Join Our Telegram channel to stay up to date on breaking news coverage

Venture capital investments in cryptocurrency startups have witnessed a significant decline of more than 70% in the past year. The industry is grappling with a changing landscape as institutional traders shift their focus from blockchain to artificial intelligence.

Cryptocurrency Startups Face Steep Decline in Venture Capital Investments

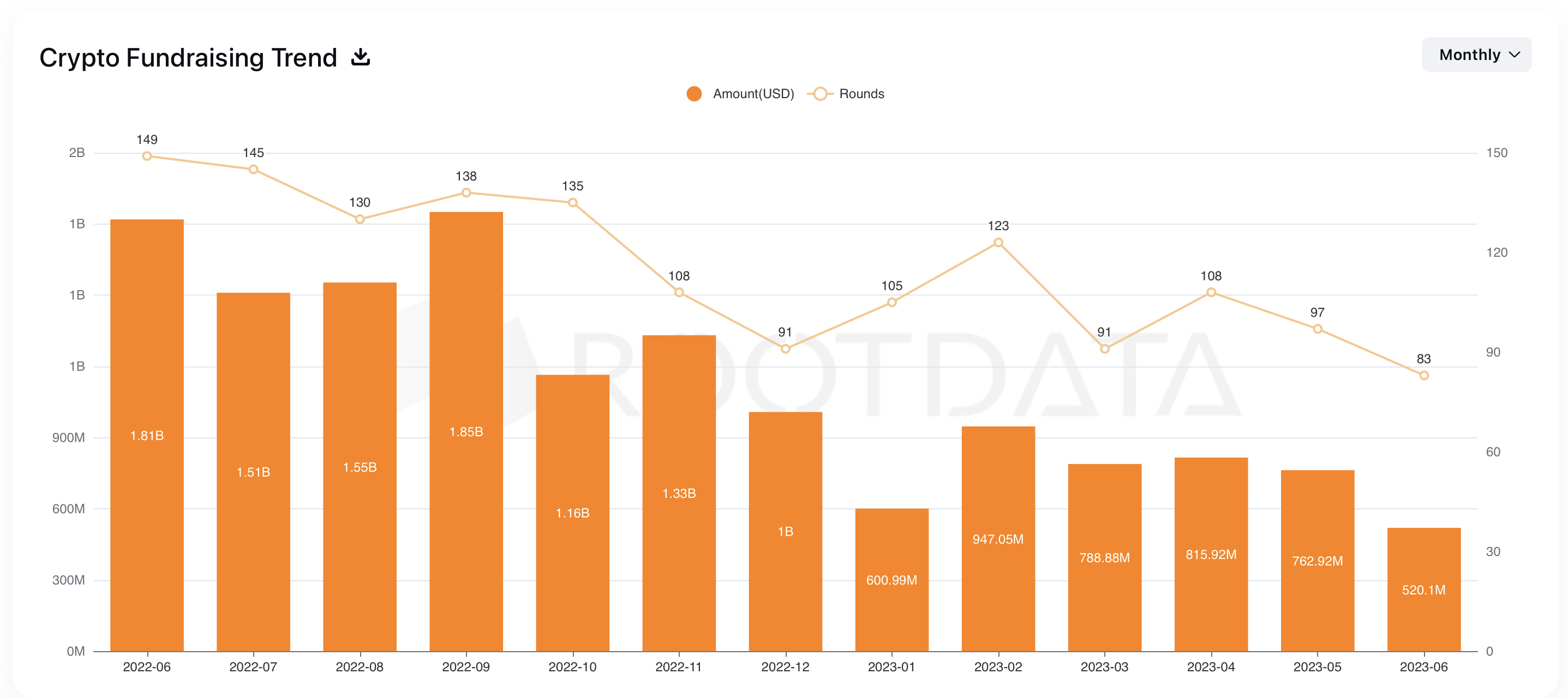

Venture capital investments in cryptocurrency companies have witnessed a dramatic drop of over 70% in the past year, according to data published by RootData, a crypto data provider.

The figures reveal a significant shift in investor sentiment, with only $520 million raised across 83 projects in June this year, marking the lowest-funded month to date.

The downward trend in venture capital interest within the digital asset space becomes evident when examining the data provided by RootData. Although there were sporadic increases in funding during certain months, the overall trajectory has been on a downward slope.

For instance, September 2022 saw record-breaking funding of $1.85 billion invested in 138 rounds, while June of the same year witnessed the highest number of recipients with 149 rounds.

Analyzing the recent data, it becomes apparent that the infrastructure category remains the frontrunner, receiving $213 million in funding last month across 26 projects.

However, even this category experienced a nearly 50% decrease from the previous month, when 28 projects secured $410 million in funding.

Pleased to have @a16zcrypto lead our $43M Series A and join us on the @gensynai journey!

Thanks also to @coinfund_io, @edenblockvc, @ZeePrimeCap, @Maven11Capital, @JSquare_co, @id4vc, Peer, @ai, @protocollabs, @M31Capital, and some fantastic angelshttps://t.co/F3QBWbX1v7

— Ben Fielding (@fenbielding) June 11, 2023

In particular, UK-based startup Gensyn AI emerged as the winner in the infrastructure category, securing an impressive $43 million in a Series A funding round led by a16z crypto, further emphasizing the growing importance of artificial intelligence in the industry.

Shifting Landscape: Institutional Traders Turn Towards Artificial Intelligence

According to a recent report by JP Morgan, institutional traders have also shifted their attention away from blockchain technology towards artificial intelligence (AI).

Over half of the institutional traders surveyed, totalling 835 individuals across 60 global markets, believe that AI and machine learning will be the most influential technologies shaping the future of trading in the next three years.

These technologies were cited four times more often than blockchain and distributed ledger technology.

The report sheds light on the evolving patterns in investment preferences within the crypto industry. Centralized finance (CeFi), embodied by firms like OPNX and Chiliz, emerged as the second most funded category, attracting a substantial $101 million, which accounted for nearly 20% of the total financing.

The gaming sector closely trailed behind, securing $62 million in funding, with Mythical Games claiming the majority portion by raising an impressive $37 million during its Series C1 round. DeFi and NFTs complete the list of categories, occupying the subsequent positions in the ranking.

Ethereum has emerged as the cryptocurrency with the most funded projects over the past year, with 1,826 rounds of funding, followed by Polygon (MATIC) at a distant second with 1,076 funding rounds.

Geographically, the United States claimed the largest portion of funding, receiving 34% of the total investments. However, this dominance may be subject to change as market dynamics evolve.

Coinbase Ventures secured the position of the most active venture capital firm, participating in 71 funding rounds over the past year. Hashkey Capital and Shima Capital followed closely behind, funding 54 and 49 projects, respectively.

The declining interest from venture capitalists in the crypto asset space can be attributed to various factors. The actions of companies like FTX and Terra, along with the recent banking turmoil that impacted all four “crypto-friendly banks,” have likely contributed to the decreased investor enthusiasm.

Furthermore, the regulatory clampdown in the United States, despite being a leader in crypto investments, has created an uncertain environment for investors.

While venture capital investments in cryptocurrency companies have experienced a sharp decline, alternative sectors such as artificial intelligence have garnered significant attention from investors.

AI’s ability to cater to a broader audience has been a driving factor in this shift, as stated by Evan Cheng, co-founder, and CEO of Mysten Labs. Cheng sees AI as complementary to Web3, and this sentiment is reflected in Justin Sun’s recent launch of a $100 million AI development fund.

As the crypto industry faces these challenges, it remains to be seen how it will adapt and whether new trends and technologies will reshape the landscape in the coming months.

While the trends say that VCs are veering away from crypto, there are presale investments still worth noticing.

Wall Street Memes is one of those presales that is trailblazing forward thanks to community support. Inspired by wall street bets, this token may lie as a testament to crypto’s strength tied to the community, not venture capitalists.

Related News

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage