Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – January 18

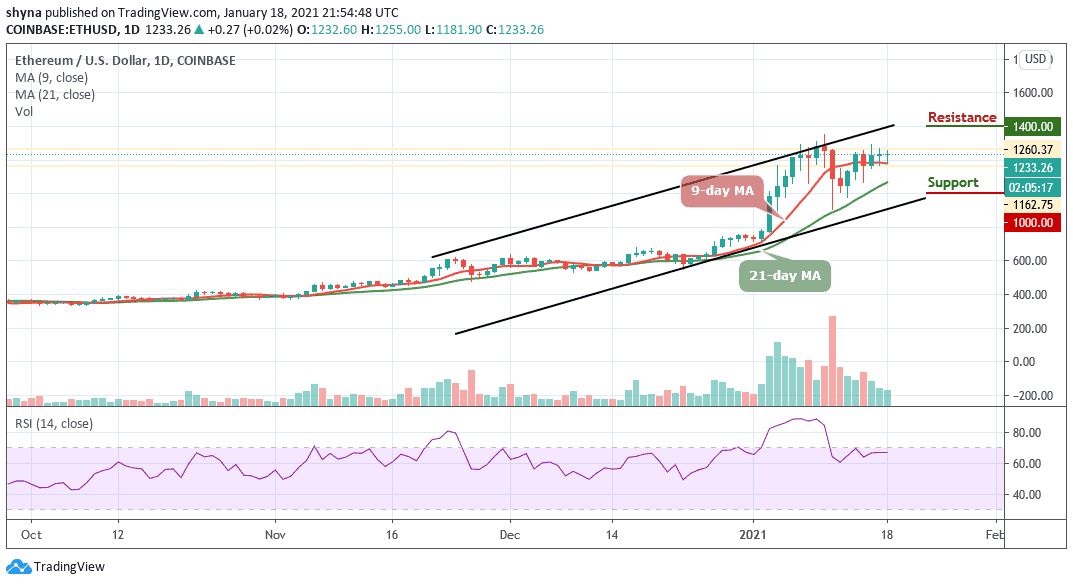

ETH/USD price action continues to move within a bullish nature, forming technical patterns for moves to the north.

ETH/USD Market

Key Levels:

Resistance levels: $1400, $1500, $1600

Support levels: $1000, $900, $800

ETH/USD continues to struggle this week as it trades with a slight gain of 0.02% to bring back the price of the coin from the low of $1181. Ethereum (ETH) continues to trade within a long term ascending price channel. A couple of days ago, the cryptocurrency was struggling to break resistance at $1294 but it must overcome here to travel higher.

What Expect from Ethereum (ETH)

Looking ahead, if the sellers push ETH back below the 9-day moving averages, initial support lies at $1100. Beneath this, support is located at $1050, and below the lower boundary of the channel, the critical support levels lie at $1000, $900, and $800. Alternatively, if the buyers regroup and start to push higher, resistance is located at $1300. Above this, resistance lies at $1400, $1500, and $1600.

However, the technical indicator RSI (14) is trending around 67-level, below the overbought zone if the price continues to move above the 9-day and 12-day moving averages and this indicates that the price could rise a bit more before it goes retreats again.

When compares with BTC, Ethereum is currently trading at 0.3413 BTC after witnessing a bearish moment in the last few days. Looking at the daily chart, the current trend of the coin is looking bearish in the short-term, but should the price break below the moving averages of the channel, the new monthly low might be created.

However, a continuation of the downtrend could hit the main support at 0.0315 BTC before falling to 0.0300 BTC and below. More so, the buyers could probably push the market above the upper boundary of the channel, with potential resistance of 0.038 BTC and above. The technical indicator RSI (14) nosedives below the 65-level, indicating that the bearish movement may continue.

Join Our Telegram channel to stay up to date on breaking news coverage