Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum has been struggling to surpass the $2000 resistance level amidst a stock rally and regulatory challenges. On the other hand, the token is successfully holding the $1800 resistance, with optimistic predictions for the near future.

Ethereum Struggles to Break Resistance at $2000 Amid Stock Rally and Regulatory Pressure

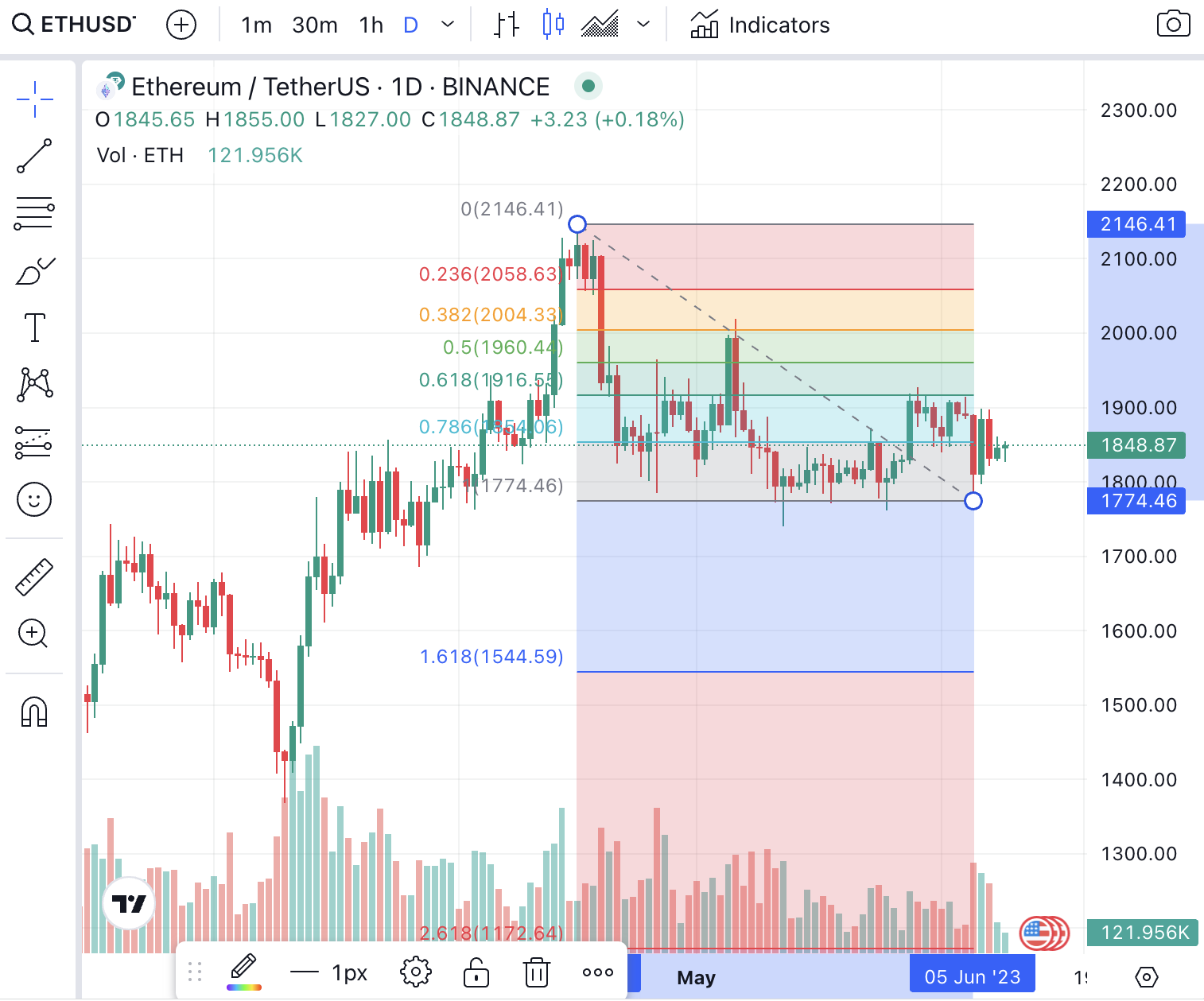

Ethereum (ETH) finds itself constrained below the $2000 mark, unable to break through this resistance level despite a recent stock rally, as noted by Mike McGlone, Senior Macro Strategist for Bloomberg Intelligence.

McGlone suggests that the 12-month-long resistance level needs to be overcome for Ethereum to make significant progress.

Despite the NASDAQ 100 stock index reaching a new 52-week high in Q2, Ethereum has struggled to sustain its position above $2000.

In the past, there has been a strong correlation between cryptocurrencies and high-beta tech stocks. This was particularly evident in June 2022 when both asset classes experienced a downturn due to macroeconomic pressures, resulting in Ethereum losing its $2000 level.

McGlone adds that Ethereum’s performance may depend on the stock index to drive broader market growth, indicating a close connection between the two. Investors often draw parallels between Ethereum, altcoins, and tech securities, perceiving them through a similar lens.

Renowned investor Bill Miller, known for consistently outperforming the stock market, has referred to altcoins as “venture assets.” Meanwhile, figures like Paul Tudor Jones have likened Bitcoin to “digital gold,” considering it a safe haven against inflation and a means to guard against bank failures.

Bitcoin’s correlation with gold has strengthened in recent months as both assets surged following several bank collapses in March. Conversely, its correlation with stocks has decreased. This divergence in correlation may help explain why Ethereum has not experienced a similar surge alongside the tech stock rally, given Bitcoin’s influence on its price and that of other assets.

The cryptocurrency market has faced downward pressure this week following lawsuits filed by the U.S. Securities and Exchange Commission (SEC) against two major exchanges, Binance and Coinbase.

Bitcoin and Ethereum both experienced a 1.5% decline this week, while coins like Solana (SOL) and Cardano (ADA) saw larger drops of 10% and 12%, respectively. The SEC’s lawsuit against Coinbase explicitly named Solana and Cardano as securities, resulting in price falls similar to what was observed with XRP in 2020.

Ethereum Holds Support at Critical Level Amid Regulatory Impact, Anticipates Price Surge

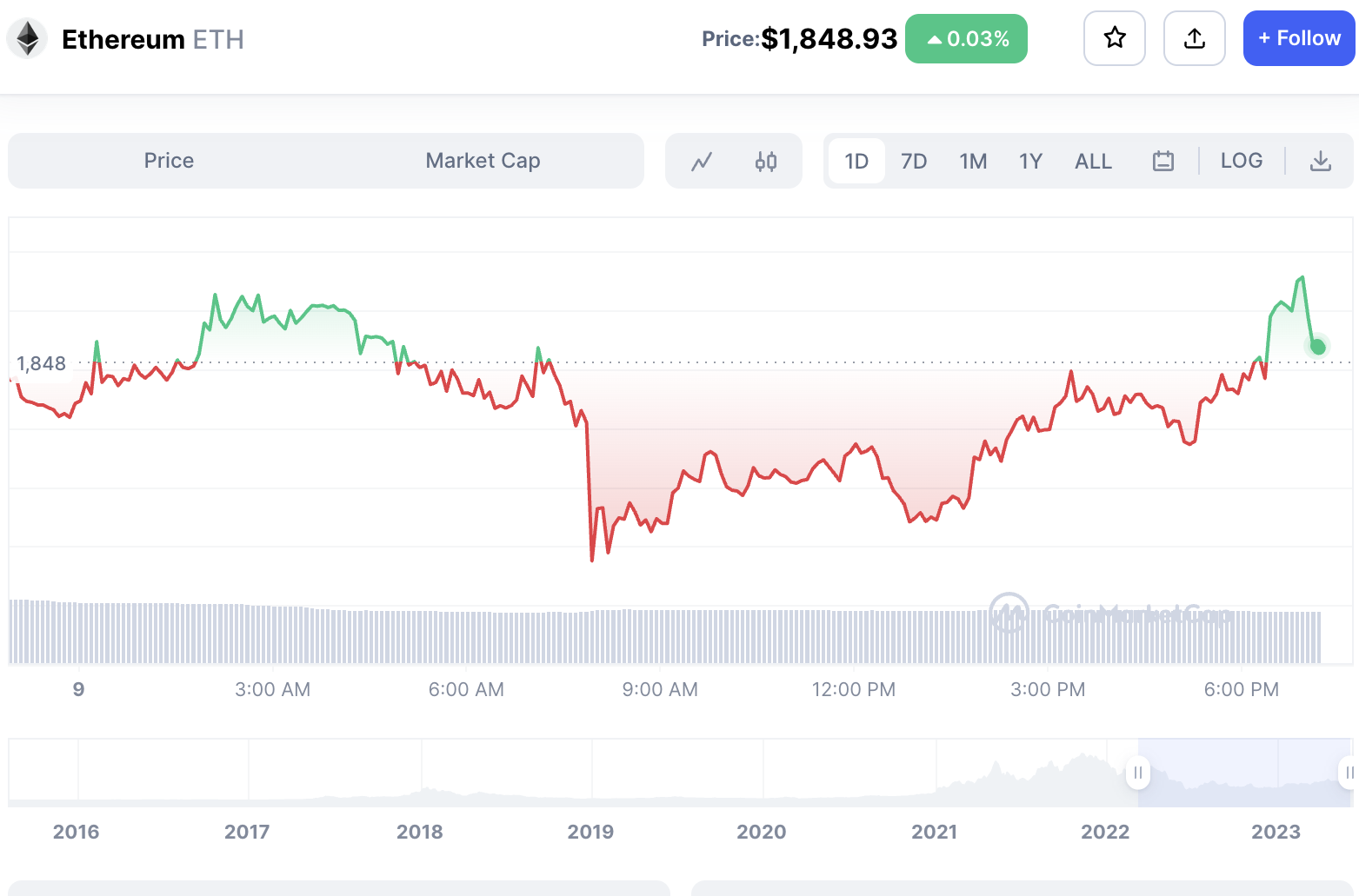

Over the past 24 hours, the price of Ethereum (ETH) has experienced a slight 0.21% decline, yet it has managed to maintain its long-standing support level at $1,800.

With the current price at $1,841, ETH has seen a 1.96% drop over the course of a week, mainly due to the impact of regulatory actions taken by the SEC, which have affected the entire cryptocurrency market.

ETH’s relative strength index (RSI) has returned to the 50 level, having previously dipped close to 20, indicating an oversold condition. Additionally, ETH’s 30-day moving average is approaching its 200-day moving average, and once it falls below the longer-term average and reaches a bottom, it may trigger a rebound for the altcoin.

This rebound may not be too far off, especially since Ethereum’s support level has remained intact around the $1,800 mark and shows signs of a slight increase.

As a result, ETH is unlikely to experience a significant decline beyond what has already occurred in the past week. Comparatively, Ethereum’s prospects appear more favorable than numerous other layer-one utility tokens.

As SEC considers ETH staking by Coinbase as an unregistered security, people must remain cautious.

Ethereum’s successful staking withdrawals have boosted demand, locking up over 22 million ETH and reducing circulating supply. With significant adoption and no regulatory hurdles, Ethereum could see a substantial price surge. Starting at $1,800, ETH may reach $2,000 near term and potentially reach $2,500 to $3,000 by year-end.

Ethereum Alternatives

As regulatory uncertainty is keeping the ETH price at a low point, crypto presales present a better investment opportunity. These presales offer early-moving gains along with many long-term upsides.

Related Articles

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage