Join Our Telegram channel to stay up to date on breaking news coverage

Balancer has joined the rising list of DeFi protocols exploited by cybercriminals this year. The Ethereum automated market maker has been on the receiving end of a $900k loss on August 27.

Balancer is aware of an exploit related to the vulnerability below.

Mitigation procedures have drastically reduced risks, but are unable to pause affected pools.

To prevent further exploits, users must withdraw from affected LPs.https://t.co/PDzX32gqeS https://t.co/b4CSqVFbDg

— Balancer (@Balancer) August 27, 2023

This news comes shortly after unveiling a vulnerability that has already impacted several pools. Balancer’s team has posted on X (formerly Twitter) that since the affected collections could not be paused, users must withdraw their holdings from the affected liquidity pools as soon as possible.

Balancer has received a critical vulnerability report affecting a number of V2 Pools.

Emergency mitigation procedures have been executed to secure a majority of TVL, but some funds remain at risk.

Users are advised to withdraw affected LPs immediately.https://t.co/PDzX32gqeS pic.twitter.com/F1f649Wz3L

— Balancer (@Balancer) August 22, 2023

Blockchain security expert Meir Delov revealed the identity of the attacker. He stated that the attacker continues his operation and has moved more than $600k to a particular address.

The attacker continues with his operation, approx $900K affected, more than $600K moved to this address

0xB23711b9D92C0f1c7b211c4E2DC69791c2df38c1 pic.twitter.com/inNqH4zel2— Meir Dolev (@Meir_Dv) August 27, 2023

Soon after the exploit, the exact address received two transfers in DAI stablecoin worth $636,812 and $257,527, making a total loss of $893,978.

Withdraw Funds Quickly – Balancer

Balancer unveiled the issues on August 22, warning users about the prevalent exploits and urging them to withdraw their assets from LPS before facing any damage. The help at risk were those deployed on Optimis, Ethereum, Avalanche, Gnosis, zkEVM, Fantom, and Polygon.

On the day of the warning, only 1.45 of the total assets were at risk, meaning $5 million worth of cryptos were vulnerable. $2.8 million of those assets inside the TVL were also at risk, prompting Balancer to warn its users on X (formerly Twitter).

While the mitigated pools are safe, users must move their assets to safe collections or withdraw. Unmitigated pools were at risk. With that, Balancer urged users to exit immediately.

Over $204 Million Lost to DeFi Hacks in Q2 Alone

Since the beginning of 2023, the DeFi space has been at the receiving end of more than a few hacks.

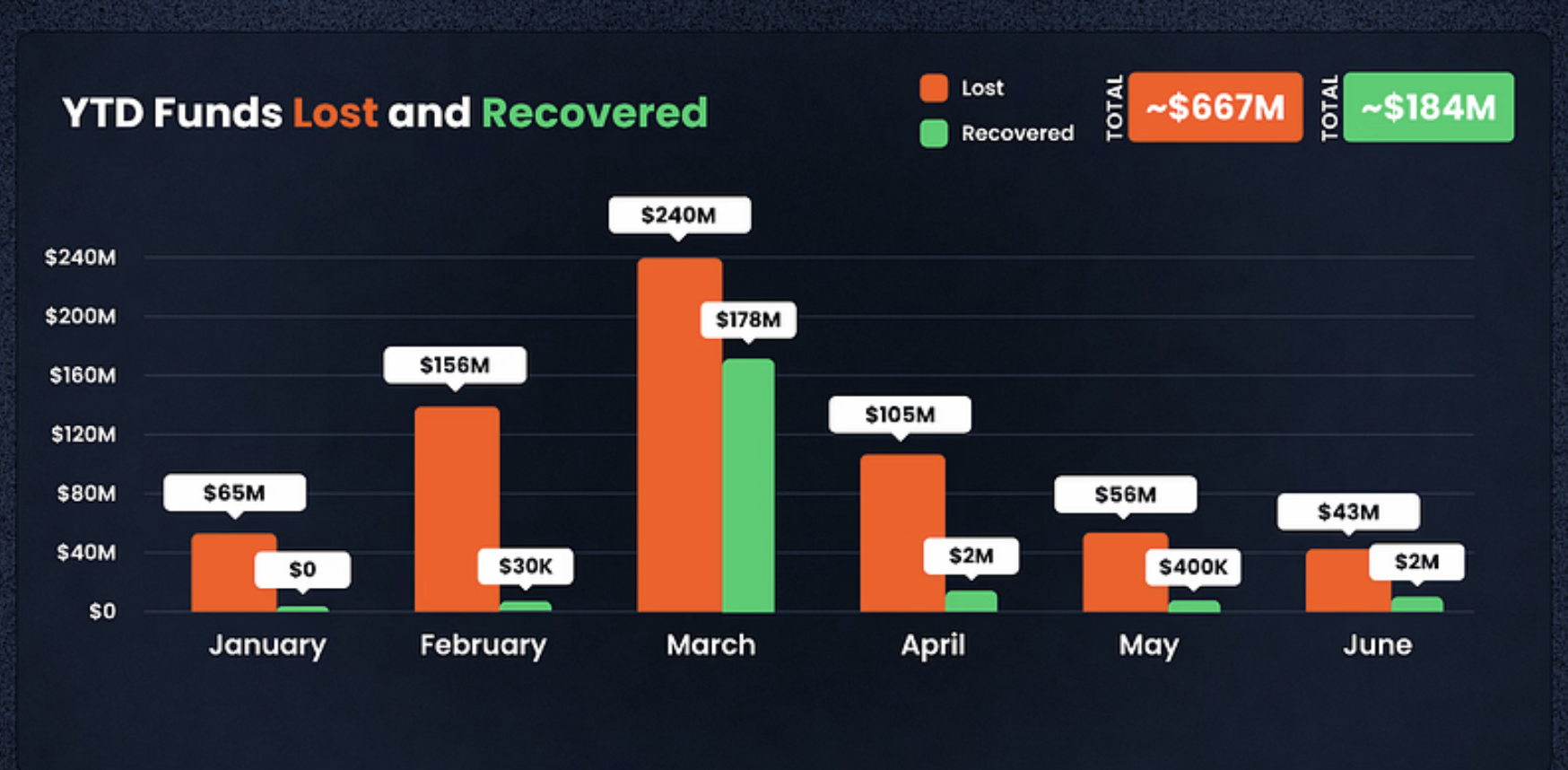

In Q2, DeFi suffered losses worth $204 million, according to a report by De. Fi Rekt. IT reported a total loss in Q2 of 2023 of $204 million, making the total year-to-date loss $677 million.

This loss is seven times the loss the crypto economy suffered in the same quarter last year.

The biggest hack of the year, however, was suffered by Euler in Q1, which led to a loss of $197 million.

Q3 faired a bit better, as the surge in Crypto prices in July 2023, thanks to Ripple’s partial victory over SEC, has led to a 70% decrease in crypto scams, according to a report by Chainalysis, which was done in July this year.

Related

- Working for Sam Bankman-Fried: A Former Alameda Colleague’s Inside Story

- US Charges Tornado Cash Developers With Laundering $1 Billion Of Crypto Assets, Sanctions Violations

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage