Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – March 16

Ethereum price is likely to lose ground towards $100 but the recovery above $125 will help to mitigate the initial pressure.

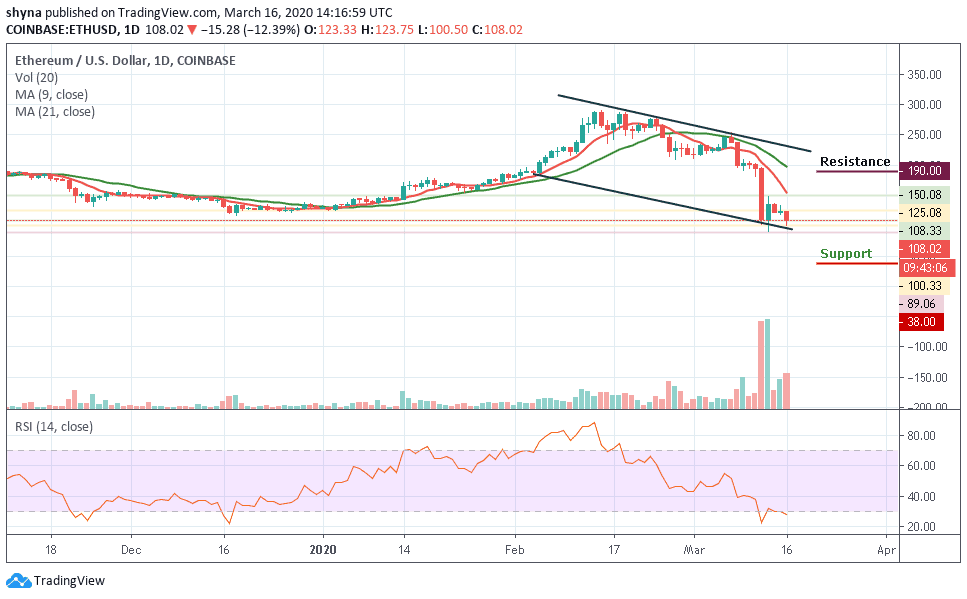

ETH/USD Market

Key Levels:

Resistance levels: $190, $195, $200

Support levels: $38, $33, $28

Currently, ETH/USD displays just enough power to defend the support at $100. All the attempts made towards recovery since the dip to $90 have bowed to the selling activity under $120. At the time of writing, ETH/USD is trading at $108 after a 12.9% loss on the day. In the short term, bearish momentum is very likely especially if the bulls fail to hold the price above $100 and the support at the lower side of the channel is broken.

Ethereum has dropped by a steep 18% over the past 10-days of trading after it rolled over from resistance at $250 from the start of the last 2 weeks. On March 13, ETH/USD continued to drop further lower until finding some recent support at a downside level at around $89.06 and has allowed the buyers to start the battle to try and push higher.

At the moment, the coin is still following the downward movement but if the bulls can ignore the fear and enter the market, traders could experience growth above $130 but the gains may not be able to break the resistance at $170 due to the present movement of the technical indicator. Meanwhile, if the selling pressure continues to drive ETH/USD beneath $100, support can then be located at $38, $33 and $28 levels.

Toward the upside, the first level of resistance lies at $170. Above this, other resistance lies at $190, $195 and $200 while the technical indicator RSI (14) faces the oversold zone.

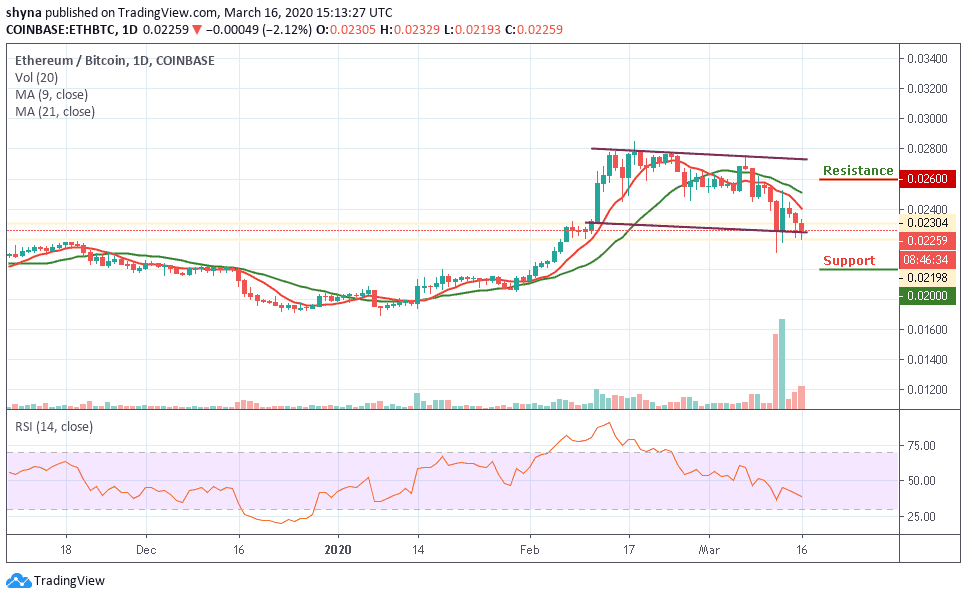

Against Bitcoin, the Ethereum price keeps following the downward trend within the channel as the bears are still dominating the market. ETH/BTC is currently trading at 0.0225 BTC as the bears are pushing the market to the south. As it stands now, the coin may likely reach the support levels at $0.020 BTC and beyond since the RSI (14) is moving below 40-level.

However, looking at the daily chart, if the 0.0220 BTC can act as a solid line of defense against any further downtrend; the market may experience a buying pressure at 0.0200 BTC and above.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage