Join Our Telegram channel to stay up to date on breaking news coverage

Digital asset investment funds experienced a continued trend of outflows, with $54 million exiting during the week ending on May 13, according to CoinShares’ weekly report.

Digital Asset Investment Funds See $54 Million Exit in a Single Week

The newly released numbers mark the fourth consecutive week of net outflows, coinciding with significant declines in cryptocurrency prices, including Bitcoin’s drop from above $28,000 to below $26,000 within that time frame.

CoinShares noted that the outflows were not limited to a few investors but were observed across various regions, indicating a negative sentiment prevailing among market participants.

Out of the total outflows, Bitcoin-related products accounted for $38 million, representing 80% of all outflows. Over the past four weeks, Bitcoin outflows alone reached $160 million, making up the majority of outflows in the crypto market during that period.

Despite multi-asset investments seeing outflows of $7 million, there was a notable influx of funds into eight distinct altcoins, such as Cardano (ADA), Tron (TRX), and Sandbox (SAND). This trend indicates a growing inclination among investors to embrace a more daring and discerning approach when it comes to their cryptocurrency portfolios.

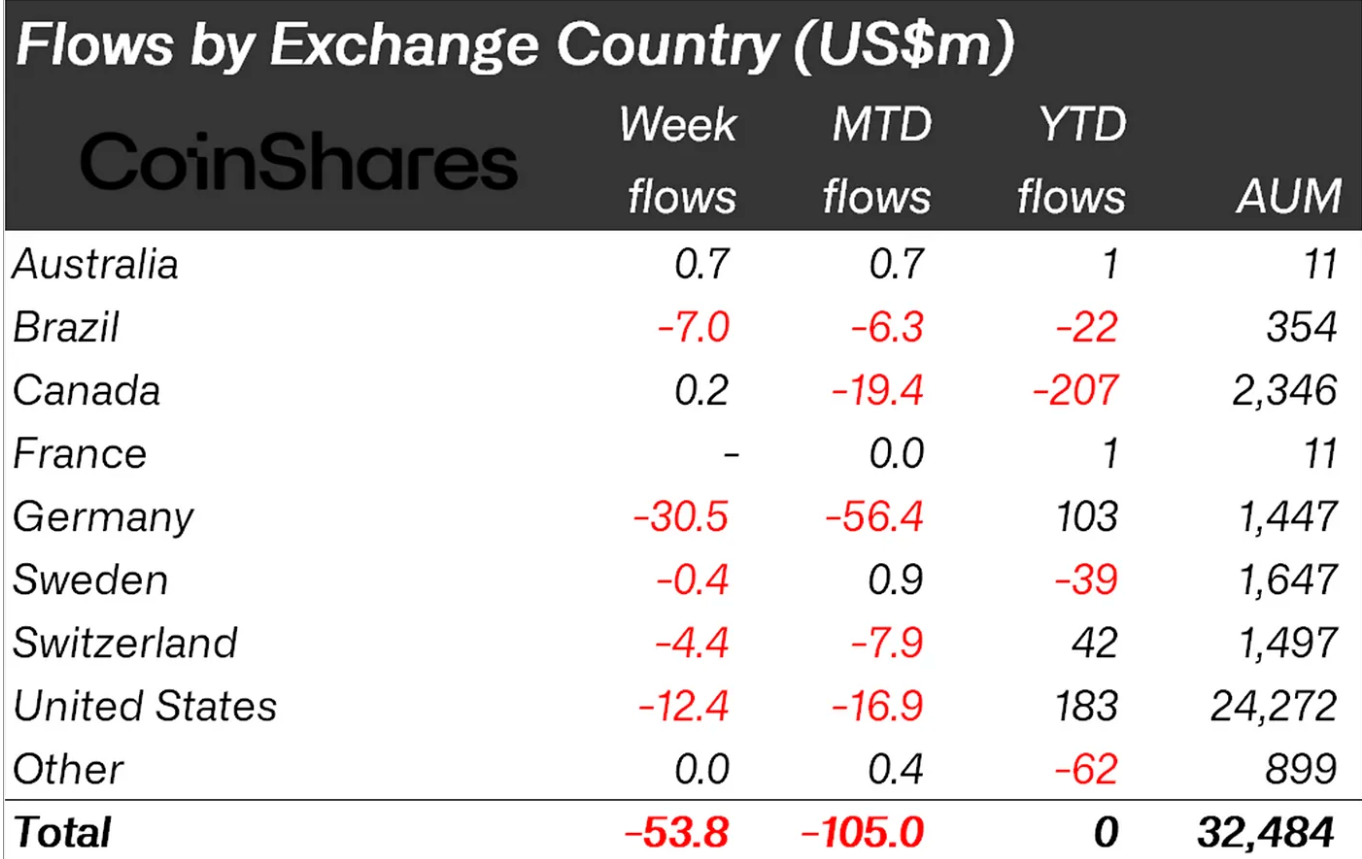

In terms of country-specific flows, Germany witnessed the largest outflows amounting to $30.5 million during the week, followed by the United States with $12.4 billion. Brazil recorded outflows of $7 million, while Switzerland saw $4.2 million leaving its digital asset investment products. Sweden experienced outflows of $400,000.

On the other hand, Australia and Canada reported positive inflows of $700,000 and $200,000, respectively. Inflows and outflows from France were not reported, and other countries had no significant inflows or outflows during the period.

The ongoing trend of outflows over the past four weeks has resulted in a total outflow of approximately $200 million, equivalent to 0.6% of the total assets under management.

These figures highlight the cautious sentiment prevailing in the digital asset investment space, with investors showing a preference for Bitcoin outflows while exploring select altcoins. The outflows were not confined to specific regions, indicating a widespread negative sentiment in the market.

Assessing The Potential Reasons For Consistent Cryptocurrency Outflows

In recent weeks, the cryptocurrency market has witnessed a significant trend of outflows from crypto investment funds. There are several factors that have collectively influenced this trend, with market volatility being the primary catalyst.

Cryptocurrencies, including Bitcoin, witnessed significant price fluctuations, causing some investors to adopt a cautious approach. The potential risks associated with such price volatility have prompted investors to withdraw their funds and seek more stable investment opportunities.

In addition to this, governments and regulatory bodies worldwide have been actively attempting to implement increasingly tighter measures to regulate the cryptocurrency market. Uncertainty surrounding future regulations can cause investors to become wary, leading to outflows from crypto investment funds as they seek a clearer regulatory landscape.

Another factor contributing to the outflows is profit-taking. Investors have seen substantial gains from the start of the year in their cryptocurrency investments and many have decided to capitalize on the profits.

Investor preferences can also influence the flow of funds. The crypto market has seen a growing interest in decentralized finance (DeFi) projects and non-fungible tokens (NFTs), which has led some investors to reallocate their funds to these emerging sectors. This shift in focus may have contributed to the outflows from traditional crypto investment funds.

The overall sentiment in the market can strongly impact investor behaviour. Negative news, market corrections, or concerns over an impending market bubble can create a sense of uncertainty and prompt investors to withdraw their funds.

Global Equity Funds Imitate Crypto Industry With Its 4th Week of Outflows

In the week ending May 10, global equity funds experienced their fourth consecutive week of outflows, attributed to concerns over the U.S. debt ceiling deadlock and economic slowdown.

Refinitiv Lipper reported that global equity funds saw outflows totalling $4.9 billion. U.S. equity funds faced outflows of $5.7 billion, while Asia and European funds saw modest inflows of $1.1 billion and $0.59 billion, respectively.

Sector-wise, financials witnessed the largest outflows, amounting to $1.5 billion, while real estate and energy sector funds had net sales of $446 million and $376 million, respectively.

Analysts warned that the ongoing disputes between Republicans and Democrats over the debt limit ceiling could harm the U.S. economy. In the event of a debt default, equities could suffer losses amounting to billions of dollars.

Despite U.S. inflation data indicating weakened price pressures, analysts remained cautious. Mark Haefele, Chief Investment Officer of Global Wealth Management at UBS, advised against assuming that lower-than-expected consumer price inflation for April would lead to another period of equity market outperformance.

He stated that equities face challenges due to elevated valuations, and high-quality bonds present a more appealing risk-reward opportunity, suggesting the time is right to diversify fixed-income exposure for stability in investment returns.

Continuing their trend for the third consecutive week, global bond funds experienced a significant influx of $3.4 billion. Within this category, government bond funds received a substantial amount of $3.01 billion, whereas high-yield bond funds and inflation-linked bond funds encountered outflows of $1.5 billion and $125.3 million, respectively.

Global money market funds continued to receive inflows for the third straight week, totalling $10.8 billion. Kendall Dilley, Portfolio Manager at Vineyard Global Advisors, noted that money market fund flows are expected to remain strong until the U.S. debt ceiling situation is resolved, regional bank stability is restored, and uncertainties surrounding a potential U.S. recession and downward earnings revisions diminish.

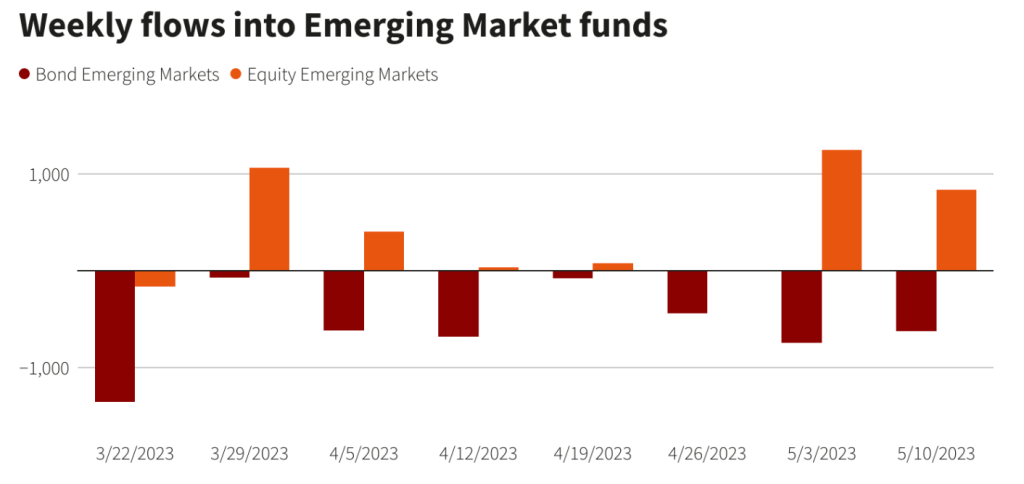

Data for 23,973 emerging market funds revealed net inflows of $838 million into equity funds, while bond funds experienced net outflows of $622 million.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage