Join Our Telegram channel to stay up to date on breaking news coverage

The bears are exerting more pressure in DASH market

DASH Price Analysis – September 21

Should the bears increase their momentum and push DASH below the support level of $39, then, $32 and $27 levels may be tested. In case the price is rejected at the $39 level, the price may reverse. The resistance level can be found at $42, $45, and $48 levels.

DASH/USD Market

Key Levels:

Resistance levels: $42, $45, $48

Support levels: $39, $32, $27

DASH/USD Long-term Trend: Bearish

DASH is bearish in the long-term outlook. The former support level of $42 was tested on September 06. The bears’ momentum could not break down the level. The price pulled back and tested the resistance level of $45; consolidation was carried out for six days. The bears were able to defend the just mentioned level and formed a bearish engulfing candle which pushed down the price to test the previous low at $39 level. This is the third time DASH is testing the just mentioned level.

The price has broken down the 9 periods EMA and the 21 periods EMA while the former is below the latter. At the moment, the price is trading below the two EMAs which indicates a bearish movement in the DASH market. Should the bears increase their momentum and push the price below the support level of $39, then, $32 and $27 levels may be tested. In case the price is rejected at the $39 level, the price may reverse. The resistance level can be found at $42, $45, and $48 levels.

Your capital is at risk

DASH/USD Medium-term Trend: Bearish, A Whale Buys Tamadoge

DASH/USD is bearish on the 4-hour chart. The bullish pressure could not withstand the resistance at $50. The bearish engulfing candle emerges, the price decline towards the $39 price level. The price is currently consolidating trying to break down the support level of $39. There is a high probability that the price will reverse at the mentioned level.

DASH is trading below the 9 periods EMA and 21 periods EMA which indicates bearish momentum and that the bears are dominating the market. The Relative Strength Index period 14 with its signal line pointing down at 36 levels connotes a sell signal.

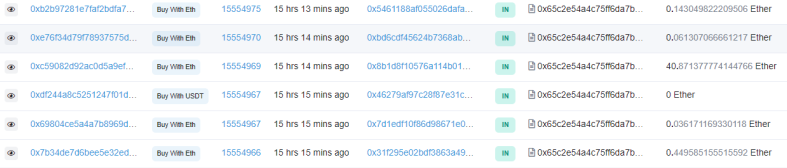

The final days of the Tamadoge (TAMA) presale this weekend were marked by large FOMO buys worth upwards of $80,000 in Ethereum. The Tamadoge token presale hit its target of 19 million USDT on Sunday, a hard cap that Jacob noted on YouTube was higher than the 2014 Ethereum ICO and the 2022 STEPN ICO. The presale ran for just under eight weeks from July 25 to September 18 – making it one of the most successful crypto presales of this year alongside Battle Infinity, which we also reviewed, another play-to-earn crypto token that rose in value by several hundred percent at its IDO. The large whale buys this weekend could indicate that TAMA will also perform well on launch day. Tamadoge was featured on CNBC last week as having high potential with its deflationary tokenomics and similarity to popular video games. The listing price of Tamadoge will be $0.03, and its maximum supply 2 billion tokens.

Related

Join Our Telegram channel to stay up to date on breaking news coverage