Join Our Telegram channel to stay up to date on breaking news coverage

As bitcoin mining hash rates record fresh highs, bitcoin mining revenue, often described as “hash price,” has recently dipped to figures reminiscent of the levels witnessed during the FTX crash in November last year. Hash price is the earnings that bitcoin miners make per terahash per second per day.

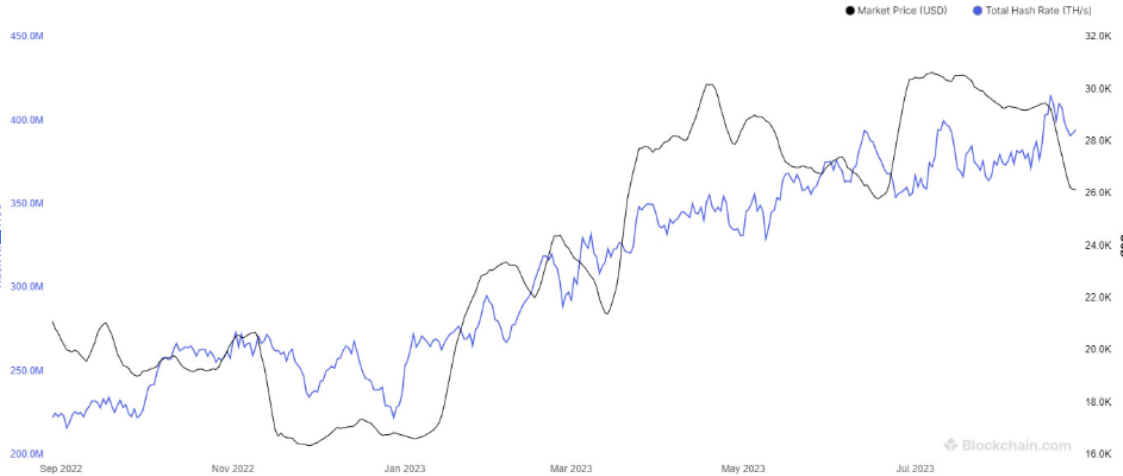

According to a recent analysis by Blockchain.com, the Bitcoin network hash rate had reached a staggering 414 exahashes per second (EH/s) on August 18, setting a new benchmark. This unprecedented surge represents a 54% increase from the start of 2023 and a staggering 80% leap over the last year.

Bitcoin Mining Revenue Plummets

Data from HashPriceIndex reveals that the current revenue for bitcoin miners is a mere $0.060 for every terahash per second daily. This pales compared to the numbers from early May, which almost doubled. The spike back then was driven by the Bitcoin Ordinals movement, which spurred a massive demand for block space.

Although the hash rate uptick showcases strengthened security in the Bitcoin network, the scenario for Bitcoin miners offers a gloomy picture. Profits have plummeted, reaching similar figures to when Bitcoin dipped to roughly $16,500 in November 2022.

This profit dip has triggered Bitcoin miners to adopt alternative financial strategies to navigate the bearish market conditions. A recent article from Bloomberg on August 24 revealed that major publicly traded mining entities, about 12 of them, successfully raised $440 million through stock sales in just the second quarter of the year.

Analysts Explain

Reflecting on the scenario, a seasoned market analyst, Dylan LeClair acknowledged the influx of advanced and efficient mining equipment in the market. However, he underlined the imminent challenge, explaining how the onus is now on the price to rise and match the pace. In other words, he emphasized a need for an uptick in Bitcoin price to ensure miners continue generating reasonable profits amid the soaring hash rates.

Remember the $BTC miner revenue spike this spring?

Well that was fun…

Miner revenue per terahash nearing fresh all time lows, as is tradition. pic.twitter.com/lgugTpHd7n

— Dylan LeClair 🟠 (@DylanLeClair_) August 27, 2023

Mark Jeftovic, the mind behind the Bitcoin Capitalist newsletter, offered a word of caution warning that mining companies are increasingly diluting shareholder value at a high rate. He further explained that if this dilution outpaces Bitcoin’s appreciation rate, the community will strive forward while constantly pulling backward, thus having no value addition.

The current phase for the Bitcoin network displays an intriguing interplay of strengthening network prowess but waning miner revenues. It remains to be seen whether this will lead to broader shifts in strategy or adjustments in the Bitcoin marketplace

Related

- Balancer Loses $900k in DeFi Hack

- Working for Sam Bankman-Fried: A Former Alameda Colleague’s Inside Story

- Bitcoin To Hit $35k By April, $148K in 2025, Top Crypto Hedge Fund Says

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage