Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – June 17

Ethereum lost its daily uptrend and it is trading in a confirmed downtrend.

ETH/USD Market

Key Levels:

Resistance levels: $255, $265, $275

Support levels: $210, $200, $190

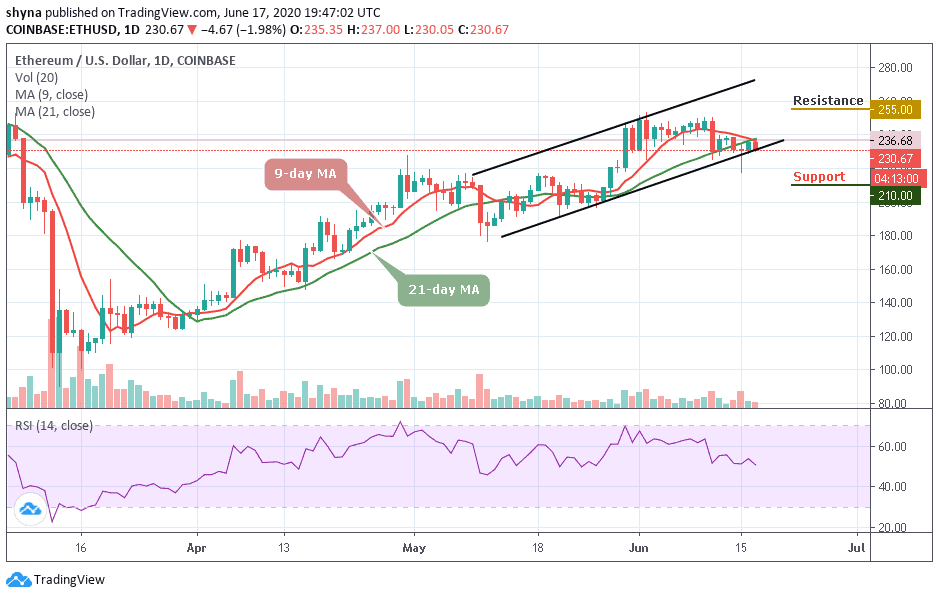

Yesterday, ETH/USD was above the newly formed major resistance level of $236 but the price of the Ethereum is dropping significantly today and it couldn’t go beyond the 9-day and 21-day moving averages. ETH/USD now faces the south trading around $230.67 but yet to cross below the lower boundary of the channel.

Moreover, the Ethereum (ETH) is following the sideways movement within the ascending channel, and currently, in its price correction phase, it is attempting to take progressive steps to combat the loss. However, if the bulls energized and power the market, the coin may reach the resistance level of $255, $265, and $275.

In other words, if the bulls couldn’t push the coin higher, it may remain low as it could cross below the channel with the nearest supports at $210, $200, and $190 respectively. The technical indicator RSI (14) is making an attempt to move below 50-level as the market faces a downward trend, which could trigger more bearish signals in the market soon.

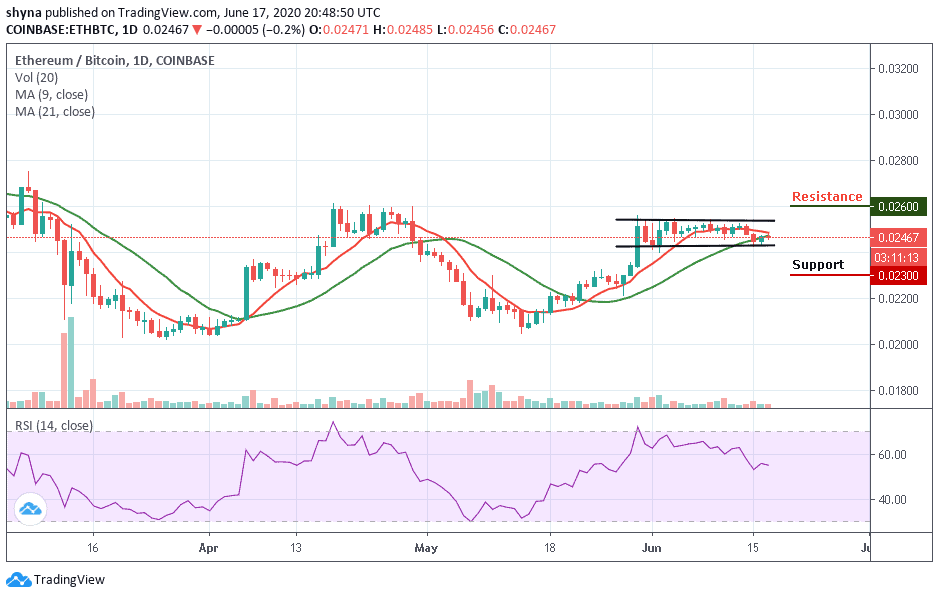

Against Bitcoin, Ethereum is seen following a sideways movement and trading below the 9-day and 21-day moving averages, as the token suffers from minor selling power. Anytime the bulls make an attempt to gain momentum, the bears will continue to release slight pressure on the market. At the time of writing, Ethereum is trading around 2467 SAT which is very close to its all-time low.

However, the bearish scenario might rally further to 2300 SAT and 2200 SAT support levels. Currently, the Ethereum price is moving below the 55-level of the daily RSI (14). If the bulls could manage to find support at this level, an upward movement to the 2600 SAT and potentially 2700 SAT resistance levels may likely surface. But a glance at the current market suggests a dominant downward trend for the ETH/BTC market.

Please note: Insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results.

Join Our Telegram channel to stay up to date on breaking news coverage