Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market has lost a massive $17 billion in market share since early April $1.3 trillion to the current $1.13 trillion. After Bitcoin and Ethereum took a breather from their March and April rallies above $30,000 and $2,000, respectively, investors turned their heads to alternative assets – meme tokens like Pepe (PEPE) and its variants to be precise.

Meanwhile, Ethereum has been doddering around $1,800 for a few days following a rebound from a massive drop that slashed gains to $1,738 on May 12. The largest smart contracts token is trading 13% down in 30 days, 2.1% down in 14 days, and 1.2% in seven days.

Support at $1,800 appears to be strengthening with ETH gaining 0.5% in the last 24 hours to trade at $1,820 at the time of writing. Despite the bullish move from $1,738, Ethereum price is not out of the woods yet as a sustained break above $1,840 is required to secure bullish confidence in the uptrend targeting highs above $2,000 in the short term.

Are Ethereum Bulls Abstaining from Fresh Accumulation?

Crypto investors, especially those holding Bitcoin (BTC) and Ethereum (ETH) offloaded their wallets in favor of the meme coin frenzy fueled by the fangled amphibian-themed PEPE. Although the meme token rallied significantly, with its market capitalization reaching more than $1.6 million earlier this month, many were left in disarray as it reversed gains soon after.

As more and more investors got wrecked, it became increasingly difficult to buy back the Ether and BTC they had sold. This situation continues to deprive the two prominent cryptos of the liquidity they need to bounce back.

According to recent on-chain data, whales seem to be holding back the bulls, with addresses containing more than 1,000 ETH shunning re-accumulation of the tokens at the prevailing price level.

Glassnode’s metrics on Thursday revealed that the “number of addresses holding 1k+ coins just reached a 6-month low of 6,435,” compared to the previous 6-month low at 6,446 as recorded on May 15, 2023.

📉 #Ethereum $ETH Number of Addresses Holding 1k+ Coins just reached a 6-month low of 6,435

Previous 6-month low of 6,446 was observed on 15 May 2023

View metric:https://t.co/iDNXAbbLRt pic.twitter.com/V5fxUR6bAz

— glassnode alerts (@glassnodealerts) May 16, 2023

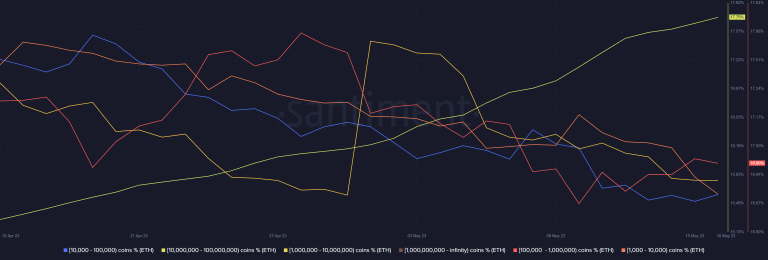

New data analysis from Santiment shows that most Ethereum whales, or addresses holding at least 1,000 ETH, have been contributing to selling pressure in recent weeks. However, addresses holding over 10 million ETH have been accumulating during the same period.

As of May 16, 2023, these large addresses controlled 17.75% of all ETH in circulation. This suggests that some whales may be taking advantage of the recent price weakness to accumulate more ETH at a discount.

It is important to note that this data is only a snapshot of the current market conditions. It is possible that the behavior of whales could change in the future. However, this data does provide some insights into the current state of the Ethereum market.

Here are some additional details from the data analysis:

- The number of addresses holding at least 1,000 ETH has been declining since January 2023.

- The number of addresses holding over 10 million ETH has been increasing since January 2023 but are not influencing the market because they are very few besides, these addresses could be owned by exchanges.

- The average price of ETH held by addresses holding at least 1,000 ETH has been declining since January 2023.

- The average price of ETH held by addresses holding over 10 million ETH has been increasing since January 2023.

In other words, the Santiment data on the second-largest crypto suggests that some whales may be selling ETH at a loss in order to raise cash. However, other whales may be accumulating ETH at a discount in anticipation of a future price rally.

Only time will tell what the ultimate impact of this whale activity will be on the Ethereum market.

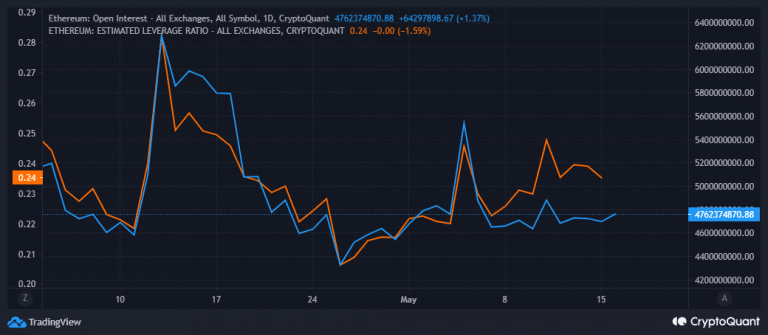

Evaluating ETH Demand in the Derivatives Market

Demand for Ethereum in the derivatives market rolled back significantly in the last ten days, implying fading excitement. There was a noticeable uptick in the second week of this month as Ethereum price nosedived to $1,738 mainly because of short selling.

Nevertheless, that demand was not sustainable as it rolled back towards the end of last week, around the time the bearish momentum was weakening – hinting at short sellers retreating to the sidelines.

Ethereum Price Analysis As Sideways Trading Takes Over

Ethereum price is wobbling between a crucial range with psychological resistance at $1,840 and support at $1,800.

The 50-day Exponential Moving Average (EMA) (in red), holding at 1,826 on the four-hour time frame chart caps Ether’s movement, putting pressure on the immediate support area – $1,800.

The position of the Moving Average Convergence Divergence (MACD) indicator as it is leveling on the mean line affirms the ongoing sideways trading. This means Ethereum would remain relatively untradeable for the rest of the week, or until the stalemate between bulls and bears resolves.

Nevertheless, there is a higher chance of a bearish outcome carrying the day, especially if short-term support at the ascending trendline gives way to increasing overhead pressure below the above-mentioned 50-day EMA.

Day traders would be looking for a break below the previous day’s point of control (POC) which currently sits at $1,816 for a short position to the previous day’s VAL around $1,812.

If Ethereum price drops below both of these points, investors can acclimatize to losses targeting the previous month’s VAL area at 1,805 with the weekly open at $1,800 within reach.

On the upside, trading above the daily open at $1,824 could open the door and allow bulls to propel Ethereum to $1,840. For further gains, Ethereum price will need an additional push from the whales, otherwise, there is a high chance of the crypto retreating to test support at $1,800.

yPredict – A Ground-Breaking AI-Powered Trading Platform

Investors are rushing to get a piece of YPRED, the token powering the newest innovative AI market intelligence ecosystem, yPredict. Participants in the crypto market do not need a reminder of why price prediction is an uphill battle that often leads to more losses than gains even for the most experienced traders.

However, this is about to change with the introduction of yPredict’s AI-enabled crypto price prediction dashboard.

The platform’s AI models have been trained to analyze huge amounts of price data which helps with identifying trends that would have otherwise gone unnoticed even to an experienced human eye.

Investors are particularly interested in this new ecosystem, whose platform is currently in development for real-time trading signals.

📢 Big news! While AI Coin Crypto prices are taking a hit, #YPRED is standing strong! We're nearing an impressive milestone of $1 Million raised! 🎉

🚀 Your trust in our AI-driven platform fuels our progress. Thank you for your support! Join the success wave at… pic.twitter.com/ZtiheSLSXR

— yPredict.ai (@yPredict_ai) May 13, 2023

Using state-of-art predictive models and data insights built by top 1% AI developers and quants, yPredict’s in-development platform plans to hand market participants an “unbeatable edge.”

In addition to this the team is “building a cutting-edge crypto research and trading platform that provides traders and investors access to dozens of AI-powered signals, breakouts, pattern recognition, and social/news sentiment features” the team behind the project said in their Litepaper.

With $1.11 million raised within a few weeks of the presale debut, potential investors must hurry to catch YPRED tokens in stage five, selling for $0.07. Investors must move quickly as stage six is around the corner with YPRED tokens expected to go for $0.09.

Recommended Articles:

- Next Shitcoins to Pump Like Pepe – BOB, PC, MUSK, LAMBO, Trending Meme Tokens

- Love Hate Inu Crypto Exchange Listings This Week, Holders to Receive Sponge Token Airdrop

- Top Crypto Gainers Today, May 16 – GRT, LDO, AiDoge, Launchpad, yPredict, DLANCE, FXS, ECOTERRA, SPONGE

Join Our Telegram channel to stay up to date on breaking news coverage