Join Our Telegram channel to stay up to date on breaking news coverage

2023 has been tumultuous for the crypto industry, as 13% of all crypto funds have collapsed, signaling a crisis of confidence and operational challenges. Data insights from 21e6 Capital AG, a Swiss investment advisor, reveal that these funds have faced a vicious circle of obstacles, including regulatory uncertainties and difficulties in attracting investors and banking partners to an unregulated market.

Crypto Funds Struggle to Survive

Increased chaos in the crypto industry has led to heightened awareness and alertness in customers and investors. The need for more secure crypto exchanges and custodians amid regulatory uncertainties has made it difficult for crypto funds to lure investors considering the unregulated status of the market.

Despite the steady rise of Bitcoin experienced since the start of the year, the report states that 97 out of over 700 crypto funds have closed shop, with most of the remaining ones struggling to make returns.

In fact, statistics by Bloomberg show that, on average, crypto funds generated a 15.2% return in the first half of 2023. This was a significant underperformance compared to Bitcoin, which gained 83.3% over the same period.

Crypto Panic: Startling Data Shows 97 Crypto Funds Have Collapsed This Year https://t.co/6cQ9u6PAyg

— Crypto Trader Pro 🇺🇸 (@CryptoTraderPro) August 7, 2023

This is mainly because the FTX collapse late last year caused many hedge funds to hold their funds in more extensive cash reserves than usual. While this move was meant to protect them from the high volatility that the market has been suffering, it also caused them to miss out on the Bitcoin surge that has been ongoing since the year began.

As of the end of July 2023, statistics by 21e6 Capital show that only 31% of crypto funds had significant exposure to Bitcoin.

Aside from the psychological trauma, the demise of FTX also directly impacted crypto funds. For instance, Galois Capital imploded in February with $40 million worth of assets trapped in the defunct exchange.

In its aftermath, top crypto-friendly banks, such as Silvergate and Silicon Valley Bank, collapsed, leaving the crypto industry without banking services. This created skepticism in the rest of the traditional banking industry, with no bank rising to help the crypto industry. As a result, “even exceptionally well-performing funds shut down due to lack of a new banking partner,” says the report.

Directional Funds Fail to Catch Up with Bitcoin

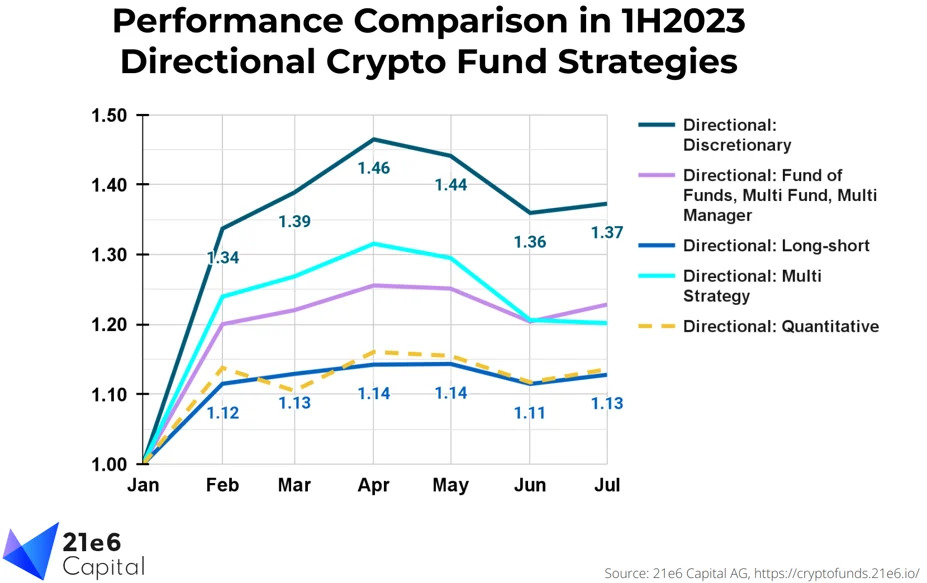

According to the report, directional funds outperformed their non-directional peers. The data showed that the latter had an average return of just 6.8% from January to June. On the other hand, funds that place directional bets typically had a return of 21.9%.

Directional funds implement tactics in response to expected market changes. They rely more on futures markets and frequently place wagers on short-term price fluctuations than their non-directional counterparts.

However, their performance was still significantly lower than that of Bitcoin. This underperformance has impacted investor confidence, especially those with significant exposure to altcoins, causing cash inflows and the launch of new crypto funds to dwindle.

More precisely, the “quantitative directional” approach, one of the investing strategies employed by hedge funds, is the least successful in 2023 so far.

This method typically employs trading algorithms and focuses on statistical decision-making. Such data-based tactics brought directional funds issues in a year marked by bumpy markets, as noted in the 21e6 Capital study. In other words, although cryptocurrency prices have increased, they haven’t done so in a consistent manner.

As such, the market has been sending erratic signals to systematic crypto-quant funds. This has aggravated the situation by deceiving trading algorithms into following sub-optimal strategies.

Related Articles:

- Elon Musk Quashes Rumours of X Token

- CRV Price Soars as Hacker Returns Funds

- Two Renowned Cryptocurrency Specialists, Followed by Half a Million People, Predict XRP Value Will Plunge to $0.45, While XRP20’s Presale Reaches the $1 Million Mark

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage