaking news coverage