Join Our Telegram channel to stay up to date on breaking news coverage

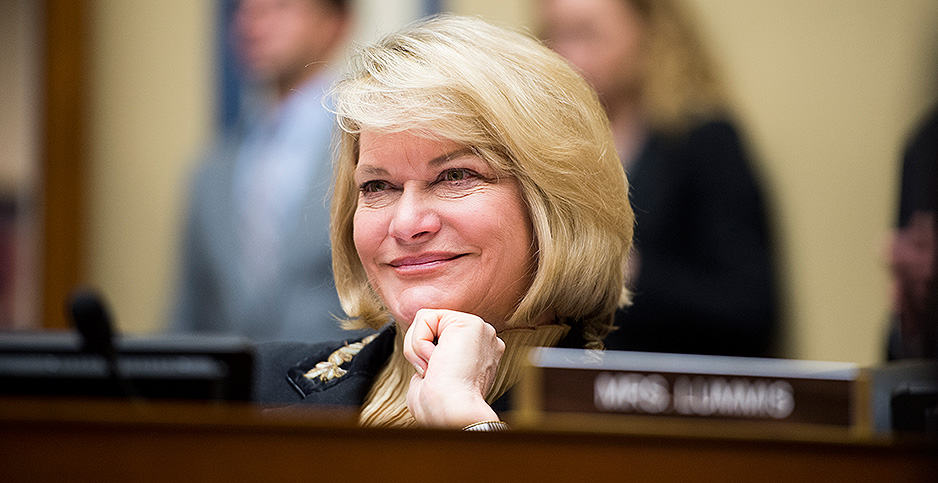

The crypto platforms have recently received an aggressive crackdown from the Securities and Exchange Commission (SEC), making it harder for firms to engage in the mainstream financial system. The republican lawmakers in the United States have argued that the Securities regulators overstepped with its Staff Bulletin. However, two U.S. lawmakers say the SEC accounting policy undermines safe crypto custody. The Republican lawmakers include Rep Patrick Mc Henry, House Financial Services Committee chairman, and Senator Cynthia Lummis.

U.S. Rep. Patrick McHenry, who chairs the House Financial Services Committee, and Sen. Cynthia Lummis are asking federal banking regulators to explain how they're dealing with a controversial SEC bulletin.@jesseahamilton reportshttps://t.co/LpaHZAlAdM

— CoinDesk (@CoinDesk) March 2, 2023

Notably, U.S. lawmakers have been keen on the U.S. Congress’s ongoing efforts concerning crypto regulation. On March 2, they sent a letter to several bank agencies questioning government policies controlling how financial firms handle their accounting for crypto. Additionally, they asked how the bank agencies are dealing with a controversial bulletin from the SEC. The Staff Accounting Bulletin 121 (SAB 121) advised financial platforms that they should maintain the users’ crypto holdings on their balance sheets.

Last year, the Staff Accounting Bulletin 121 by the SEC intended to clarify the accounting treatment of digital assets safeguarded by custodians and other platforms engaged in digital asset activities. However, the letter to the Federal Reserve and other U.S. banking agencies criticized SEC’s move. It noted SEC’s move is a measure that could hinder the majority of Americans’ access to safe and secure custodial arrangements for digital assets. This is because it would force the regulated banks to turn down crypto custody as something that is equipped with a significant capital demand.

Noteworthy, the lawmakers alleged in the letter that:

A recent decision by the Celsius bankruptcy categorized all Celsius users as unsecured creditors, and therefore at the back of the line to recover their assets. It highlights the legal risk of effectively forcing customer custodial assets to be placed on the balance sheet.

Additionally, the two republican lawmakers questioned the banking agencies on their interactions with the SEC. Further, they asked whether the securities regulators’ position conflicts with their policies. The U.S. lawmakers have given the banking agencies till March 16 to respond to various questions addressed to them.

Federal Reserve’s Chair, Powell, remarks on crypto custody

Last year, the Federal Reserve Chairman, Jerome Powell, gave his remarks before the Senate Banking Committee, noting that the central bank was evaluating SEC’s derivative. Powell asserted:

Custody assets are off balance and have always been. The SEC made a different decision regarding digital assets for reasons it explained, and we must consider those.

However, SEC’s move led Coinbase (COIN) to allege in a public filing that the customer’s assets may have caught up with the platform’s debatable bankruptcy. The admission caused a lot of fear among customers. However, the firm claimed it wasn’t a signal about the platform’s health.

Additionally, Powell noted that SEC’s interpretation is something that they are focusing on now. He further stipulated that the Federal Reserve agency is working with other bank regulators to determine how it can change the way they assess lenders that keep cryptocurrencies.

More News:

- Jerome Powell’s speech affects cryptocurrency, although not as much

- Best Crypto to Buy March 2023 – Next Cryptocurrency Set to Explode

- Silvergate’s Delayed Financial Report Sends Stock Crashing

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage