Join Our Telegram channel to stay up to date on breaking news coverage

Litecoin (LTC) Price Prediction – May 23

The LTC/USD pair may be looking for support at $42, where the market is likely to provide a rebound level for the price.

LTC/USD Market

Key Levels:

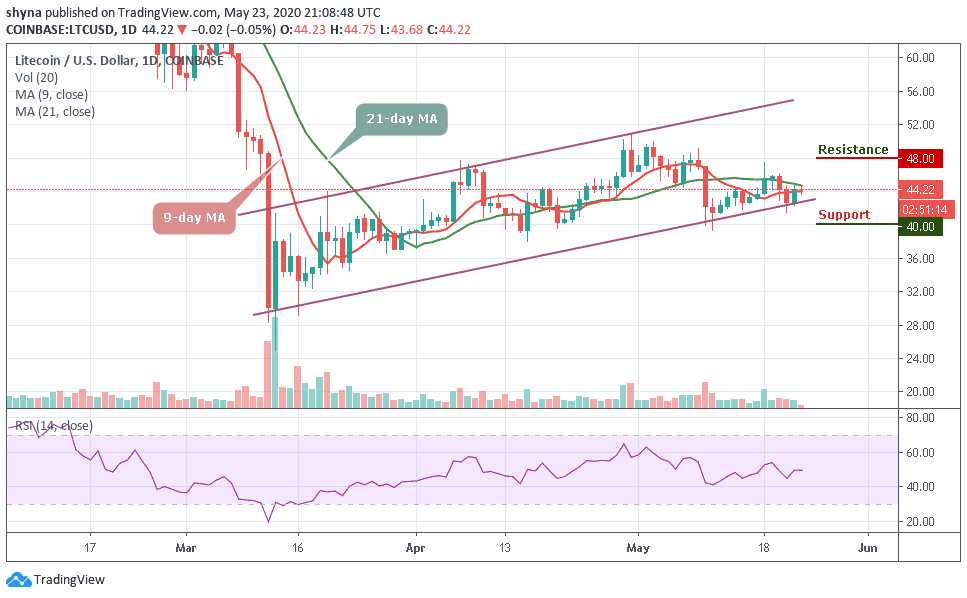

Resistance levels: $48, $50, $52

Support levels: $40, $38, $36

As LTC/USD ranges at the lower boundary of the channel, the $42 support level may be penetrated by the bears provided there is an increase in the bears’ momentum and the price may fall to the previous low of May 11 which is $39.32 support level. In case the $42 support level holds, there could be a reversal and the price may begin a bullish movement.

Looking at the daily chart, LTC/USD is bullish and the pair may break above the 9-day and 21-day moving averages. At the moment, the bears hold the LTC/USD market, and the RSI (14) is seen moving in the same direction, suggesting a sideways movement in the market. The price may decline below the channel and towards the critical support levels of $40, $38, and $36.

Currently, the price is testing the $44.22 level following the recent drop. However, the market may likely bounce higher to $45 and $46 resistance level but the potential resistance to watch for is found at $48, $50, and $52 levels. For now, Litecoin price is on a range and there’s a high probability for a break than a bounce.

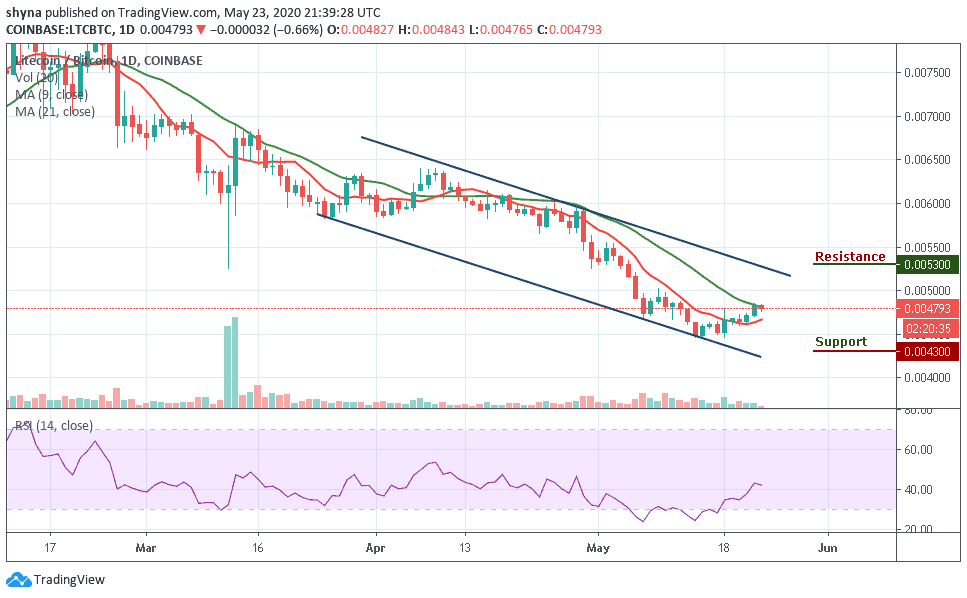

Meanwhile, when compared with Bitcoin, Litecoin price is making an attempt to cross the 921-day moving average in other to reach the resistance at 0.0050 BTC. It is important for the coin to close above the mentioned resistance level; if not, there might not be any reason to expect the long-term bullish reversal.

However, trading below the moving averages could refresh lows under 0.0045 BTC and a possible bearish continuation may likely meet the major support at 0.0044 BTC before falling to 0.0043 BTC and below while the buyers may push the market to the potential resistances at 0.0053 BTC and above. Meanwhile the RSI (14) is currently moving around 42-level.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage