Join Our Telegram channel to stay up to date on breaking news coverage

Ethereum (ETH) price established a local high at $1,742 on February 16, after which the price attempted to inch higher. However, profit-takers and the non-existent momentum for Bitcoin (BTC) led to consolidation into a brief horizontal movement. The result has been a lot of uncollected liquidity upward at around $1,720, which initiated a correction to a low of $1,594 on Wednesday.

At the time of writing, ETH was recording a live market cap of $204.394 billion, up 2.48% in the last day. There was reduced trading activity for the smart contract token, as it had lost almost 3% in trading volume. Resultantly, the price was in limbo, hovering around $1,662, just below the midpoint ($1,668) of the recent downswing.

Relative to the current level, based on how Ethereum produces a daily candlestick close in the daily chart, ETH will either initiate a minor rally north or continue the downtrend. However, until then, the second-largest crypto is not showing any perceptible directional bias.

Ethereum Forces That Could Influence Price

In the current state of confusion, one factor that could influence a change in ETH price is the developers’ Shanghai/Capella upgrade. Based on recent reports, a final date for this launch on the Sepolia test network has been set.

🚨 The Shapella update will be deployed Feb. 28 on the @ethereum Sepolia testnet.

See what this means for #unstaking on #Ethereum! 🔥#Shanghai #Capella $ETHhttps://t.co/nnCXSFNhUe

— BSCN (@BSCNews) February 23, 2023

The Shanghai/Capella upgrade, christened Shapella, will be deployed on February 28 around 4 a.m. UTC on the Ethereum Sepolia TestNet. This would enable staking withdrawals and marks for the biggest update on the Ethereum ecosystem after The Merge. An excerpt from the Ethereum Foundation’s blog post reads:

This upgrade follows The Merge and enables validators to withdraw their stake from the Beacon Chain back to the execution layer. It also introduces new functionality to both the execution and consensus layer.

The upgrade comprises changes to the execution and consensus layers. Shanghai serves to improve Ethereum’s execution layer, while Capella serves to upgrade the blockchain’s consensus layer. Notably, the Shanghai/Capella upgrade is part of the steps leading to a major upgrade slated for March. After Shapella is live on the Sepolia TestNet, developers will advance to the last phase involving the Goerli TestNet before the MainNet launch.

As the countdown to the deployment continues, the upgrade is expected to affect the demand for ETH in the market. A similar case ensued immediately after the Zhejiang TestNet activation. This makes it logical to speculate an upward price movement following the Shapella TestNet debut.

Confusion For Ethereum Price As Investors Hope For Positive Outcome

On February 16, ETH price established a local high at $1,742, after which the price attempted to creep northward. It was rejected at the $1,747 level because of early profit taking and the current unreliable momentum for Bitcoin. This caused the price to consolidate under this level before crawling to record a local low at $1,594 on Wednesday. Consequently, there has been plenty of uncollected liquidity to the upside around $1720, which provoked a correction to $1,604.

Today, Thursday, February 23, the brief bearish advent has been extinguished, and the ETH price is attempting a recovery. So far, the price has soared almost 2% to tag the midpoint ($1,662) of the $1,747 to $1,604 range.

ETH/USD Daily Chart

An increase in buyer momentum past this midrange, followed by the bull’s ability to sustain above that level, could fuel ETH price to record another positive rally. In such a scenario, the price could tag the range high at $1,742.

In a highly bullish case, the recovery rally could extrapolate higher to retest the $2,000 psychological level last tested in August.

It is important to note that the bullish outlook hinges on Ethereum flipping the midrange at $1,668. Failure to do that could send the price of the second-largest crypto down, potentially resuming the downtrend.

However, the 50-day Simple Moving Average (SMA) moving upwards was a good sign as it showed more buyers were approaching the scene. Its position at $1,559, together with that of the 200-day SMA at $1,440 and the 100-day SMA at $1,390, were support levels for the ETH price upward. The SMAs provided potential sheds for bulls to replenish buying power.

The Relative Strength Index (RSI) at 56 showed that there was still more room upward. The price strength also indicated that buyers still had the synergy to increase the token’s value.

Ethereum Bullish Outlook Supported By The IOMAP Model

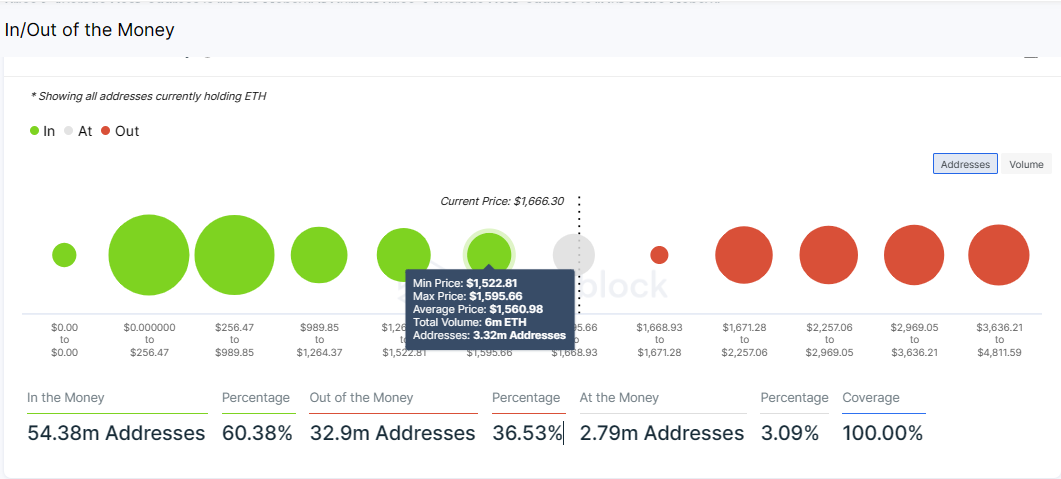

ETH’s bullish outlook is also authenticated by on-chain metrics from IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model.

The IOMAP showed that the Ethereum price had more substantial downward support than the resistance fought on the upside. The immediate support at $1,641 is stronger than the immediate resistance at $1,707. This was the zone where 6 million ETH were previously bought by 3.32 million addresses.

Conversely, on the off chance that investors begin to collect profit at this level, ETH price could resume its downtrend. In such a case, the price could retest the $1,604 range low, although the ideal target for the bears would be to pull the price lower to $1,565.

In the worst-case scenario, the price could descend to lose the support offered by the SMAs, or in extreme cases, go down to the $1,500 swing low.

Given the flattening RSI and MACD indicators, buyers and sellers were both on the scene, each fighting to dominate the Ethereum market. Notice the fading histograms that were losing the green feel, a sign that bears were about to overpower the bulls.

ETH Alternative

While ETH is on the balance, consider FGHT, the native token of the Fight Out ecosystem. FGHT is currently in the presale stage, with more than $4.56 million collected thus far. The ecosystem introduced a 5% referral bonus reported earlier with this milestone.

You can now become an affiliate with #FightOut! 👏

Create your own link on our website and earn 5% for referring your friends and family to our platform.

Visit our website to learn more! 👊⚡️https://t.co/z34Nkx3ffi#Crypto #Affilate #AffiliateMarketing pic.twitter.com/ji7LfJumbZ

— Fight Out (@FightOut_) February 17, 2023

Connect your wallet to the Fight Out website and click the ‘5% Referral Link’ icon at the bottom of the pop-up screen to join the program. To start earning, share the link and earn whenever purchases are made using your link.

More News:

- Frax Share Price Prediction As FXS Escapes From A Bearish Triangle

- Cronos (CRO) Price Prediction: Can It Resume Its Uptrend?

- The Future of EV Charging Is Here – Join This New Presale and Be Part of the Revolution

Join Our Telegram channel to stay up to date on breaking news coverage