Join Our Telegram channel to stay up to date on breaking news coverage

EOSUSD Price Analysis – September 01

The Bears may break down the support level of $3.0 provide the level does not hold. In case the mentioned level holds, the price may consolidate further.

EOSUSD Market

Key Levels:

Resistance levels: $3.7, $4.4, $5.1, $5.9

Support levels: $3.0, $2.1, $1.0

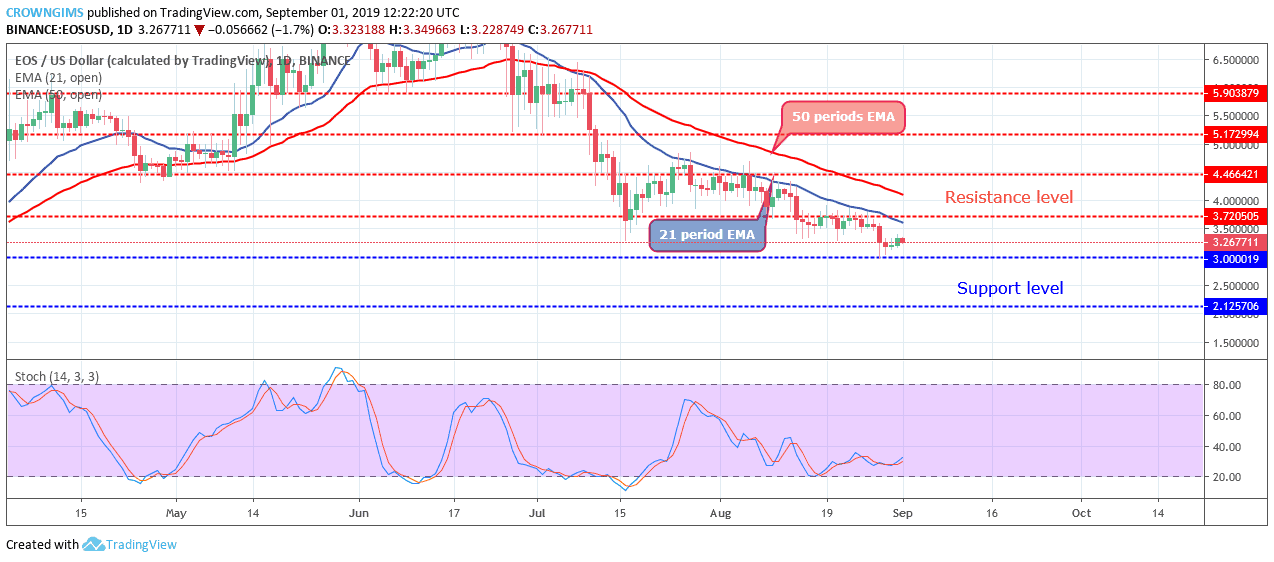

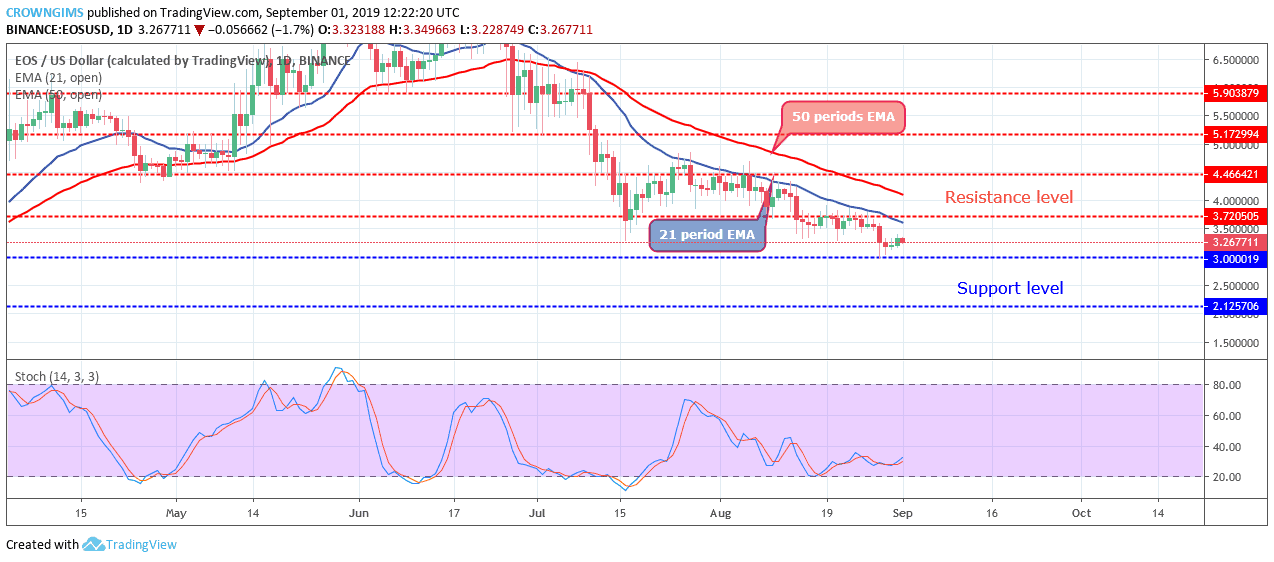

EOS/USD Medium-term Trend: Bearish

EOS/USD is bearish on the long-term outlook. The cryptocurrency was range-bound within the resistance level of $4.4 and the $3.7 price level for a long period. The bears eventually broke down the former demand level of $3.7 at a slow rate. The EOS price declined to the support level of $3.0 on August 28. The coin is currently consolidating at the support level of $3.0.

The coin is trading below the 21 periods EMA and 50 periods EMA and the two EMAs keeps a distance from each other as a symbol of bearish momentum. However, the stochastic oscillator period 14 is horizontally flat above 20 levels and the signal lines are interlocked which indicates that consolidation is ongoing in the EOS market. The Bears may break down the support level of $3.0 provide the level does not hold. In case the mentioned level holds, the price may consolidate further.

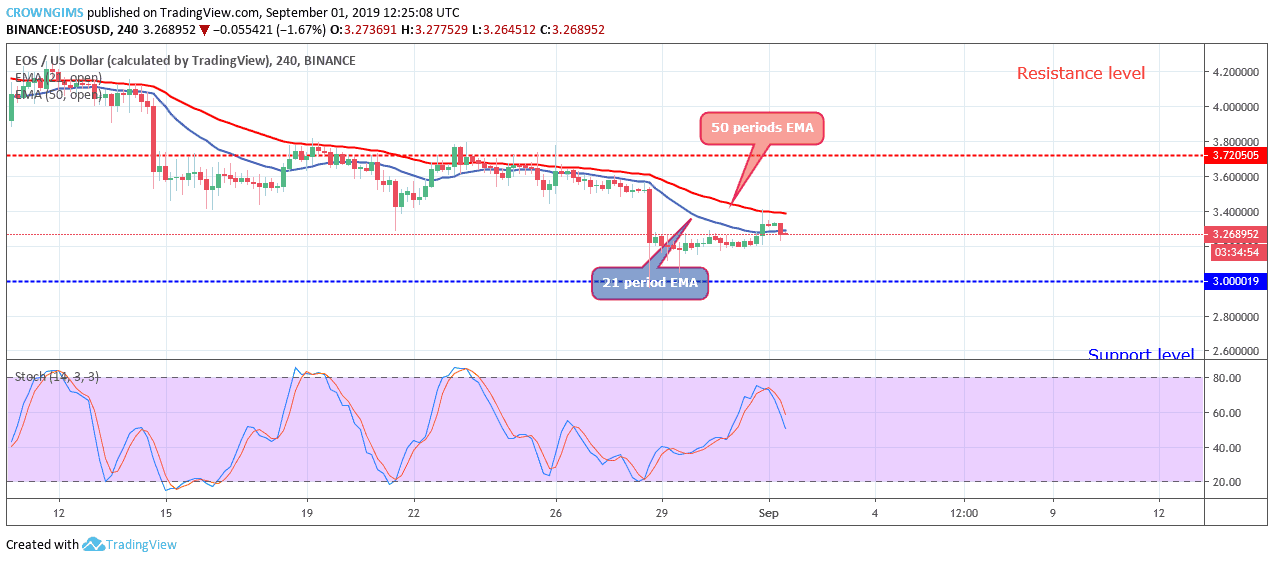

EOS/USD Short-term Trend: Bearish

EOS is bearish on the short-term outlook. The Bears prevailed over the Bulls in the 4-hour chart. The Bulls’ momentum and the Bears momentum were at equilibrium on the 4-hour chart for many days and the price was at the same level. On August 28, a strong massive bearish candle emerged and the price suddenly dropped to the support level of $3.0. The price equally pulled back and commenced consolidation.

The stochastic oscillator period 14 is at 75 levels with the signal lines pointing up which connotes buy signal.

Please note: insidebitcoins.com is not a financial advisor. Do your research before investing your funds in any financial asset or presented product or event. We are not responsible for your investing results

Join Our Telegram channel to stay up to date on breaking news coverage