Join Our Telegram channel to stay up to date on breaking news coverage

The Decentraland price prediction escalates, but a break above $0.55 is expected to push the coin to trade near the channel.

Decentraland Prediction Statistics Data:

- Decentraland price now – $0.51

- Decentraland market cap – $879.4 million

- Decentraland circulating supply – 1.8 billion

- Decentraland total supply – 2.1 billion

- Decentraland Coinmarketcap ranking – #50

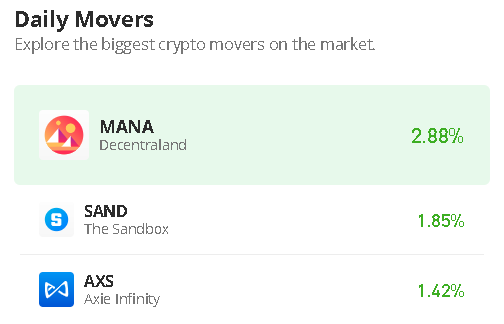

MANA/USD Market

Key Levels:

Resistance levels: $0.70, $0.75, $0.80

Support levels: $0.35, $0.30, $0.25

MANA/USD is trading around the resistance level of $0.51 after touching the daily high of $0.53 during the European session today. This is a move that could easily pave the way for gains above the upper boundary of the channel to touch the resistance level of $0.60. Therefore, if the technical indicator Relative Strength Index (14) moves to cross above the 60-level, the market could show that the bullish grip is getting stronger.

Decentraland Price Prediction: Where is MANA Price Going Next?

The Decentraland price is currently holding the ground within the channel after a major recovery from the opening price of $0.50. This shows that buyers could have the upper hand in the price movement, and they could easily push the coin toward the potential resistance of $0.70, $0.75, and $0.80 respectively. In other words, if the buying action fails to break above $0.60, MANA/USD could instead settle for consolidation.

Nevertheless, it is about time that buyers increase their confidence in the recovery because $0.60 is still achievable. Meanwhile, if the bears bring the coin below the 9-day and 21-day moving averages, the support levels of $0.35, $0.30, and $0.25 could be reached.

Against Bitcoin, MANA hovers above the 9-day and 21-day moving averages preparing to cross above the channel. Unless this resistance is effectively exceeded and the price eventually closes above the barrier, there might not be any reason to expect a long-term bullish reversal.

Meanwhile, trading below the moving averages could recall the lows, and a possible bearish continuation could meet the nearest support at 1700 SAT before falling to 1600 SAT and below. However, the buyers may need to push the market above the channel which could hit the potential resistance level at 2200 SAT and above. The technical indicator Relative Strength Index (14) shows that bulls are in control as the signal line moves above the 60-level.

Alternatives to Decentraland

The Decentraland price seems to be facing the north; it has been following a bullish movement since the beginning of today. In the next few days, MANA/USD is likely to maintain a consistent bullish run as the Relative Strength Index (14) moves to cross above the 60-level and it may continue to show signs of an upward movement in the market soon.

Meanwhile, the Wall Street Memes coin was created to provide the Wall Street Memes community with a token that connects them and helps them achieve wealth., raising above $4 million at the moment as it continues its presale.

Read more:

- AUDUSD Broke Up $0.692 Level, Targeting $0.701

- Ripple Price Prediction: XRP/USD Slips Below $0.150 Again; Faces Volatility on the Downside

- Bitcoin Price Prediction: BTC/USD Recovers from $6,700 Support, Makes a Fresh Attempt at $7,000 Resistance

New OKX Listing - Wall Street Memes

- Established Community of Stocks & Crypto Traders

- Featured on Cointelegraph, CoinMarketCap, Yahoo Finance

- Rated Best Crypto to Buy Now In Meme Coin Sector

- Team Behind OpenSea NFT Collection - Wall St Bulls

- Tweets Replied to by Elon Musk

Join Our Telegram channel to stay up to date on breaking news coverage