Join Our Telegram channel to stay up to date on breaking news coverage

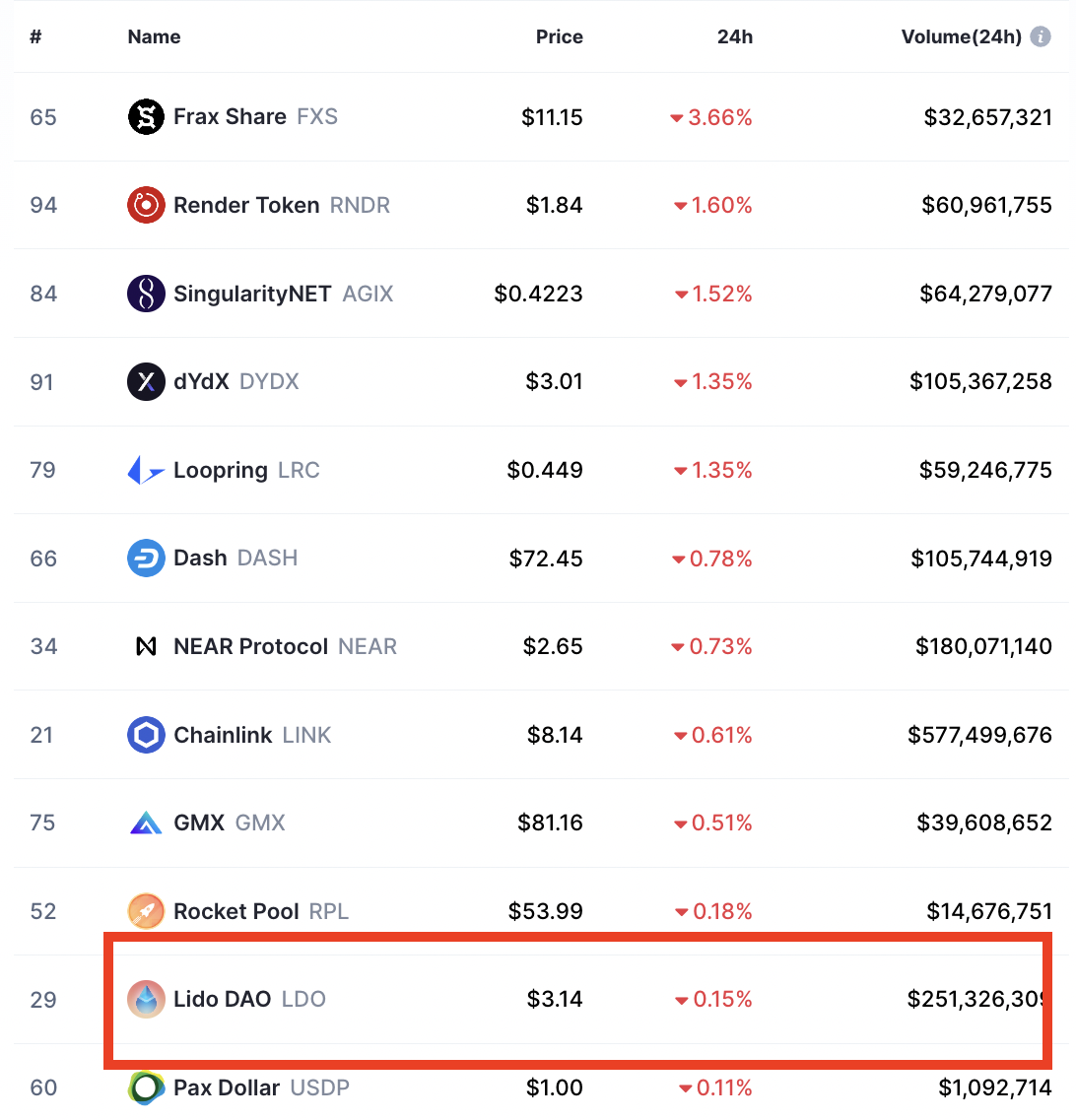

The crypto market was flashing green at beginning of the New York trading session on Sunday. Most top-cap cryptocurrencies including, Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB) and Cardano (ADA) were flashing green with the global crypto market value rising 1.10% to $1.13 trillion, according to data from CoinMarketCap. Lido DAO price was among the top losers with a total drop of 0.15% in price (see figure below).

Top Crypto Losers Today

Lido DAO Price At Risk Of More Losses To $0.9

LDO Price started the New Year on a positive note bouncing off the $0.89 support floor to stage a 278% rally to yesterday’s high above $3.4. This move took the liquidity staking token just above $3.11, a level where it was rejected in mid-August sending the price on a downward spiral.

At the time of writing, the Lido DAO price was facing rejection from this same level, hence the ongoing correction. This implies that the price action may have formed a double top at this level and the ongoing correction may continue sending the altcoin 71.75% lower to tag the $0.89 support level, just as it happened in August.

This gloomy outlook was supported by the relative strength index (RSI) which was facing down, suggesting that the sellers had begun returning to the scene. If this trend-following indicator continues to move down to cross the 50 line, it would suggest that the bears are aggressively selling on the rally to $3.1.

The first line of defense for LDO is found at $2.68, where the 12-day Simple Moving Average (SMA) sat. Other areas of support are found at the $2.5 psychological level, embraced by the 26-day SMA, the 50-day SMA at $2.19, and the $2.0 demand level.

Perhaps the strongest support for Lido DAO lies within a significant buyer congestion zone stretching from $0.89 to $1.26. Note that this is where the price consolidated for almost two months before staging the amazing recovery that has been witnessed since January 1.

These areas provide soft landing spots for buyers where they would regroup and buy more LDO at lower levels before making another attempt at recovery.

LDO/USD Daily Chart

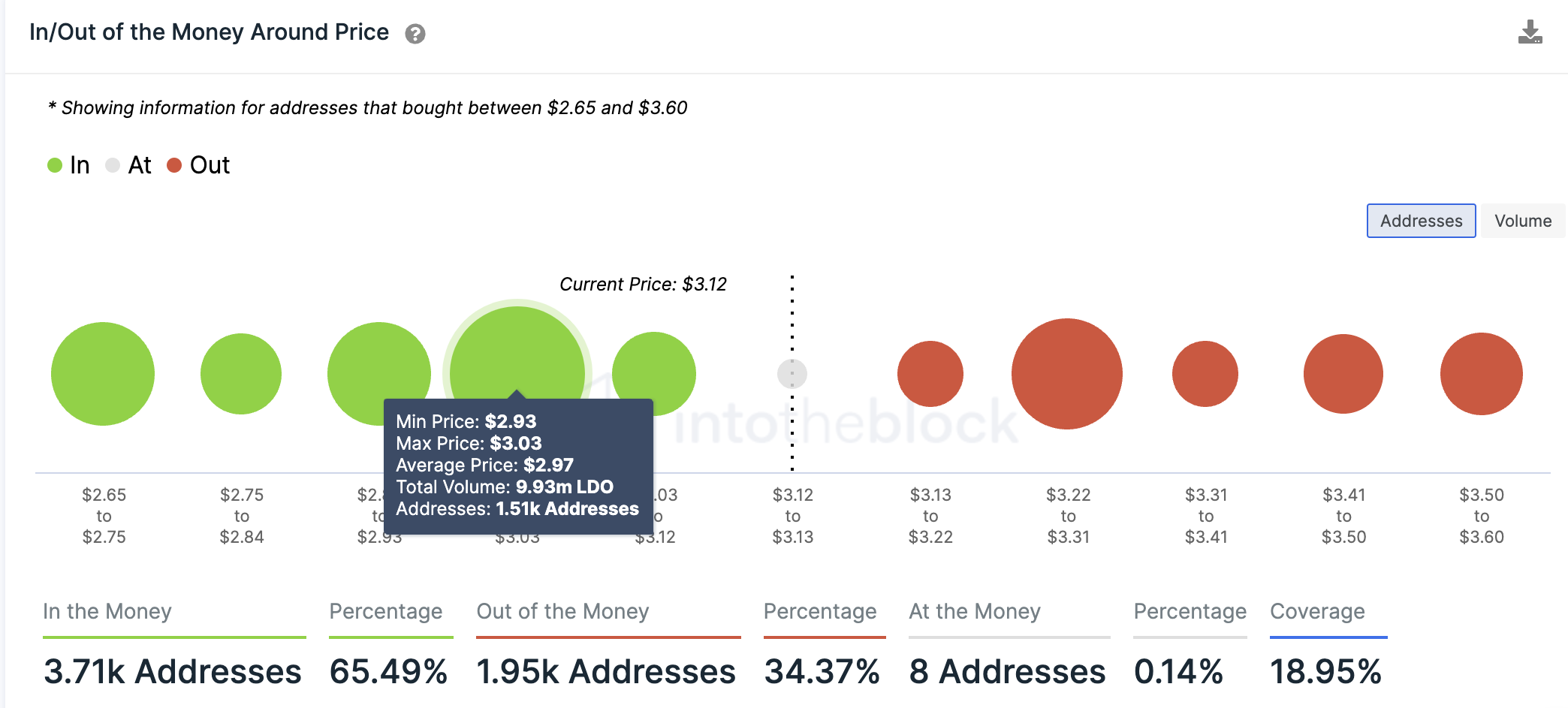

The robust support enjoyed by the Lido bulls on the downside was reinforced by on-chain metrics from IntoTheBlock, a crypto intelligence and blockchain data analytics firm. Its l In/Out of the Money Around Price (IOMAP) model showed that the immediate support provided by the $3.0 psychological level was relatively stronger compared to areas of resistance on the upside.

This foothold was within the $2.93 and $3.03 price range where a total of 1,510 addresses previously bought 9.93 million LDO.

Lido DAO IOMAP Chart

As such, any attempt by the sellers to push the price below this level would be met by massive buying from this cohort of investors who would want to see the price remain high to maximize their profits.

Therefore, even though the double top could spell doom for the Lido DAO price, it sits on various support lines that are likely to weaken the sell-off. Additionally, the RSI is still positioned in the positive region at 64 suggesting that there are still more buyers than sellers in the market.

These buyers could lift the LDO price from the current levels to above to $3.14 to confront resistance from the $3.40 local high. Shattering this barrier could see the Lido DAO token climb higher to tag the $4.0 psychological level, representing a 26% rise.

Read More:

- Blockchain.com’s Assets Not For Sale, Spokesman Says

- Blockchain.com is acquiring assets to close a $270 million hole left by Three Arrows Capital

- How to Buy Cryptocurrencies

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage