Join Our Telegram channel to stay up to date on breaking news coverage

EURCHF Price Analysis – August 07

Increase in the Bulls’ momentum will push up the price towards the resistance level of $1.098 and the level may be penetrated by the Bulls. In case the resistance level of #1.098 holds, the price may reverse.

EUR/CHF Market

Key levels:

Resistance levels: $1.098, $1.104, $1.110

Support levels: $1.092, $1.084, $1.0779

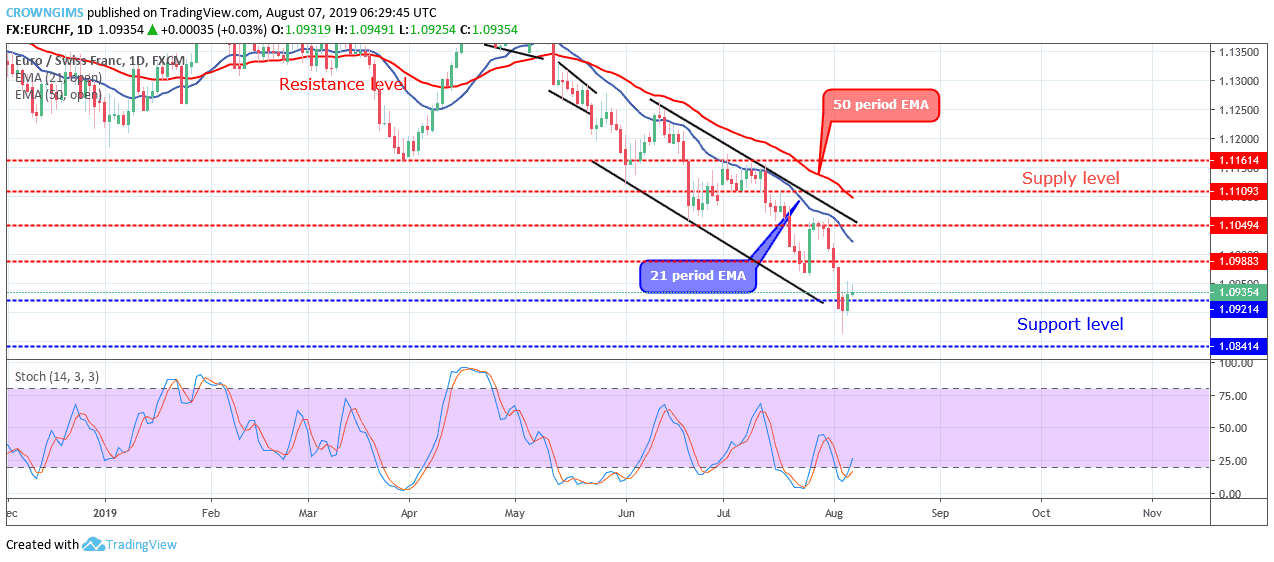

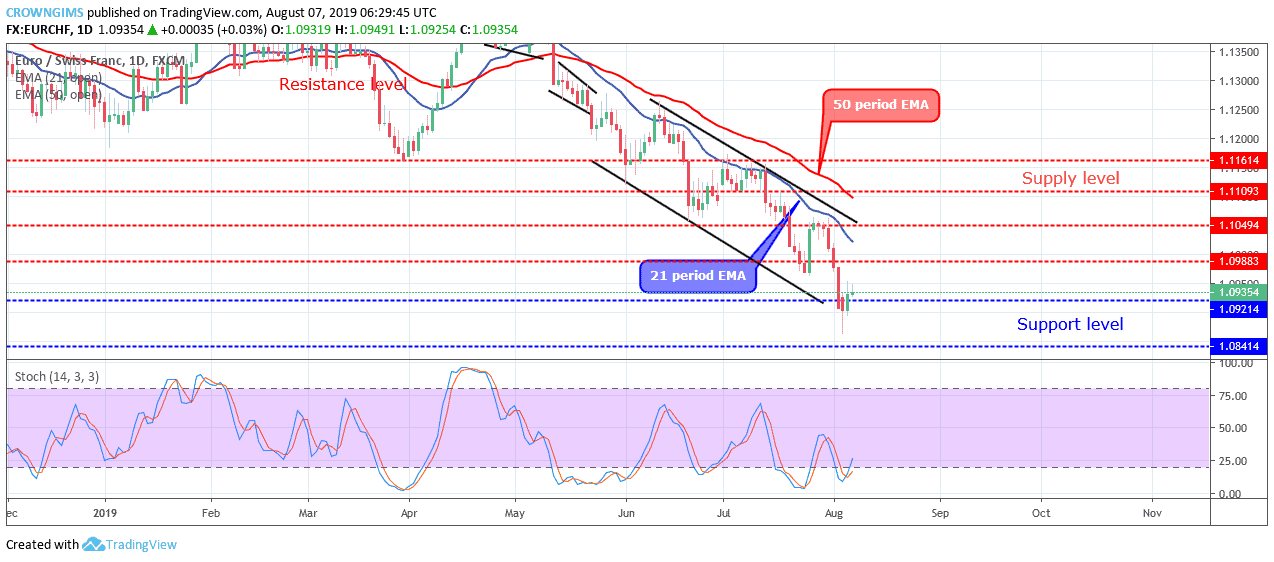

EURCHF Long-term trend: Bearish

On the long-term outlook, EURCHF is bearish. EURCHF continue the bearish movement within the descending channel. Last two weeks, the price was consolidating at $1.1049. The bearish momentum broke out bearishly at the level on July 31 and the price rolled down and broke down the former demand levels of $1.0988 and $1.092. The price touched the support level of $1.092 on August 05 and bounced up. A bullish candle emerged and broke up the $1.092 level yesterday. Another bullish candle opened the EURCHF market today which indicates that the price may increase towards the resistance level of $1.098.

The currency pair is currently trading at a far distance to the two EMAs; that is below the 21 periods EMA and 50 periods EMA which connotes strong bearish trend. Increase in the Bulls’ momentum will push up the price towards the resistance level of $1.098 and the level may be penetrated by the Bulls. In case the resistance level of #1.098 holds, the price may reverse. The Stochastic Oscillator period 14 is at 25 levels with the signal lines pointing up to indicate a buy signal.

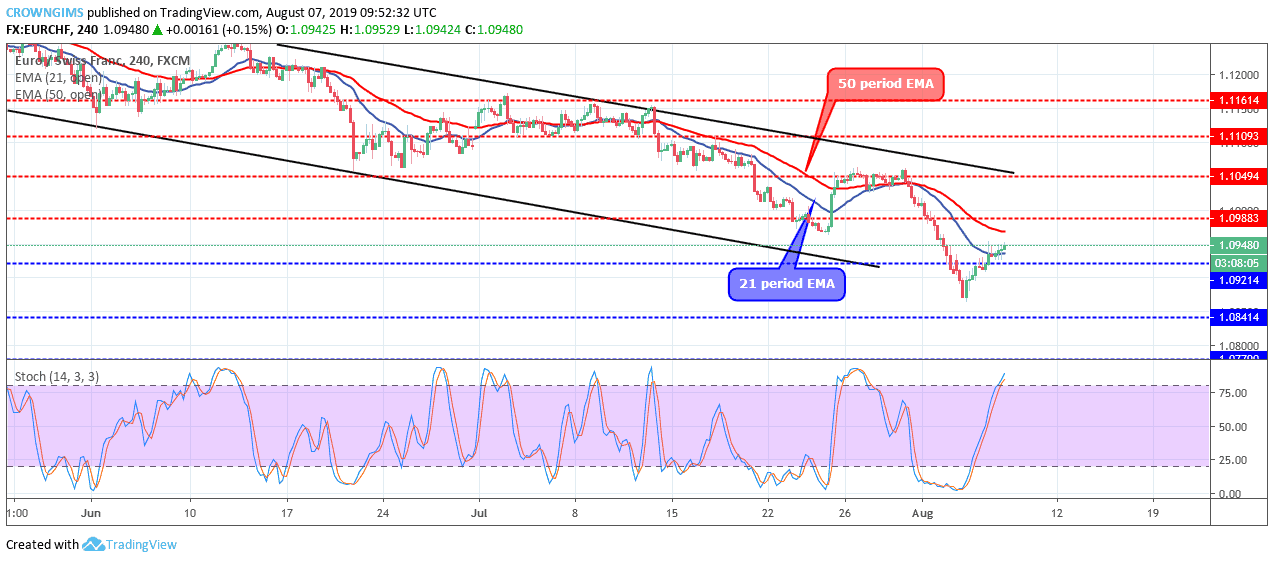

EURCHF medium-term Trend: Bearish

On the medium-term outlook, EURCHF is bearish. The bearish momentum continues in the EURCHF market. The price dropped to the demand level of $1.092 on August 02 but the level could not hold the price. EURCHF price penetrated the level and exposed to the demand level of $1.084. Further decrease in price was interrupted by the Bulls with the formation of tweezer bottom candle pattern. This candle pattern reversed the price and it is currently approaching $1.098 supply level.

The Stochastic Oscillator period 14 is above 80 levels and the signal lines strongly pointing up to indicate a strong buy signal.

Please note: insidebitcoins.com is not a financial advisor. Do your own research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage