Join Our Telegram channel to stay up to date on breaking news coverage

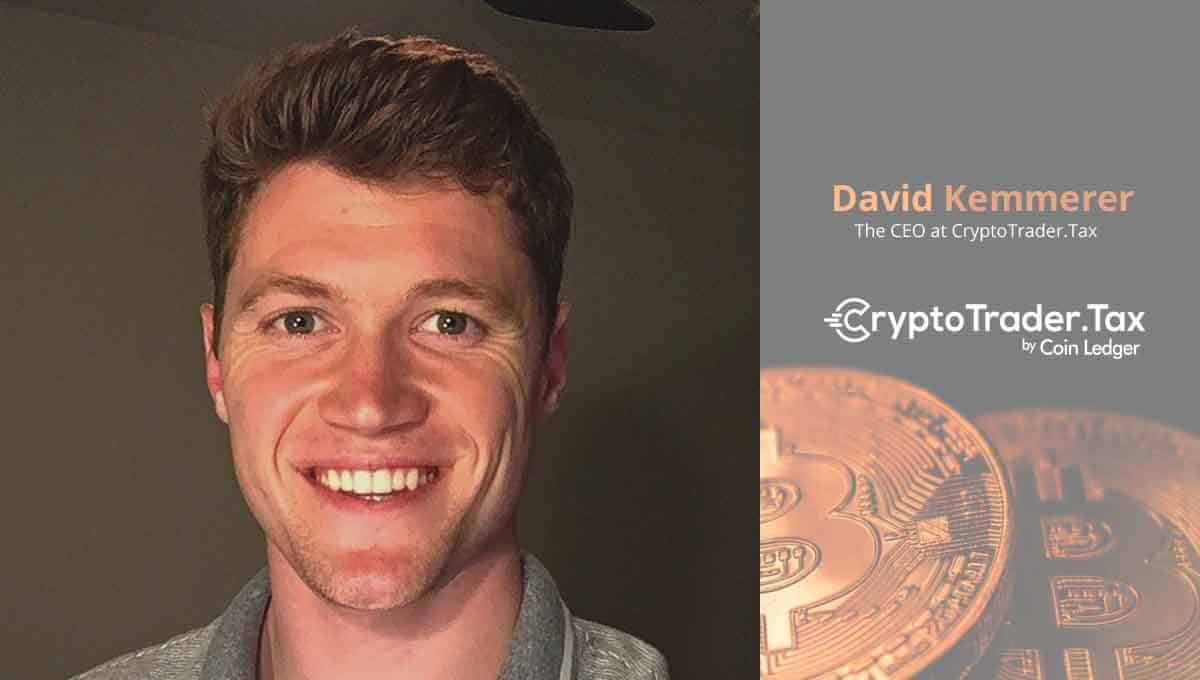

In a recent interview with Insidebitcoins.com, David Kemmerer, co-founder and chief executive at CryptoTrader.tax has explained why he believes clear crypto regulations will not be the only catalyst for the mainstream adoption of digital currencies. During the interview, Kemmerer also gave his insights on how the IRS can tackle the complex cryptocurrency tax puzzle.

The chief executive further shared his thoughts on why it is near to impossible for cryptocurrency exchanges to give correct tax reports for users. Kemmerer also talked out CryptoTrader.tax future plans of partnering with exchanges and wallets to help users file taxes effectively.

1. Gatehub and CryptoTrader.tax recently partnered to help users file their taxes from the wallet and exchange. Are there plans to partner with other exchanges and what are the timelines?

“Yes indeed. We have plans to continue partnering with the best cryptocurrency exchanges, wallets, and platforms on the market. CryptoTrader.Tax gives these platforms an easy way for their users to report their crypto taxes as well as an additional revenue stream. Unfortunately, I can’t dive into specifics on timelines, but you can expect more to come in the future.”

2. CryptoTrader.tax has diversified its services to offer a tax professional suite built for accountants, CPAs, and tax pros. Why did CryptoTrader venture into this?

“We will always build tools that align with the needs of our users and the needs of the market. Over the past year, we’ve seen tax professionals have a need for a different set of tools than DIY crypto investors who want to do their own taxes. We saw a great opportunity to expand our offerings to service tax professionals as well as the DIY consumer. We are also able to leverage a lot of the same technology we have already built as well as our current distribution channels to help accelerate our speed to market with this new offering.”

3. Tell us about Cryptotrader.tax expansion plans outside the United States. What factors do you look at before venturing into a new jurisdiction?

“CryptoTrader.Tax is quickly expanding globally. Capital gains and losses work fairly universally, and most countries treat cryptocurrency taxes in a very similar way. This means our software is able to be tweaked slightly to service different global markets. Factors that we take into account when looking at new jurisdictions to expand to are #1 the size of the market and #2 How similar or different the tax laws are to U.S. cryptocurrency tax laws.”

4. How are you helping users understand how cryptocurrencies work?

“We employ an entire content team here at CryptoTrader.Tax whose sole focus is to create accessible and easy to understand blog articles, videos, and other forms of content that help our users and prospective users better understand how cryptocurrency taxes work. You can check out our entire blog on our website!”

5. In your opinion, why is cryptocurrency tax still a complex subject within different jurisdictions?

“The same reason why taxes are complex in different jurisdictions. Every country has its own governing body and its own tax regulations and rules. It works no different for the world of cryptocurrency. Each government has the ability to mandate different elements within tax laws. Canada’s crypto tax rules are a great example of rules that work slightly differently than those of the U.S. Our job at CryptoTrader.Tax is to build the different tax laws into our system to abstract the complexity away from the user. It should be a matter of button clicks for them—they shouldn’t have to become tax professionals.”

6. Should cryptocurrency exchanges be held accountable for giving user’s inaccurate tax reports? And why does this happen in the first place?

“This is a complex question that we could spend hours discussing. I do not believe cryptocurrency exchanges should be held accountable for giving their users completed gains and losses reports that can be used for tax reporting. I hold this opinion because it is fundamentally impossible for these exchanges to do this, and requiring them to do so would fundamentally change how their businesses operate and how cryptocurrency as a whole operates.

The reason exchanges can’t give accurate tax documents stems from the transferable nature of cryptocurrencies. You can send crypto from one wallet to another. It’s fundamental to crypto. However, this transferability often makes it impossible for one exchange or one platform to hold all of the required data needed for cost basis and fair market value reporting, which in turn is needed to calculate capital gains and capital losses.”

7. What is your opinion on IRS tax regulations on cryptocurrency tax? Do you find the regulations clear to the ordinary crypto holder? What would be your advice for the IRS on crypto regulation?

“I think people don’t give the IRS enough credit. They have a very difficult job. Of course, there are ways they can improve, and they are working to improve. My advice for the IRS would be to bring in as many people who live and breathe these tax problems together—namely leaders of exchanges, tax software companies, etc—and collect feedback from them. These issues are extremely complex, and there is no way regulators who have zero experience in this space can create effective legislation from an arm’s length away. They must work closely with the private sector.”

8. Do you think unclear regulations around cryptocurrency taxes have impacted the mainstream adoption of cryptocurrencies?

“I do believe this is a problem. Markets need clarity, and they hate uncertainty. However, I don’t think the lack thereof is what has held cryptocurrencies from reaching mainstream adoption. Regulatory clarity will help, but I don’t think regulatory clarity will launch crypto into mainstream adoption either. We need much more than just that. We need true, value-added use cases that do not exist in the world of today.”

Thank you, David, for the conversation!

Join Our Telegram channel to stay up to date on breaking news coverage