Join Our Telegram channel to stay up to date on breaking news coverage

The Ethereum price is up 4% in the last 24 hours to trade for $2,306 as of 3:00 a.m. EST time, with a 45% surge in trading volume.

The rise comes amid broader market optimism, with altcoins that have large market capitalizations enjoying capital overflows from the Bitcoin (BTC) market.

Also, there appears to be a change in sentiment towards Ethereum that’s best reflected in the volume of ETH inflows totaling $29 million since the start of the year. The numbers are even higher over the last nine weeks, recording up to $215 million, representing a marked turnaround in sentiment, CoinShares said.

Ethereum Price Outlook Amid Shifting Sentiment

With optimism still heating up in the market about the possibility of spot Bitcoin exchange-traded funds (ETFs) launch, the upside potential for Ethereum remains alive. Judging from the trajectory of the Relative Strength Index (RSI), buying pressure is increasing, which precipitates a move north.

Specifically, the RSI hovering around 53, marks a recovery from its presence in the oversold region (below 30) earlier in the month. With the formation of a higher low, it points to a slow but steadily strengthening upward momentum.

In addition, Ethereum price remains confined within the boundaries of an ascending parallel channel, which promises more gains as long as it moves within it. Further, the histogram bars of the Awesome Oscillator (AO) are also turning green, suggesting the bulls are increasing their presence in the market. This, coupled with the Average Directional Index (ADX) indicator bottoming out suggests that the next play for Ethereum price is likely to the north.

Increased buying pressure above current levels could see Ethereum price move north to clear the $2,388 resistance. An extended move north could set the pace for the largest altcoin by market capitalization to clear the $2,445 range high with the possibility of a higher high reach the $2,500 target. A strong jolt above this level could see Ether price hit the $3,000 psychological level, in a move denoting a 30% climb above current levels.

Converse Case

Conversely, should profit booking kick off, the Ethereum price may continue with its previous trajectory south, possibly losing the critical support at $2,135.

Beyond the critical support, Ethereum price could roll over to the depths of the $2,000 psychological level, or in the worst case scenario, slip below the $1,935 level, invalidating the big-picture bullish outlook in the process.

On-chain Metrics Supporting Bullish Outlook for Ethereum Price

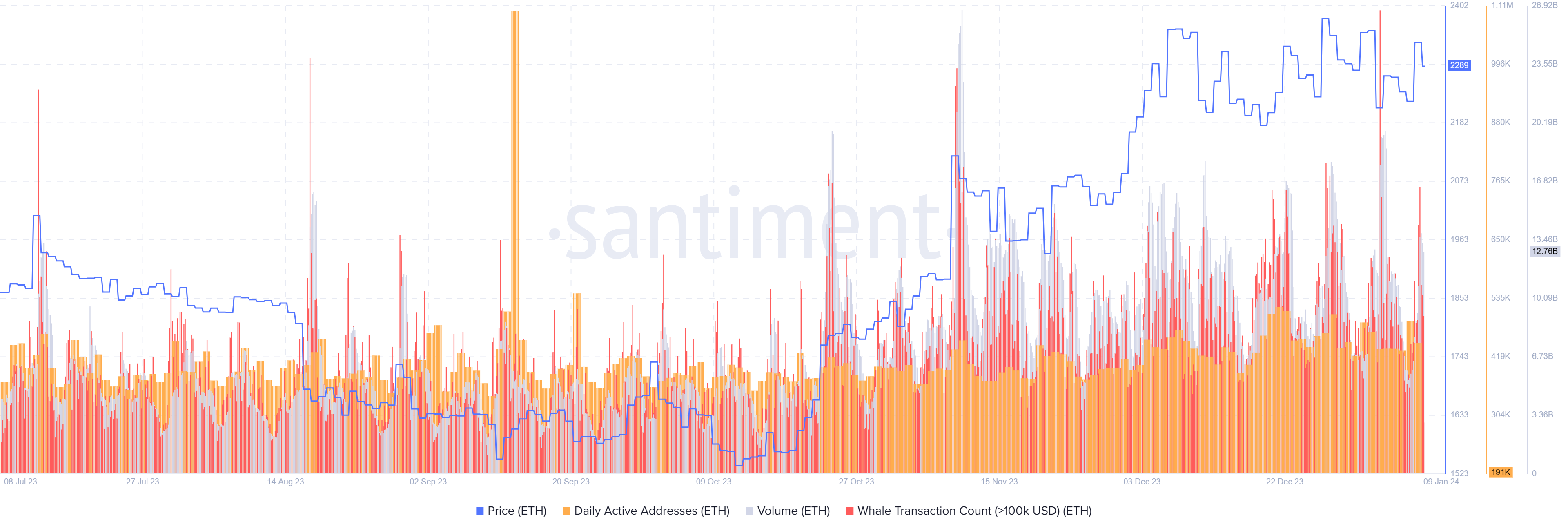

The bullish outlook for Ethereum price draws support from the notable spike in Whale Transaction Count and Volume metrics, data from Santiment shows. The surge or uptick started even as the market suffered a massive sell-off on January 2, suggesting investors were buying the dip.

Specifically, the whale transaction count metric tracking transfers worth $100,000 or more spiked accentuating the buy-the-dip assumption from institutional investors. Owing to the fact that the volume coincides with these spikes, there is even more credence to the bullish outlook.

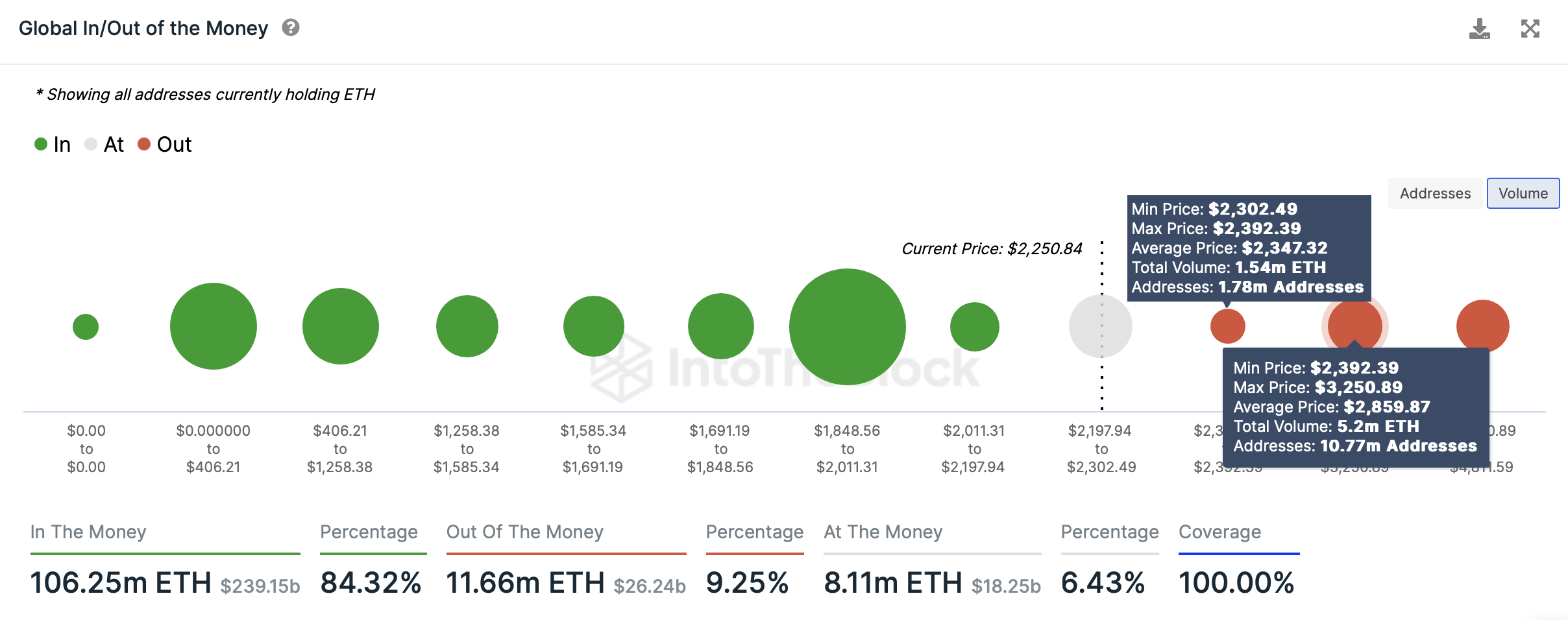

Further, data according to IntoTheBlock’s Global In/Out Of The Money (GIOM) indicator shows the immediate resistance for Ethereum price at $2,347 is rather weak. This shows that getting past this roadblock could send Ethereum to the next critical barrier of $2,859, where approximately 10.77 million addresses hold 5.2 million ETH tokens and are sitting in unrealized losses.

In principle, should ETH Bulls push Ethereum price into this hurdle, they would be countered by a significant amount of selling pressure from these holders as they try to break even.

Promising Alternative To Ethereum

Meanwhile, the attention of some investors is shifting to Launchpad XYZ, whose token, LPX, is analysts’ top pick for the best AI crypto to invest in. The project gives investors a chance to discover the next 10X trades.

Experience seamless trading on an intuitive platform. #LaunchpadXYZ is designed for all traders. 🌟 #TradingPlatform #Presale #Crypto pic.twitter.com/skSvutjGyo

— Launchpad.xyz (@launchpadlpx) January 7, 2024

The project is consumer-focused, with a portal providing insights and analytics on all Web3 sectors through a beautifully designed, humanized interface. With this, Launchpad XYZ delivers Web3 to everyone.

#LaunchpadXYZ has a mission – and that is to make sure anyone can understand how the Web3 markets work. 💪

Learn how to create your own trading framework to give you the best chance of success. 🔥#Presale #Crypto #Web3 #Altcoins pic.twitter.com/GrdrtGp18F

— Launchpad.xyz (@launchpadlpx) January 8, 2024

LPX, the ticker for the Launchpad XYZ ecosystem, is available for purchase, with each token selling for $0.0445. So far, presale collections have reached $2.467 million, even as investors accumulate one of the best penny cryptos to buy in 2024. Buy LPX even as the small-cap AI coin powers to within a whisker of $2.5 million.

Visit Launchpad XYZ to buy LPX in the presale here.

Also Read:

- How to Buy Launchpad XYZ – LPX Token Presale

- Last Call for Launchpad XYZ? Alessandro De Crypto Offers Last-Minute Insights

- Ethereum Co-Founder Vitalik Buterin Tells Investors To Diversify, Gets Hammered On X

- Ethereum Price Prediction: Justin Sun Is Accumulating ETH And He Might Buy More Of This Surging New Meme Coin That Some Say Is The Next Pepe Coin

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage