Join Our Telegram channel to stay up to date on breaking news coverage

ETH Price Prediction – September 25

The Ethereum (ETH) has switched on recovery mode and it may move past the moving averages before the end of this month.

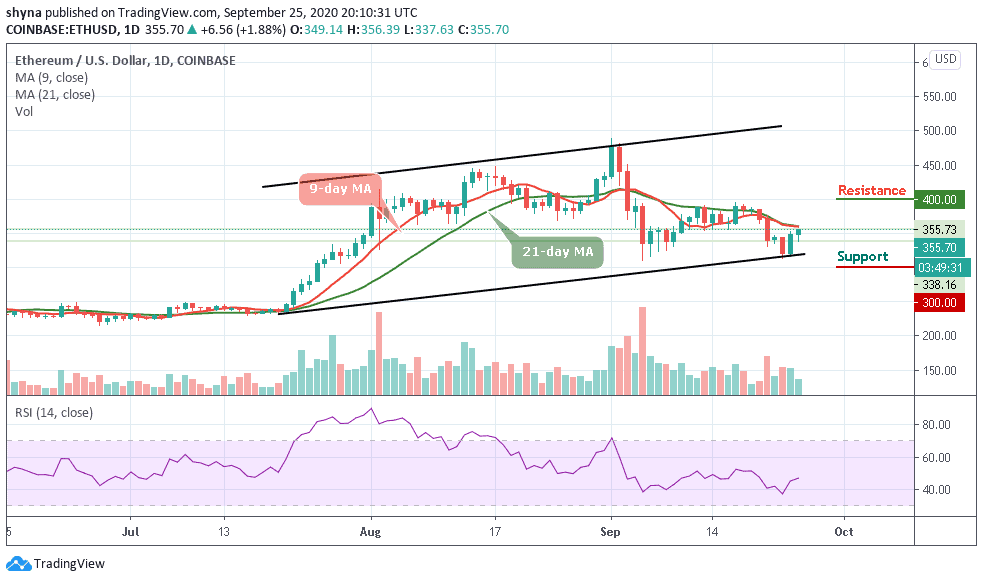

ETH/USD Market

Key Levels:

Resistance levels: $400, $420, $440

Support levels: $300, $280, $260

This is a good time for Ethereum holders as ETH/USD is starting to show a few signs of improvement and is likely to begin to trade above $400 very soon. The current performance of the coin in the market also indicates the continuation of an uptrend and traders must therefore closely monitor this coin very well.

Where is ETH Price Going Next?

The highest value Ethereum has had in the last 15 days was $394.55 and in the last 7 days, it has gone down to $313. ETH can be expected to rise from $380 to $400 before the end of this month. The on-going trend may move a little bit higher this coming week as the coin may cross the 9-day and 21-day moving averages to touch the nearest resistance at $370.

Moreover, if the bulls put more effort, the price could hit additional resistance levels at $400, $420, and $440 respectively. Meanwhile, the support levels to watch are $300, $280, and $260. The RSI (14) indicator is seen moving above 45-level, any cross above the 50-level may confirm a bullish movement.

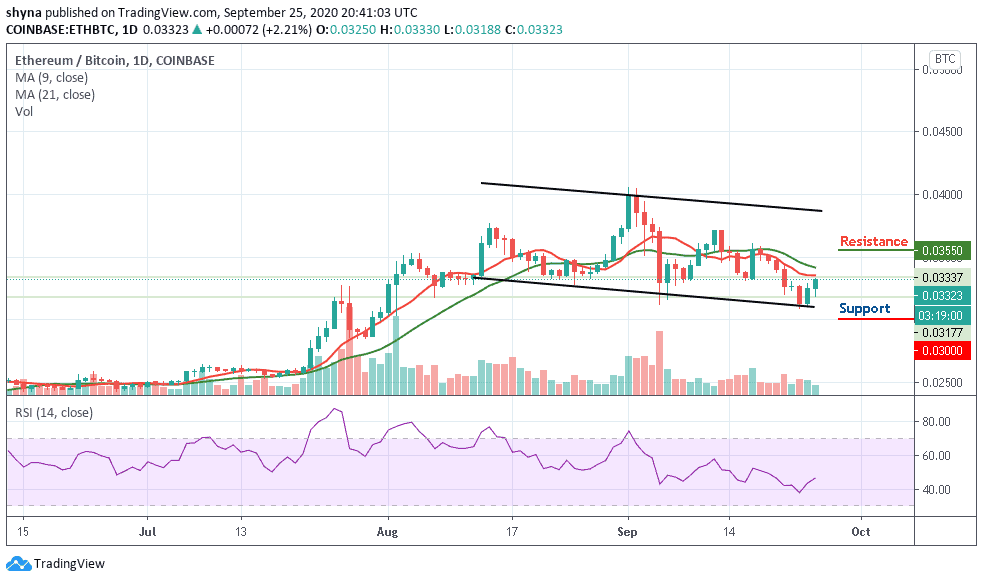

Against Bitcoin, ETHBTC is bullish. The price formed a bullish trend on the chart and still below the 9-day and 21-day moving averages consolidating. The bulls are still pushing the price upward but if they are able to maintain the trends, the price may likely hit the resistance levels at 0.035 BTC and above.

However, Ethereum has been trending within the channel and it may likely break above the moving averages but any retracement could bring the price to the nearest support level and this may reach the major support level of 0.030 BTC and below. I other words, the technical indicator RSI (14) is seen moving above the 45-level, which may give more bullish signals in the nearest term.

Join Our Telegram channel to stay up to date on breaking news coverage