Join Our Telegram channel to stay up to date on breaking news coverage

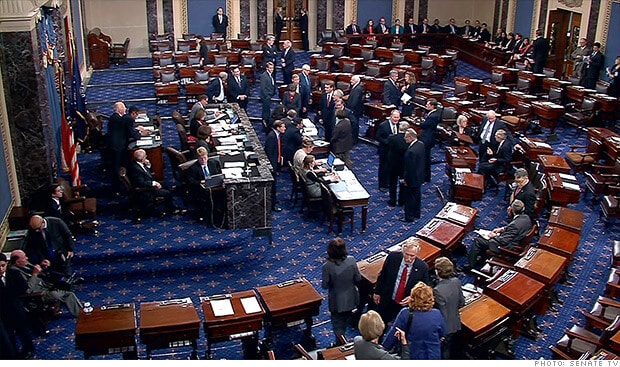

Ahead of the United States Senate’s hearing on cryptocurrency regulations scheduled later this week, Mehrsa Baradaran, an international lawyer, has expressed her views on the role of cryptocurrencies and how they could play within the financial framework. In simple terms, while she has no qualms with bitcoin trading and other crypto activities, she believes that there should be no link between crypto-assets and payment processing.

In her statement, Baradaran expressed that while there are issues of inefficiency and inequality in the financial industry, they ought to be solved with appropriate policies, therefore rendering the need for tech to dabble with finance unnecessary.

She said, “While I share many of the cryptocurrency industry’s concerns with respect to failures of the banking industry, I do not believe cryptocurrency is the best solution to the problems of financial inclusion and equity in banking.”

Baradaran especially criticized the United States Federal Reserve and its role in ensuring financial inclusion, adding that while the payment system of the Federal Reserve is being employed by citizens through commercial banks, a staggering 25 percent of Americans today remain either unbanked or underbanked.

According to her, the latter condition is difficult, as it is expensive and time-consuming, given the hurdles and fees involved in making transactions happen. She also claimed that while it is possible to achieve a cashless commercial system, it would be much easier for the current Federal Reserve payments system to ensure inclusion of the unbanked, as opposed to developing a new currency with some new tech platform (in this case, blockchain technology).

She said, “Practically speaking, it is much easier to expand the current Federal Reserve payments system to include the unbanked rather than create an entirely new currency on a new technological platform, wait for wholesale adoption, and then double-check to make sure the unbanked are using it.”

As far as statements go, Baradaran wasn’t lying. She might have had a harsh take on cryptocurrencies in general, but she’s right; if the Federal Reserve had done its job, then people would have been fine with the way banks work, and there wouldn’t have been much of a need for cryptocurrencies to even enter the payments scheme.

The only problem is that things aren’t in an ideal situation, and instead of waiting for the government to do its job, companies are stepping in with a better alternative; cryptocurrencies. Mati Greenspan, a senior analyst, pointed out on Twitter:

“The only way to get them to change is to disrupt their business model. By supporting Bitcoin or other independent forms of money, they will be forced to compete with it. Only then will you get the inclusion you seek. Capitalism 101!! The Fed has a monopoly.”

That is exactly the point. Cryptocurrencies have come to create a form of competition to keep the Federal Reserve and commercial banks on their toes. Without this competition, there really wouldn’t be an incentive to make things better for the people; in this case, the unbanked population of America.

For now, the tactic actually seems to be working. People are looking to buy cryptocurrency more, and while there has been a lot of talk about Facebook and its Libra stablecoin, several banks have been forced to step up their game. JPMorgan has the JPM Coin, which it uses to make faster cross-border payments. In the same vein,

David Solomon, chief executive of Goldman Sachs, has confirmed that the bank is looking into the prospect of tokenization. It has become clear at this point; the establishment needs a push to get things done. Bitcoin and other crypto-assets are bringing the fight to them.

Join Our Telegram channel to stay up to date on breaking news coverage