Join Our Telegram channel to stay up to date on breaking news coverage

The crypto market is in the red again, but this time it is not due to regulatory pressure from the United States. Dogecoin price dropped by 6.2% in 24 hours following news that Silvergate, a crypto-focused bank was evaluating its capital position to survive.

Other cryptocurrencies like Bitcoin gave back more gains by 4.3%, topping up dominant selling pressure from last week. Ethereum price is also in the red after diving 4.5%, Binance Coin dodders 2.6% lower on the day while XRP is down 3.1% to trade at $0.3671.

Silvergate Bank Sends The Crypto Market On A Tailspin

Silvergate, a California-based bank made headlines when it announced plans to cater to the needs of crypto investors, including individuals, crypto exchanges, miners, and other related businesses. It is currently one of a handful of United States-based banks offering crypto-focused services.

After posting remarkable growth in 2021, reporting a $76 million profit in November 2021 – at peak of the bull market, Silvergate embarked on a rabbit hole trip, with no signs of recovery to this date.

Signals that everything was not okay followed a reported $900 million loss in 2022. Its weakening financial position was dealt another blow by the liquidity crunch caused by the implosion of Sam Bankman-Fried’s FTX exchange.

In a filing made to the US Securities and Exchange Commission, Silvergate outline it was likely to miss the March 16 deadline due to a weakening capital position dating back to the previous monthly report.

Crypto exchanges like Coinbase swiftly declared it was no longer going to initiate transactions to or from the bank “out of an abundance of caution. A similar communication was sent out on Thursday by Galaxy Digital, a renowned crypto asset management company.

Silvergate’s capital troubles can be attributed to the longstanding crypto winter. Furthermore, the collapse of FTX exacerbated the situation. Investor confidence in the market was eroded as stakeholders ramp withdrawal activities in favor of less risky assets.

Silvergate has been forced to sell off its securities to meet customer withdrawal requests. The bank might be the latest victim of the implosion of FTX exchange, but it’s likely not to be the last. Therefore, investors should strap up and prepare well for the coming months.

Dogecoin Price Nosedive Not Over – Here Are The Levels To Watch

Dogecoin price respected February’s month-long falling trend line as observed on the daily chart for the third time at the beginning of March. Negative volume from the Silvergate-triggered sell-off only worsened a bearish setup.

An opposite outcome would have been expected if Dogecoin price confidently stepped above the same trendline. New entries above this level would bring DOGE to the next resistance around $0.0850, with investors finally able to extend their gaze above $0.10.

It is too early to call a rebound for Dogecoin price, at least until the dust from Silvergate’s likely debacle settles. The leading meme coin dodders at $0.0757 at the time of writing while bulls tap support highlighted by the band.

Weak to medium-strong liquidity can be expected from this region. Remember this same area functioned as both a resistance and support during January’s aggressive rally. However, sellers are still strongly backed by momentum from the loss of DOGE’s support at $0.80 and the rejection from the falling trendline.

For that reason, the area around $0.0740 – still in the yellow band would be the point of control for the rest of the week. A daily close above would mean the presence of more buyers, meaning a rebound could easily fire up.

On the other side of the fence, all hell could break loose for Dogecoin price if it slides below the week’s point of control – $0.0740. In other words, investors might need to acclimatize to the down leg sweeping the subsequent liquidity lows around $0.07.

Traders should keep in mind two more liquidity levels for Dogecoin price at $0.0650 and $0.0600. A dip into these areas might be an overstretch for the meme coin at the moment. However, it would be prudent to expect a rebound and prepare to buy the dips.

The Moving Average Convergence Divergence (MACD) indicator accentuates the pessimistic outlook for Dogecoin price as it capitalizes on a sell signal flashed at the beginning of March. Notice the MACD line in blue crossing below the signal line in red. DOGE’s price action is likely to remain suppressed on the upside and aggravated on the downside in the coming days.

What’s Likely to Flip Dogecoin Price Outlook Bullish?

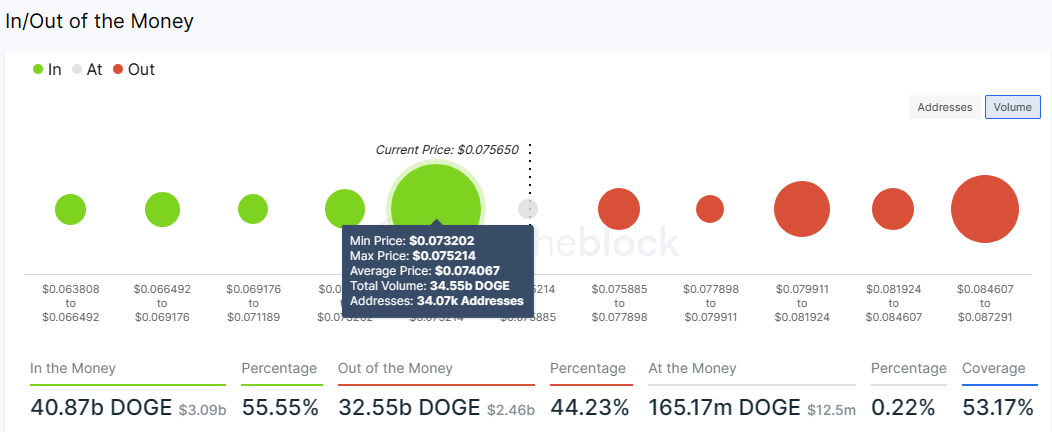

Approximately 34,000 addresses that previously purchased 34.55 billion DOGE between $0.07320 and $0.07521 are ready to hold their ground and avert a possible sweep on lows at $0.0700 – a move that might drastically change Dogecoin’s outlook for another few weeks.

If buyers in the above cohort stand their ground, Dogecoin price would be at an advantage to push for an upswing above $0.08. At the same time, this would rebuild confidence in the market ahead of the next attack on key hurdles at $0.085 and the stubborn range between $0.095 and $0.10.

Dogecoin Alternatives To Buy Today

Before buying the Dogecoin dip, you may want to check out some of the best crypto presales for 2023. InsideBitcoin reviews the list of the best altcoins to buy, bringing to your attention possible options to diversify your crypto portfolio.

Fight Out (FGHT), one of the leading crypto presales for 2023 surpassed the $5 million market. Investors scooping up FGHT tokens before the project lists on the exchanges for the first time on April 5 see potential in the move-to-earn (M2E) sector.

Fight Out is an up-and-coming fitness-oriented ecosystem, tapping the power of Web3 to help people lead healthy lifestyles. Users in the ecosystem also earn in an in-app currency called REPS when they complete daily workouts and challenges.

Every user gets a soulbound NFT which can be used as an avatar to access the metaverse. Soulbound because the NFT cannot be sold, but it grows in tandem with the owner’s fitness progress. Fight Out stands out for eliminating the need for expensive NFTs to access the metaverse and provide community members with personalized fitness programs.

Similarly, investors may want to diversify their crypto portfolios with Metropoly (METRO), the first NFT marketplace supporting the global real estate industry. The team at Metropoly is tapping the power of Web3 to channel investment in real estate while eliminating third parties like banks.

With a minimum of $100, one can buy an NFT and receive a monthly rental income. Investing in real estate through Metropoly cuts the time and process from 60 days to less than 24 hours. So far, METRO’s presale has raised $584k far ahead of the token’s listing on exchanges.

Related Articles:

- US Lawmakers Question Government’s Accounting Policy For Crypto

- Solana Price Prediction – SOL’s Breakout To $40 Imminent Despite Network Outage Woes

- Bitcoin Price Prediction for Today, March 3: BTC Price Inevitably Drops to $22K

Join Our Telegram channel to stay up to date on breaking news coverage