Join Our Telegram channel to stay up to date on breaking news coverage

European Union governments are in favor of implementing new bank-capital standards. These standards could classify unbacked cryptocurrencies as the highest-risk assets for lenders.

These bank-capital standards could potentially result in cryptocurrencies such as Bitcoin (BTC) and Ether (ETH) being given the highest possible risk weight under the extensive banking laws. This agreement on the laws could be reached as early as next week.

It is already known that the European Parliament supports measures that one lawmaker has defined as “prohibitive” to separate cryptocurrencies from the banking system. The EU’s Council, which represents member states and needs to approve the plans, also seems open to these ideas.

During a gathering in Spain to discuss the new regulations, Mats Anderson, a Swedish diplomat, voiced his approval of the commission paper. Anderson, who is the financial services and markets counselor, emphasized that he based his remarks on discussions with the other 26 members of the bloc.

However, following a gentle reprimand for unintentionally confirming the existence of an unpublished document, Anderson recognized his mistake and labeled it a “Freudian slip.”

EU’s Support For Crypto Asset Regulations

In January, the European Parliament proposed to assign crypto assets such as bitcoin a risk weight of up to 1,250 percent. This required lenders to maintain one euro of capital for each crypto-issued euro. However, certain lobbyists in the traditional finance sector cautioned against this conservative approach. According to them, this could hinder deal-making.

As a result, the commission proposed a partial relaxation of the risk weights, which would allow for lower values for stablecoins. These stablecoins will be regulated under a law called MiCA, which is set to become effective in 2024. However, this initiative is temporary until the International Basel Committee on Banking Supervision finalizes its standards.

EU: In April 2023, the European Parliament approved the Markets in Crypto-Assets (MiCA) rules. MiCA will establish a comprehensive regulatory framework for digital assets, including stablecoins, and is expected to come into force in 2024. https://t.co/dNJNDgU03u

— Haun Ventures (@HaunVentures) May 30, 2023

Martin Merlin, a director at the EU executive’s financial-services arm, expressed optimism about reaching an agreement by the end of June. Mats Anderson, in contrast, hinted at a potential political agreement even before that, pointing to the scheduled meeting on June 15 as a possible opportunity for such a deal.

The banking package has sparked disagreement as it covers crypto-related matters and evaluates corporate loan risks. It also covers the treatment of foreign lenders entering the European bloc. However, following over 18 months of negotiations, officials now believe a deal is on the horizon.

Concerns Over Increased Leverage in Crypto Trading Prompt Stricter Measures

In an effort to preserve financial stability, the European Systemic Risk Board (ESRB) has advised EU authorities to restrict leverage trading in cryptocurrencies. This recommendation aims to address the mounting concerns surrounding the potential risks linked to crypto trading.

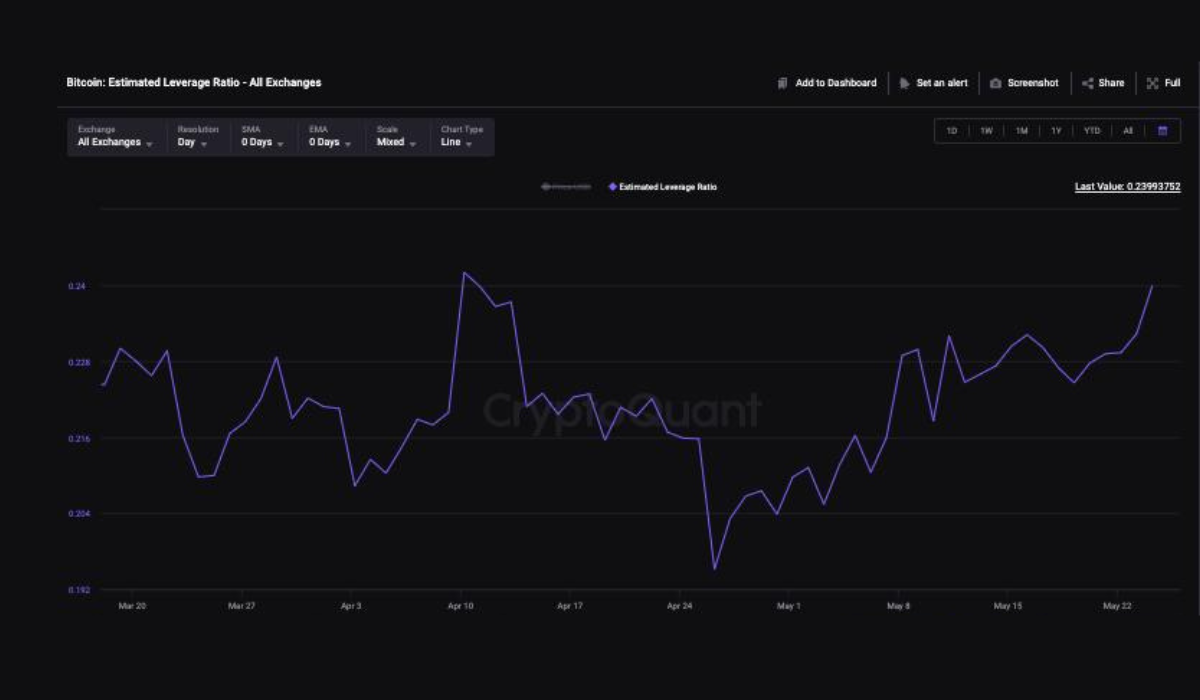

By implementing this measure, the ESRB intends to uphold the integrity of the financial system and mitigate any potential threats posed by the volatility and speculative nature of cryptocurrency markets. The rise of the Estimated Leverage Ratio for Bitcoin from 0.195 to 0.239 in just a month makes this measure particularly relevant.

Moreover, in the past 18 months, the cryptocurrency industry has faced significant challenges. Bitcoin, in particular, has experienced a sharp decline of 77% in its price. Additionally, both Luna and FTX have suffered substantial setbacks, with Luna collapsing and FTX facing bankruptcy.

The motivation behind the EU watchdog’s push for regulation is to protect investors and prevent excessive speculation. Additionally, it facilitates the sustainable growth of the cryptocurrency industry. However, developing and aligning rules in this sector is ongoing, and further developments will be in place soon.

More News

- June 9 Crypto Shopping List: StrikeX, Secret, AiDoge, AVINOC

- BitGo Signs Agreement to Buy Its Allegedly Bankrupt Rival

- Amid SEC’s Crypto Industry Scrutiny, Polygon Struggles While Green Cryptocurrency Ecoterra Raises Significant $4.9 Million

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage