Join Our Telegram channel to stay up to date on breaking news coverage

Litecoin (LTC) Price Analysis – June 16

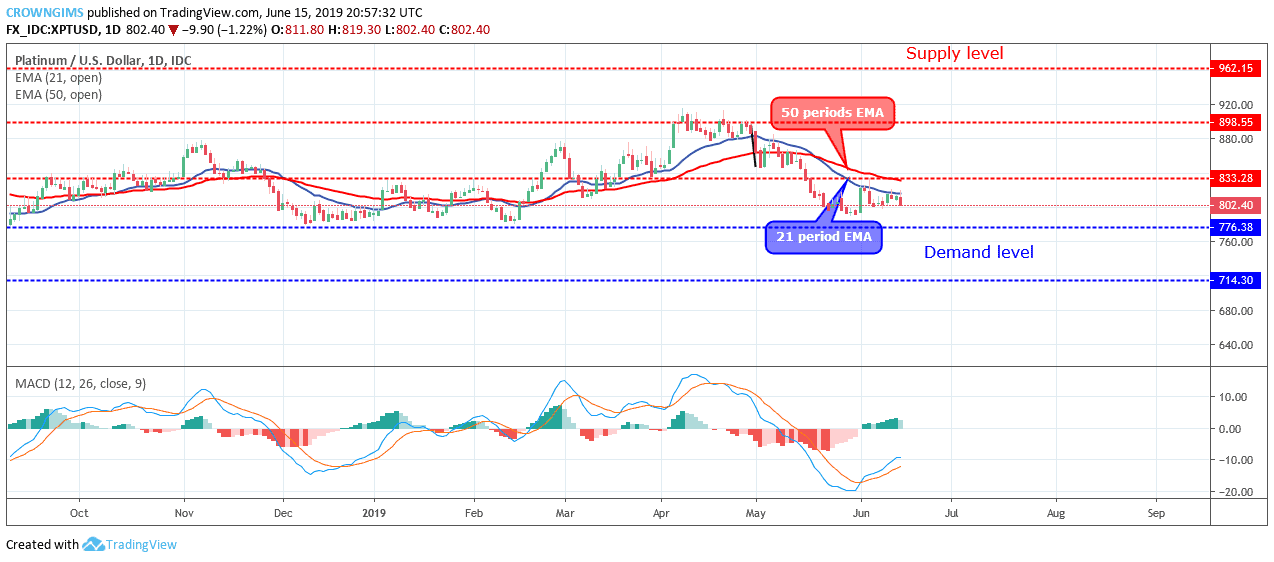

The Litecoin has stagnated slightly to $140 in the last two days, marking a slight increase of 0.14% in the last 24 hours. The cryptocurrency has increased by 17% in the past week, returning to reach the resistance level of $140.

LTC/USD Market

Key Levels:

Resistance levels: $165, $170, $175

Support levels: $100, $95, $90

Currently, the Litecoin (LTC/USD) is quoted at $134.63. The prices of the coin are negotiated above the moving average with a period of 55, which indicates an upward trend in Litecoin. For the time being, LTC/USD prices are approaching the upper limit of the Bollinger Bands indicator.

Looking at the chart, it can be seen that the Litecoin could not exceed the $140 level at the moment and had fallen to a support level of $130. The price then recovered from here, but still struggles to make any movement above the resistance at $140. If the price goes up a bit, the resistance level could be $165, $170 and $175. On the downside, the seller can find support at $100, $95 and $90.

LTC/BTC Market

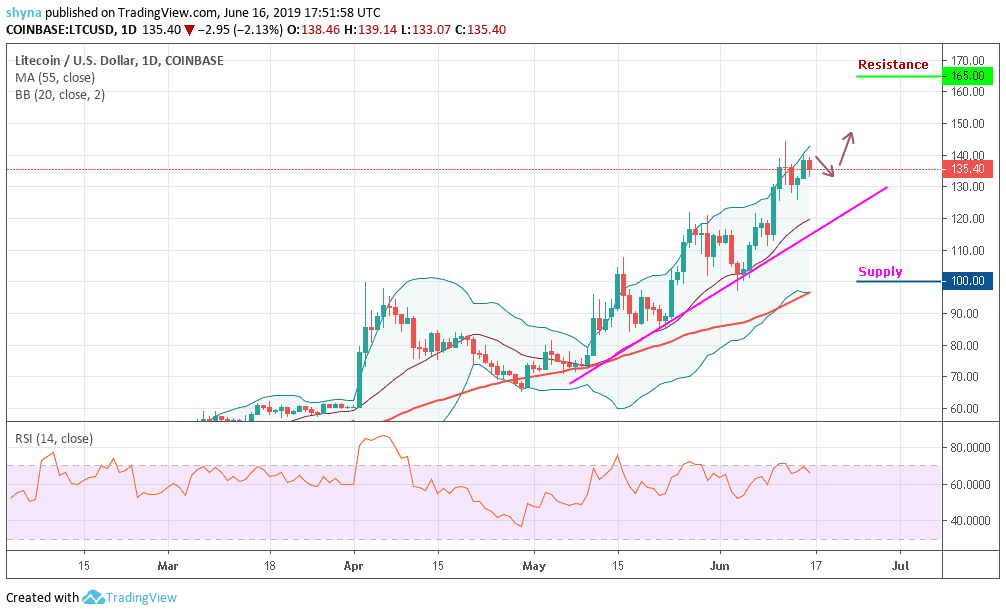

Against Bitcoin, LTC passed the resistance level of 0.0173BTC and found support around the 0.0149BTC level. Viewed from above, the closest resistance level is now at 0.0195BTC. Above this, a higher resistance is 0.0206BTC and 0.0215BTC.

From below, the closest support level is 0.0105BTC. Below this additional support is 0.0096BTC and 0.0088BTC. The trading volume is very high since the reversal of the resistance level to 0.017BTC. The stochastic RSI has recently fallen from overbought conditions and is now approaching oversold conditions, which may suggest that the recent recession is ready to stop.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage