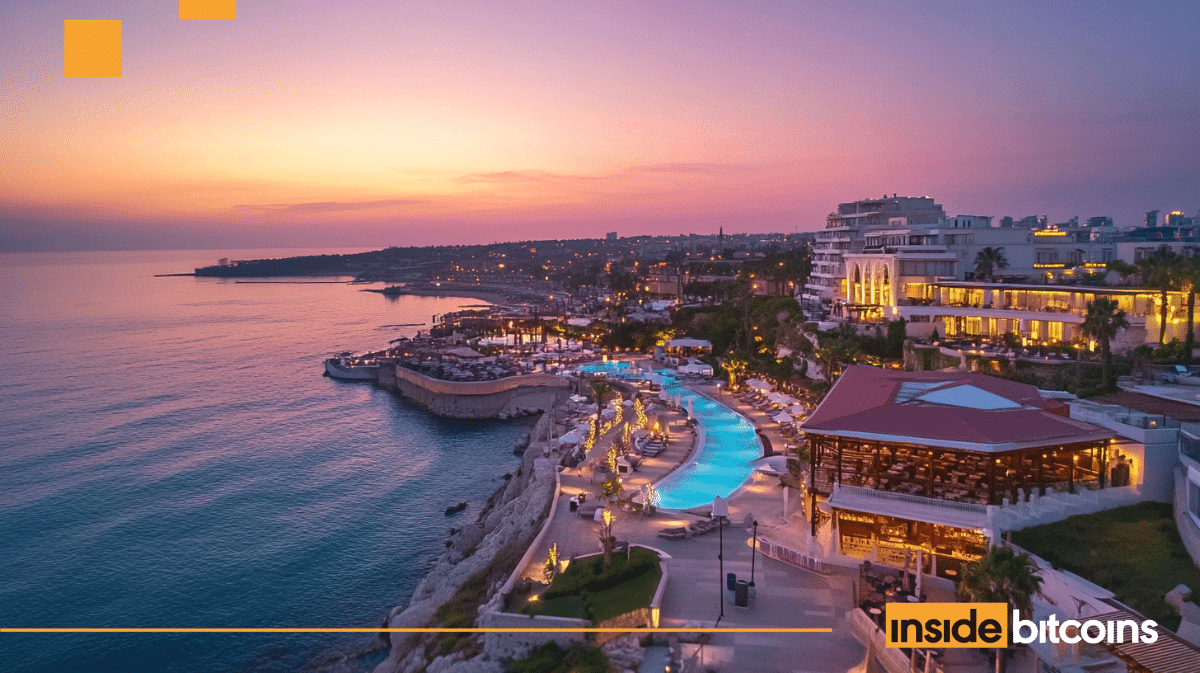

In recent weeks, Cyprus has become the epicenter of a heated legislative battle over a controversial bill that would grant casinos an exemption from the nation’s €10,000 cash transaction limit. The proposal has ignited fierce debate among lawmakers, regulatory bodies, and the public, with profound implications for the country’s financial integrity and gaming industry.

The Proposed Legislation: A Divisive Issue

The contentious bill, which would create a special carve-out for casino establishments from the standard €10,000 (approximately $10,840) cash transaction limitation, has fractured Cyprus’ political landscape. Four members of parliament—Nikolas Papadopoulos from the Democratic Party (DIKO), Marinos Mousiouttas representing the Democratic Alignment (DIPA), Efthimios Diplaros of the Democratic Rally (DISY), and independent lawmaker Andreas Themistokleous—have championed the proposal.

Support for the measure follows predictable political lines, with DISY parliamentarians Demetris Demetriou and Nicos Georgiou joining DIKO’s Zacharias Koulias in backing the exemption. Meanwhile, the opposition has coalesced around AKEL representatives Irene Charalambidou and Andreas Pasioutides, along with independent MP Alexandra Attalides, who have voiced unequivocal disapproval.

The parliamentary discussions have grown increasingly tense, with Charalambidou reportedly walking out of a committee session following what she described as “inappropriate comments” from Andreas Themistokleous during her statement. “They cannot silence us in parliament,” she later declared, adding that:

instead of fully aligning with international practices, some are trying to pass a bill opposed by supervisory and regulatory authorities

Regulatory Pushback and Money Laundering Warnings

The list of regulatory bodies opposing the exemption reads like a who’s who of Cyprus’ financial watchdogs. The Unit for Combating Money Laundering (MOKAS), Central Bank, Tax Department, Cyprus Bar Association, and Securities and Exchange Commission have all registered their objections to the proposed changes. These institutions warn that the exemption could undermine Cyprus’ anti-money laundering framework and contradict European commitments.

Independent MP Alexandra Attalides has emerged as one of the most vocal critics of the measure. In a CyBC radio interview, she didn’t mince words, accusing proponents of the bill of deliberately facilitating money laundering operations. She emphasized that Cyprus has struggled for years with its reputation as a potential money-laundering hub, making the reintroduction of this proposal particularly concerning.

“Cyprus will be participating in illegality if this exemption passes,” Attalides warned from the parliament press room. She stressed that the proposal disregards the objections of professional bodies and could damage the country’s financial standing.

The Evidence: Suspicious Transactions Already Detected

The debate hasn’t unfolded in a vacuum of speculation. The police anti-money laundering unit has already referred at least 16 cases of suspicious gambling activities at casinos to law enforcement for investigation during 2023-2024. These referrals stem from a larger pool of 182 suspicious transaction reports submitted by Integrated Casino Resorts Cyprus Ltd, the primary casino operator in Cyprus.

These suspicious transactions total approximately €480,000 over two years, with €260,171 in 2023 and €219,896 in 2024. Of the 101 suspicious transaction reports filed in 2023, 34 involved cash transactions, while in 2024, 10 of 81 reports involved cash.

A confidential memo from MOKAS revealed a diverse international element to these suspicious activities. Players flagged during due diligence checks hailed from various countries including Cyprus, Israel, Greece, Syria, Vietnam, China, Georgia, Poland, Korea, and the United Kingdom. The scale of cash gambling is substantial, with Israeli casino patrons reportedly wagering €92 million in cash in 2024 alone, while Cypriot customers placed €77 million in cash bets during the same period.

Casino Money Laundering Techniques

The concerns about casinos and money laundering extend far beyond Cyprus. Cash-intensive facilities with complex transaction chains naturally attract criminals looking to clean illicitly obtained funds. The global casino and online gambling industry, forecast to reach $261.8 billion in 2022, has been increasingly scrutinized for its vulnerability to money laundering schemes.

A common technique involves converting “dirty” money into physical casino chips, playing minimally, and then exchanging the chips for “clean” money, typically in the form of a casino check. Fixed-odds betting terminals are particularly favored in this process, as they allow gamblers to lose only small amounts before cashing out with the majority of their funds now appearing legitimate.

The consequences of inadequate anti-money laundering controls have been severe for many gaming establishments. In 2022 alone, casino regulators across the United States, United Kingdom, Austria, Sweden, and the Netherlands levied over $264 million in fines against casinos—a staggering 444 percent increase compared to 2021.

Cross-Border Complications and Northern Cyprus

Adding another layer of complexity to the situation is the movement of funds between the divided island’s jurisdictions. Recent reports indicate substantial money laundering through casinos in the occupied areas of northern Cyprus, with cash reportedly moving across crossing points into government-controlled areas without adequate oversight.

One significant loophole that exacerbates this problem is the practice by Cyprus’ Customs Department of accepting profit statements from casinos in the occupied territories without verifying their authenticity. This procedural gap allows both foreign nationals and Greek Cypriots to declare large sums as “legitimate winnings” and export the funds without restrictions.

The Industry’s Defense and Economic Arguments

Proponents of the casino cash exemption argue that the strict €10,000 limit puts southern Cyprus casinos at a competitive disadvantage, particularly compared to establishments in northern Cyprus operating outside the Republic’s jurisdiction. They contend that the stringent limitations drive business away, affecting revenues and tourism.

The Cyprus Gaming Authority has defended the industry’s existing safeguards, emphasizing that robust monitoring measures are already in place. According to their data, casinos handle approximately 40,000 transactions monthly, amounting to €32 million, with 94% of these transactions being conducted in cash.

European Context and Future Regulations

The debate in Cyprus unfolds against the backdrop of broader European efforts to combat illegal gambling and strengthen anti-money laundering measures. The European Casino Association (ECA) recently released its Manifesto for the 2025-2029 EU policy period, which emphasizes fighting crime, protecting consumers, and supporting EU competitiveness.

Research cited by the ECA indicates that 70% of online gaming revenue in the EU in 2024—around €32 billion—came from illegal operators. Additionally, approximately €10 billion in illegal land-based gaming revenue circulates outside regulatory frameworks, depriving governments of taxes and undermining consumer protections. The ECA advocates for strengthened Anti-Money Laundering and Combating the Financing of Terrorism (AML/CFT) enforcement and an expanded role for Europol in tackling illegal gambling networks. The association also calls for fair licensing requirements for all operators targeting EU markets.

Modern AML Compliance in the Gaming Sector

The evolving landscape of gambling has introduced new challenges for anti-money laundering efforts, particularly with the rise of cryptocurrency gambling. Regulatory frameworks for crypto gambling, like those in the United Kingdom, have begun adapting to address these novel risks while maintaining equivalence with regulations for traditional casino operations.

Best practices for casino AML compliance now include implementing robust Customer Due Diligence (CDD) and Enhanced Due Diligence (EDD) protocols for high-risk players, such as politically exposed persons (PEPs). Source of Wealth checks, cryptocurrency transaction monitoring, and AI-powered surveillance systems are increasingly becoming standard components of casino compliance programs.

Modern regulations typically require casinos to maintain comprehensive records, including customer identification documents, transaction logs, suspicious activity reports, and due diligence documentation for at least five years.

The Decisive Vote Approaches

The Cyprus parliament is scheduled to vote on the controversial casino cash exemption bill on March 27, 2025. The outcome will determine whether casinos will operate under the same cash transaction limitations as other businesses or receive special treatment that critics argue could undermine the country’s anti-money laundering framework.

With political parties like Volt Cyprus and the Movement of Ecologists-Citizens’ Cooperation joining regulatory bodies in opposition to the measure, the vote promises to be contentious. These groups have characterized the proposal as undermining transparency principles and contradicting Cyprus’s European obligations.

As the date approaches, both supporters seeking economic advantages and opponents warning of reputational damage continue to make their cases to lawmakers and the public. The decision will significantly impact Cyprus’s gaming industry, its international financial standing, and its ongoing efforts to combat money laundering.

Related News

-

- Ukrainian Embassy Rejects Zelensky Casino Purchase Claims as Russian Propaganda

- European Safer Gambling Week Set to Start on November 18, Confirms EGBA

- Analysis of Gambling Addiction Across U.S. States – Here are the Findings

- Dominik Nitsche Triumphs in Record-Breaking ACR Poker Tournament, Secures $1.8 Million Prize