Join Our Telegram channel to stay up to date on breaking news coverage

The International Monetary Fund (IMF) has laid out the general framework for a new class of cross-border payment systems. The system employs a single ledger to track transactions using central bank digital currencies (CBDCs), programmability, and enhanced data management.

A Bridge for Safer and Faster International Transactions

Normally, it is easier to make payments within a country than it is across international borders. The process of transferring money between countries is very complex due to differences in the laws that apply as well as the lack of a single system to facilitate the process.

In the end, cross-border payments are very expensive and take a lot of time to complete. Countries higher up in the economic ranks have attempted to streamline the process for their citizens but most people in other countries still suffer through the process.

.@KGeorgieva participated in the High-level Policy Roundtable on Central Bank Digital Currencies in Rabat 🇲🇦.

Read her press statement on the importance of collaboration across institutions for realizing CBDC benefits & payment system interoperability: https://t.co/8L3E3LK119 pic.twitter.com/8jGqpJPwU4

— IMF (@IMFNews) June 19, 2023

To make such transactions easier, the IMF believes that new platforms for cross-border CBDCs might be more effective and secure while still guaranteeing that nations can implement compliance checks and capital controls.

On Monday, the IMF presented its new platform concept during a roundtable on CBDC policy. Tobias Adrian, the director of the IMF’s department of monetary and capital markets, said during the event, that the new kind of platform may help both individual and institutional users by offering reduced fees and quicker transaction times.

Adrian stated that a worldwide CBDC platform that allows for capital controls could reduce payment costs. He, however, clarified that such a concept is very different from the decentralized financial systems that cryptocurrency enthusiasts envision.

“The cost, sluggishness, and opacity of cross-border payments comes from limited infrastructure,” Adrian said at the event which was organized in partnership with the central bank of Morocco. He added:

“Our blueprint for a new class of platforms would enhance and ensure greater interoperability, efficiency, and safety in cross-border payments, as well as in domestic financial markets.”

According to Adrian, the platform which was named the XC (cross-border payment and contracting) would also assist central banks in mediating in foreign exchange markets, compiling data on capital flows, and resolving disputes.

IMF’s XC Platform

The XC platform was designed with inspiration from the CBDC infrastructure model. The in-depth details of its functioning are discussed in an IMF FinTech Note dubbed “The Rise of Payment and Contracting Platforms” that was published on Monday.

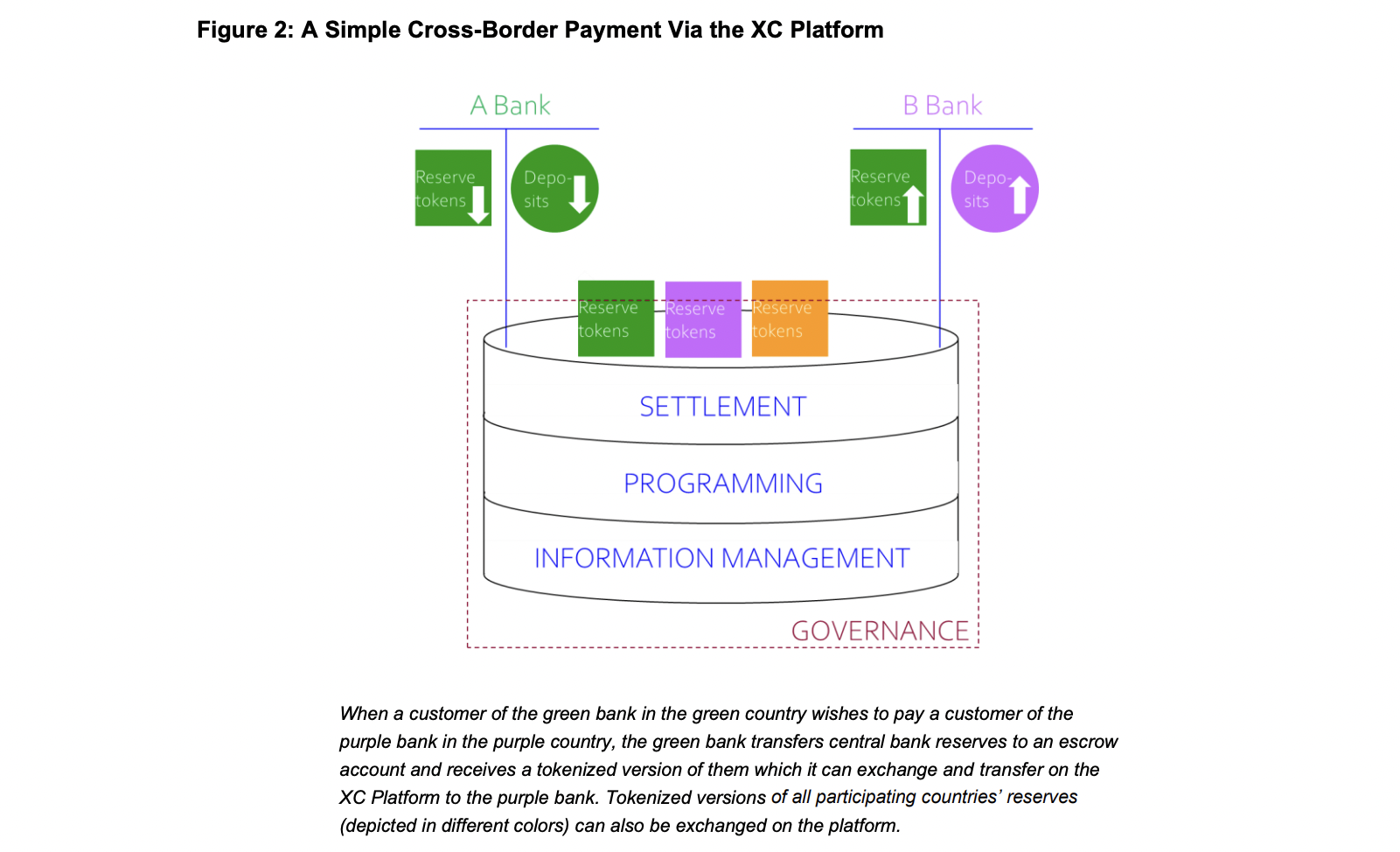

However, Adrian explained that the XC platform will have a settlement layer with a single ledger. The single ledger would ensure there is a unique description of who owns what, so no double spending can occur.

XC will have an information layer that will contain the anti–money laundering information required to satisfy trust requirements and provide privacy protections. Additionally, a programming layer would present the chance to innovate and modify services.

To facilitate cross-border payments on the platform, the IMF chose central bank reserves which it proposes should be digitized to make them interchangeable between countries.

As such, participating banks will be required to have a reserve account with their country’s central bank.

“To make a payment, participating banks would deposit their domestic central bank reserves in an escrow account controlled by the platform operator, and in return obtain a digital version to trade on the platform,” Adrian said.

Based on the idea presented, one would wonder why the IMF did not implement the platform on the already existing blockchain platforms which are decentralized and know no jurisdictions.

However, the IMF in the released document, stated that blockchains have “important limitations” in terms of validator fees, security, efficiency, and privacy. The document argued that Ethereum‘s proof-of-stake technology is expensive and unproven, whereas Bitcoin-style proof-of-work technology uses a lot of energy.

To enable countries to maintain control over financial activities in their jurisdiction, governments will keep the right to limit their citizens’ transactions in foreign currency as well as impose anti-money laundering checks.

Related articles

- Legal Advisors at Sullivan and Cromwell Bill FTX Exchange $38 Million In 3 Months

- Crypto Payment Company Wyre Winds Down Due To Market Conditions

- Binance Deregisters in UK Amid Regulatory Concerns

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage