Join Our Telegram channel to stay up to date on breaking news coverage

With inflation on the rise, investors across the economy are increasingly looking for ways to hedge against diminishing returns. Unfortunately, Hand-in-hand with increasing inflation comes higher interest rates from central banks, resulting in a situation where investors are less likely to take any additional risk or new lines of credit.

As a result, investors are in need of an asset class that can provide consistent returns while simultaneously protecting their capital. Fortunately, real estate is one of the only sectors that can provide a hedge against inflation while protecting capital.

Traditionally, real estate investment is locked off to the wealthy, but one new project is making it accessible to the masses through the magic of fractional ownership. This project is gaining considerable momentum after recently crossing $500,000 in fundraising. To find out more, keep reading.

Metropoly: Making Real Estate Accessible

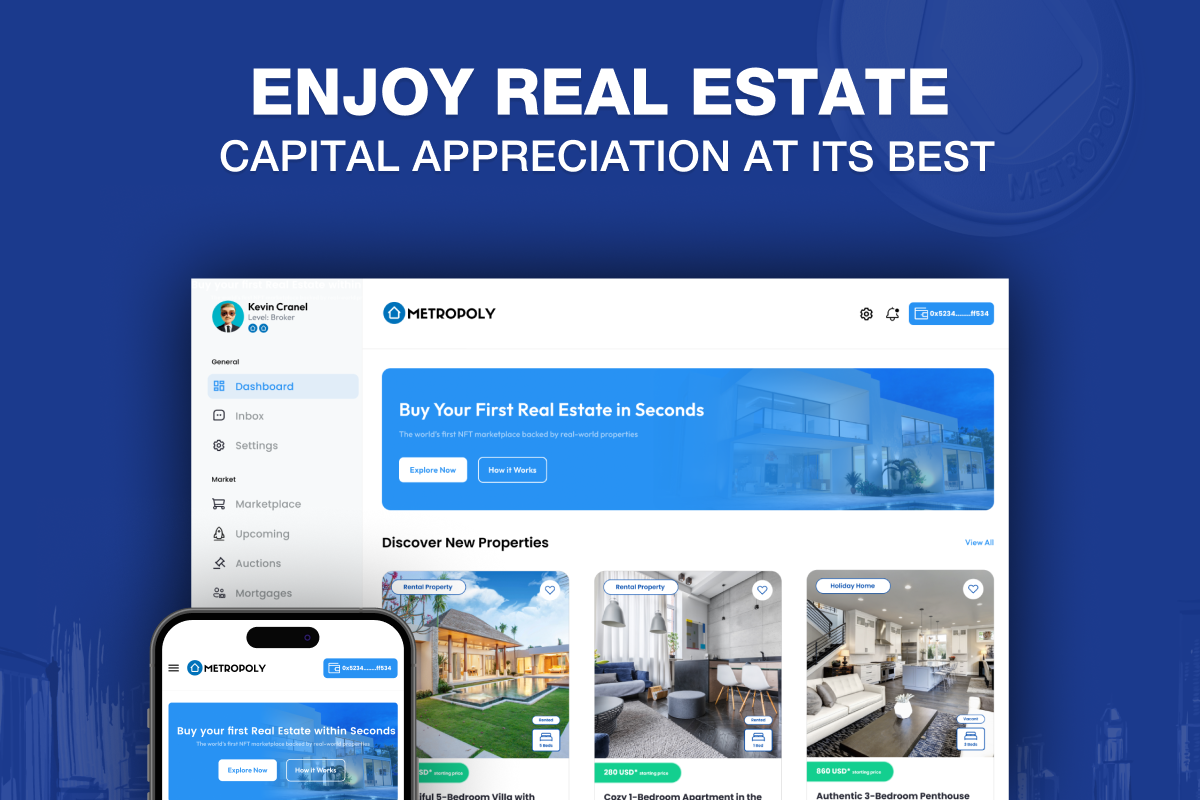

Metropoly is a project designed to make real estate accessible to the masses. It’s the industry’s first NFT marketplace backed by real-world properties that can produce a passive income source for NFT holders.

The entire idea behind Metropoly is to create a system that democratizes real estate and makes it more accessible for everyday investors. In the current landscape, real estate investments are only accessible to those that can afford the hefty down payment to secure a property. Furthermore, real estate investors typically need to have excellent credit histories, have a relationship with a bank to gain a mortgage, and are required to fill out enormous loads of paperwork.

Here at Metropoly, we have created a platform with a simple and user-friendly interface that helps you find the best investment opportunities! ?

Investing in real estate has never been this fast and hassle-free! ? Check out our beta 2.0 ? https://t.co/HPcCrqE6GL pic.twitter.com/OIJivwoBfm

— METROPOLY – PRE-SALE IS LIVE! ? (@metropoly_io) February 18, 2023

Metropoly is changing the dinosaur of the industry by providing an avenue for investors to get started on their property portfolios in under twenty seconds with as little as $100. This is achieved through fractional ownership, in which each property is broken into little ownership pieces – allowing investors to buy part of a property.

As a result, Metropoly is opening the doors for everyday investors to get started investing in real estate. Furthermore, there are no geographical restrictions for investors, so anybody can purchase a townhouse in London, a penthouse in Paris, and a luxury villa in Dubai for as little as $300.

Rising Interest Rates and Inflation Reducing Opportunities

With the economy crashing from inflation, central banks across the world have no option but to increase interest rates to make borrowing more expensive. The US Federal Reserve has been increasing interest rates at the most aggressive pace since the 1980s over the past year. As a result, liquidity has dried up across the board, removing the previous plethora of opportunities available to invest.

With liquidity drying up, interest rates rising, and inflation out of control, real estate investment is one of the best opportunities to diversify your portfolio and hedge against diminishing returns. Investing in crypto and stocks at this time seems unwise, with capitulations expected to continue throughout the year if interest rates continue to increase. As a result, investors are looking toward real estate to protect their capital in falling markets.

Real Estate Investing Is How the Wealthiest Individuals Grew Fortunes

One of the best things about real estate is that it’s the asset class that the world’s 1% of wealthiest individuals used to grow their wealth. This is because real estate has provided consistent returns over the years, and investors also benefit from the reliable cash flow generated from the rental yield.

Investors buying real estate through the Metropoly platform benefit from both of these principles surrounding real estate. As they are the fractional owners of the property, they are entitled to receive the rental yield and can benefit from the capital appreciation of the property.

It’s easy for NFT holders to bank the profit from capital gains as they simply have to sell their NFT on the marketplace. Metropoly has provided a solution to illiquidity by instantly buying NFTs at 70% of the property value to make things easier. Alternatively, NFT holders can list their NFTs for auction and receive the highest bid.

The best part about investing in NFT-backed real estate is that they provide a passive income. NFTs on the Metropoly marketplace provide a genuinely passive income as the Metropoly team takes care of all the maintenance surrounding the property. They also ensure that the tenant pays rent each month. NFT holders must purchase the NFT to earn their share of the rental yield.

Presale Continues to Flourish After Crossing $500,000

With the fundraising for the METRO token hitting $500,000, Metropoly is starting to gain some significant traction amongst investors. They’re increasingly beginning to believe that the METRO token will have a plethora of utility on the Metropoly marketplace and is worth the early investment.

METRO is the native token that will power the entire Metropoly economy and will be used as a transaction and rewards token. SolidProof has audited the presale contract for METRO, and the team has been KYC’d through CertiK.

In total, there will be a 1 billion supply for the ERC-20 METRO token. The current price for the token is set at $0.0625, but this is expected to increase once the presale hits the $1 million fundraising level. Therefore, those that purchase METRO in the earlier stages will benefit more once the token is listed on tier-1 exchanges. The team has already announced that they plan to list the token at a price of $0.1 once the presale has been completed, providing substantial gains for early investors.

How to buy METRO: A quick guide

Step 1: Get a crypto wallet: Download MetaMask or Trust Wallet

Step 2: Investors need to own Ether, Tether or BNB, which will be exchanged for METRO tokens

Step 3: Link wallet on https://t.co/tpOwICvgol

Step 4: Buy METRO tokens! pic.twitter.com/aGmFZemKnf

— METROPOLY – PRE-SALE IS LIVE! ? (@metropoly_io) February 12, 2023

Overall, Metropoly is changing the future of crypto investments by allowing users to divest away from volatile crypto assets and into more reliable real estate assets – while still maintaining the fundamentals of blockchain principles and complete ownership. In the face of surging inflation and rising interest rates, investing in real estate is one of the best options to hedge and protect against diminishing returns on capital.

Join Our Telegram channel to stay up to date on breaking news coverage