Join Our Telegram channel to stay up to date on breaking news coverage

HashKey Exchange, Hong Kong’s first licensed retail virtual asset exchange, unveiled its exchange platform for retail users at a grand launch held today.

The event occurred at Hong Kong’s Maritime Museum Central and was graced by esteemed figures from the HKSAR government, leading banks, insurers, and auditing firms.

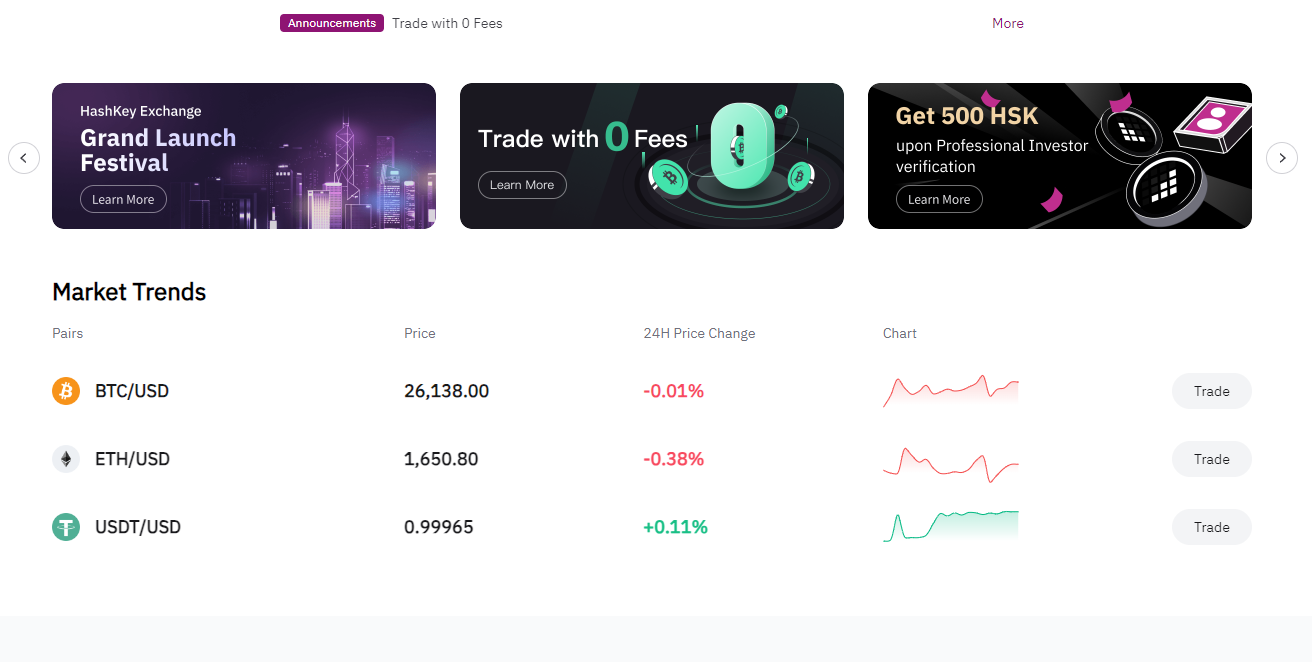

During the launch, the exchange introduced new features, which included seamless transactions and direct transfers of USD and HKD from bank accounts. In addition, it announced various fiat trading pairs on its Web platform. Initial teams, with more planned, include BTC/USD, ETH/USD, and USDT/USD.

Dr. Xiao Feng, Chairman and CEO of HashKey Group, officially launched HashKey Exchange and its retail trading services, supported by esteemed guests such as Joseph Chan Ho-lim, Undersecretary for Financial Services and the Treasury. Other

HashKey Exchange’s COO, Livio Weng, unveiled the cutting-edge “HEX Engine,” a high-performance trading system supporting up to 5,000 transactions per second (TPS). This innovation promises improved stability and faster user experiences.

Additionally, Weng announced upgrades to institutional business solutions. The upgrades include enhanced API interfaces and advanced account management tools for enhanced trading liquidity and user experiences.

HashKey Exchange is offering a zero trading fee promotion to celebrate its launch, providing customers with commission-free trading on all transactions.

The platform has various features, including fiat currency deposits and withdrawals, fiat trading pairs, licensed custody with regular regulatory oversight, segregation of cold and hot wallets for enhanced security, asset insurance from recognized institutions, and meticulous authoritative auditing.

The exchange operates 24/7, adhering to stringent user registration and KYC regulations.

Under the purview of the Hong Kong Securities and Futures Commission, the exchange has established a comprehensive compliance framework. This includes user checks, anti-money laundering measures, transaction monitoring, and intellectual property oversight, ensuring complete compliance and investor protection.

Related News

- Balancer Loses $900k in DeFi Hack

- SUI Price Prediction: SUI Targets $0.60 – Strong Fundamentals or Hype?

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage