Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum market is going on a mega bullish path as we get closer and closer to The Merge upgrade. The latest news has made Ethereum Futures surpass bitcoin for the first time. The futures markets have hit a $1 trillion market capitalization. The early signs of the rally are about to happen as the Merge upgrade finally lands on September 13.

Ethereum Surpasses Bitcoin

Ethereum is Bitcoin’s biggest competitor that started to set one milestone after another after a declaration that it would move completely to the Proof of stake consensus mechanism. However, it was not all good. The difficulty bomb debacle and the post-crash upgrades damaged Ethereum’s market position in the crypto space.

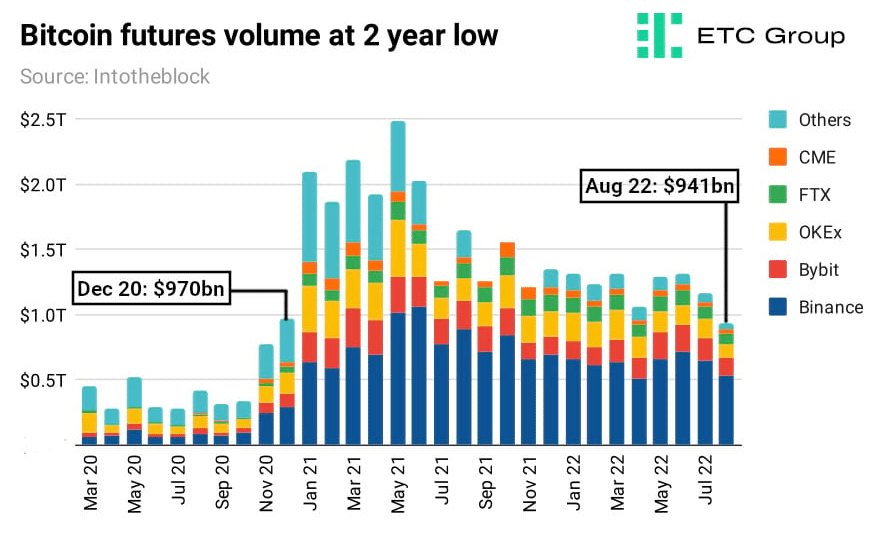

However, those days are nearly gone, as the latest data suggest Ethereum’s futures market volume has exceeded $1.07 trillion – surpassing Bitcoin’s trading volume of $941 billion. Ethereum has been closing in on Bitcoin’s trading volume for quite some time, and it has finally caught up.

Futures Volume help expert gauge the overall market sentiment about an asset and the potential of the current price moments. It does not directly show where the future lies for the crypto but establishes strong fundaments about where the price movement could go. Right now, the number of buyers and sellers of ETH is high – giving it the trading advantage.

The current charts imply two things:

- The potential of ETH to reach higher highs is high.

- And the market is about to get a lot more volatile.

At the time of writing, Ethereum is trading at $1731.5, a 2.67% decrease from the last 24 hours (an insignificant decrease). The coin is maintaining a strong #2 ranking as per CoinMarketCap.

Bitcoin Future is Following a Downtrend

While the Ethereum crowd is in the mood for celebration, the Bitcoin supporters are getting wary about BTC daily. Bitcoin futures volume has retraced to $941 billion in August 2022, behind its closest competitor, Ethereum Futures.

It is a sharp contrast as compared to the past 2 to 3 years since Bitcoin has always been the one that’s leagues ahead of Ethereum.

While the cause of this is unknown, some investors claim that the government’s stance against the Proof-of-Work has damaged their faith in Bitcoin and its prospects. Kraken, one of the leading cryptocurrency exchanges, said that Ethereum’s Proof-of-Stake migration would likely put more pressure on Bitcoin. Bitcoin’s energy consumption has always been a topic of debate. And the dialogue about it will likely escalate when the Merge Upgrade is finally complete.

Ethereum’s Flippening is Coming

BTC and ETH have recorded record-breaking open interest leverage rations recently. Many short and long bets are being placed on the fates of both cryptos. Surprisingly, there are many short betters for Ethereum, which led to the recent spike in ETH’s price.

You must also note that Bitcoin’s popularity has dwindled since this year’s halving. Proof-of-Mining continues to draw scrutiny, and few whales are willing to stand behind BTC. It has made the BTC market more volatile than ever, and it is struggling to stay above $20k levels at all times.

Furthermore, the Merge upgrade is prepping the market for the arrival of the Flippening. Many believe in the possibility that Ethereum’s market valuation will surpass Bitcoin after Merge. If these even come to pass, most cryptos would likely follow Ethereum’s price action to hit lows or highs in the market – a shift that can shift the market paradigm completely.

It will have a positive impact on ETH-based tokens like Tamadoge. Learn more about it here.

Read More

Join Our Telegram channel to stay up to date on breaking news coverage