Join Our Telegram channel to stay up to date on breaking news coverage

AUDUSD Price Analysis – April 22

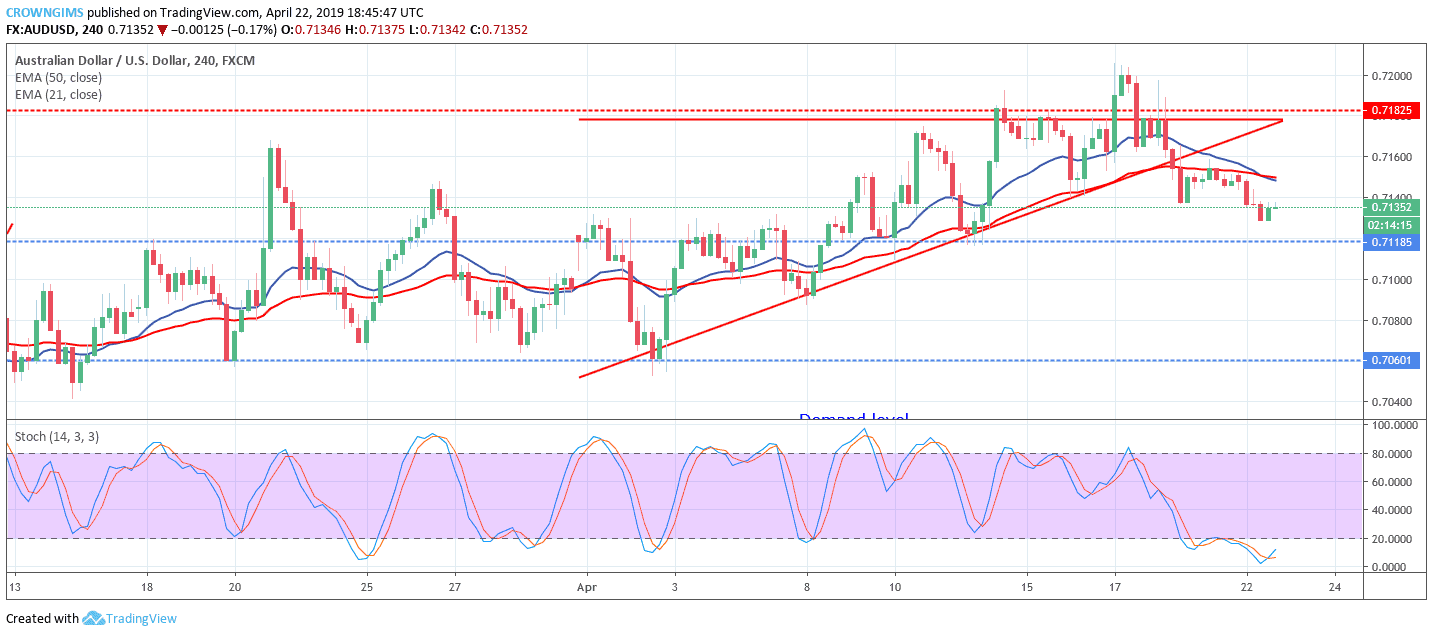

The bearish engulfing candle formed on April 18 and this declined the price towards the low of $0.711. In case the Bears break down the $0.711 demand level, it will target $0.706 demand level. Should the Bears defend $0.711 demand level, AUDUSD may continue its uptrend movement.

AUD/USD Market

Key levels:

Supply levels: $0.718, $0.722, $0.728

Demand levels: $0.711, $0.706, $0.701

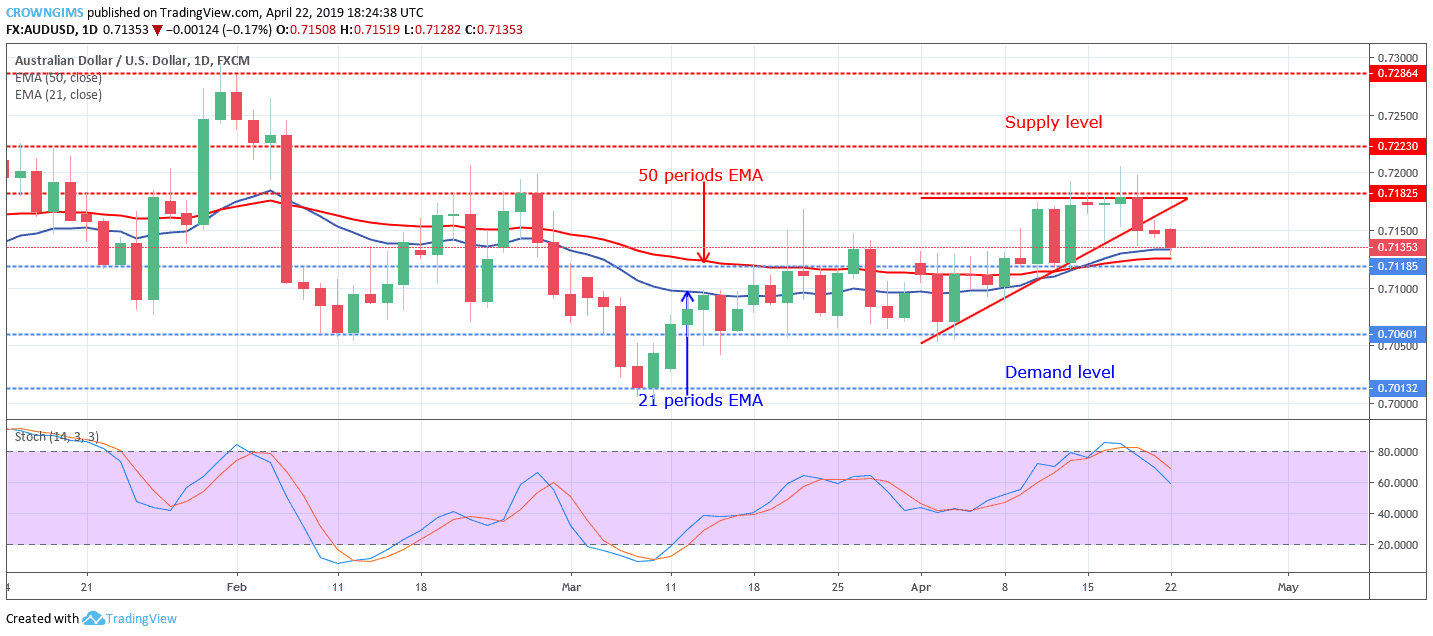

AUDUSD Long-term trend: Ranging

AUDUSD is on the sideways movement on the daily chart. The tweezer bottom candle pattern formed on April 3 triggered the bullish momentum for cryptocurrency exchanges which broke up the $0.711 price level and pushed the currency pair to the high of $0.718. The Bulls lost the momentum at the level and the price started consolidating for three days within the ascending triangle formed. The bearish engulfing candle formed on April 18 and this declined the price towards the low of $0.711.

AUDUSD is currently trading on the 21 periods EMA and 50 periods EMA in which the two EMAs are fairly separated from each other. Meanwhile, the Stochastic Oscillator period 14 is at 60 levels bending down to indicate sell signal. In case the Bears break down the $0.711 demand level, it will target $0.706 demand level. Should the Bears defend $0.711 demand level, AUDUSD may continue its uptrend movement.

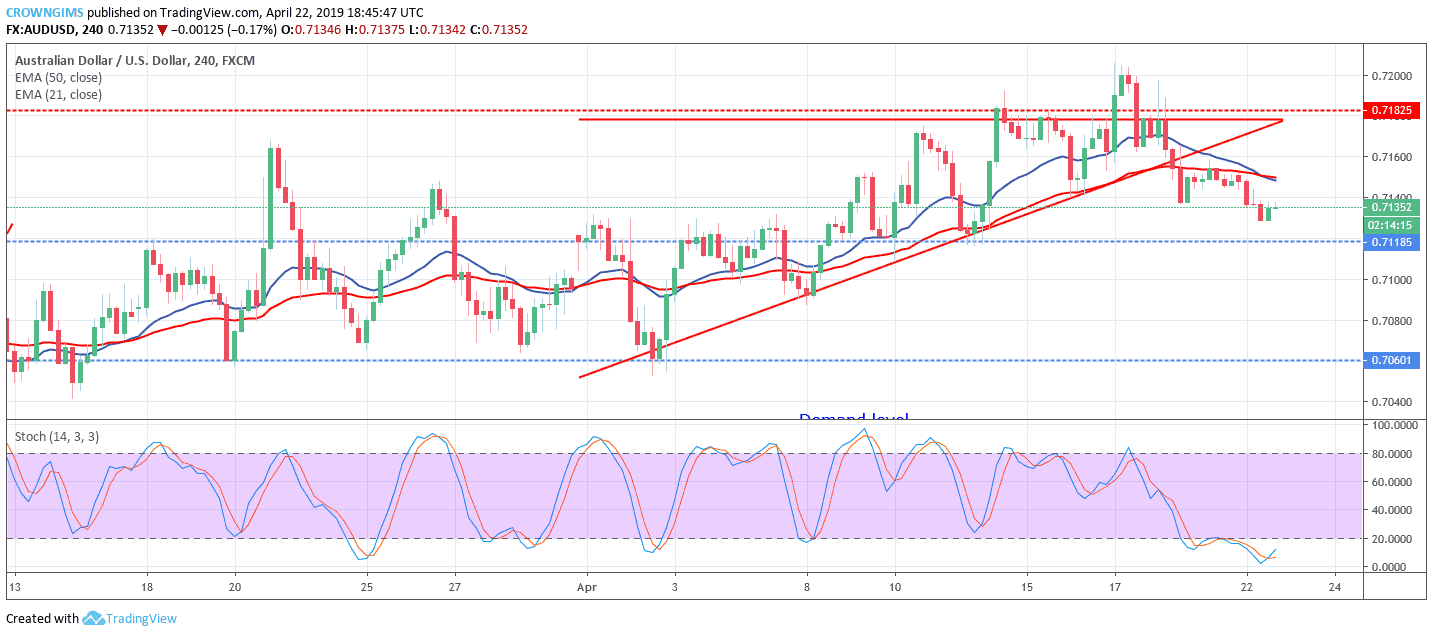

AUDUSD medium-term Trend: Bearish

AUDUSD is bearish on the medium-term outlook. The bullish trend that started on April 2 made the currency pair rallied to the north and placed the price above the supply level of $0.718. The bearish inside bar candle pattern formed indicates the increase in bearish momentum; this dropped the price to $0.711 price level.

AUDUSD price is already trading below the 50 periods EMA and the 21 periods EMA; the latter is trying to cross the former as a bearish trend confirmation.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage