Join Our Telegram channel to stay up to date on breaking news coverage

Paul Tudor-Jones views Bitcoin as having lost some of its shine. Regulatory challenges in the US and a slowdown in inflation are the primary reasons behind his revised stance. Nonetheless, he retains a modest investment in Bitcoin, although it no longer holds the same allure for him.

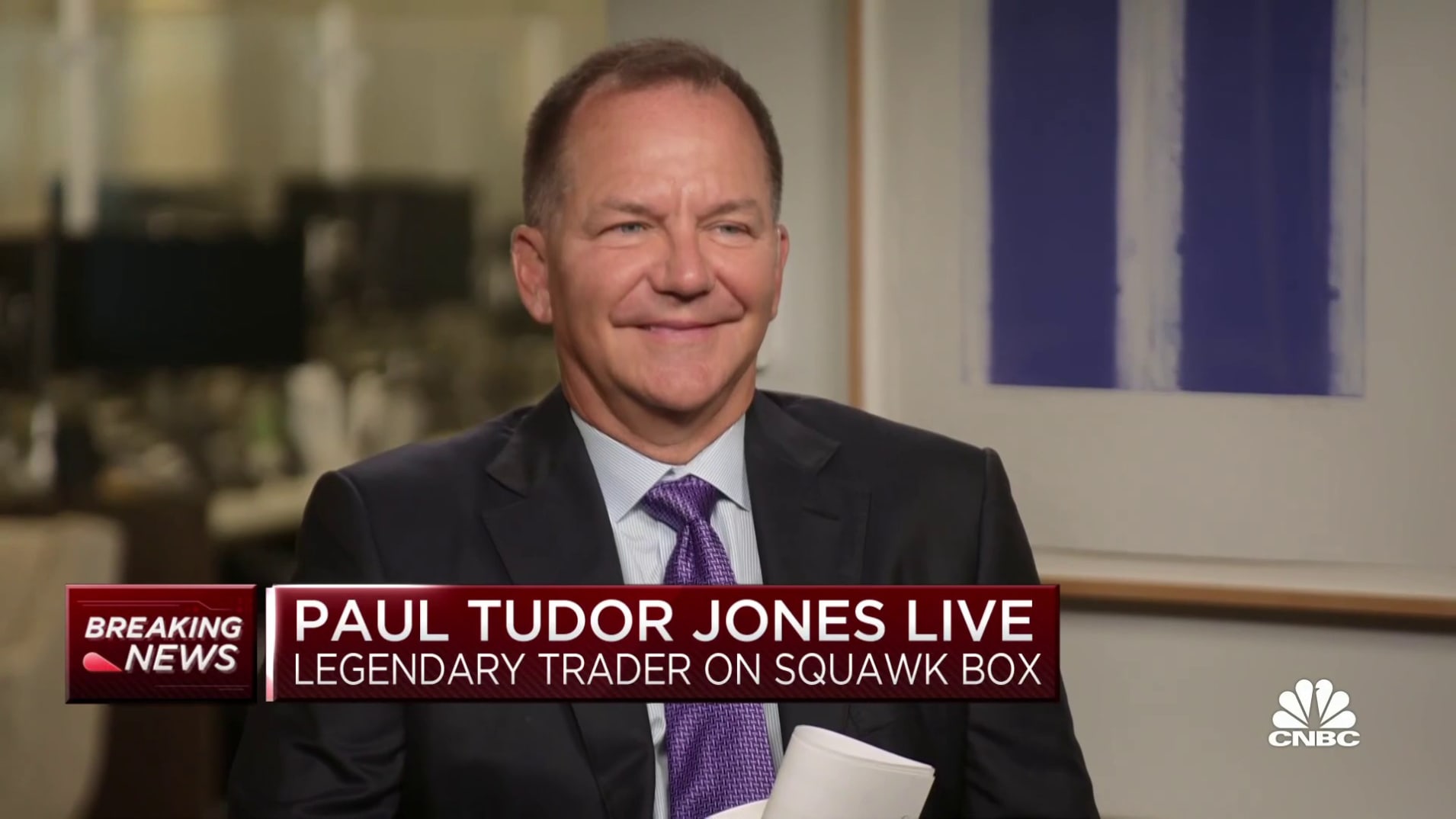

Bitcoin’s Luster Dims for Paul Tudor-Jones

Paul Tudor-Jones, a billionaire hedge fund manager, has shifted his perspective on Bitcoin, claiming that the cryptocurrency has lost some of its appeal. Previously, he lauded Bitcoin as an effective hedge against inflation, but now he cites two key factors that have diminished its attractiveness: regulatory challenges in the United States and a slowdown in inflation.

During an interview on CNBC’s Squawk Box, Jones expressed concerns about the regulatory environment in the US, stating that Bitcoin faces significant obstacles due to the opposition of the entire regulatory apparatus.

The Securities and Exchange Commission (SEC) has recently increased its enforcement actions against crypto startups and platforms, accusing them of breaching securities laws.

The regulatory crackdown has had a profound impact, even affecting prominent exchanges such as Coinbase and Kraken, with Coinbase considering relocating if regulatory clarity is not achieved.

Furthermore, Jones believes that inflation will continue to cool off, adding to the less optimistic outlook for Bitcoin.

In the past, Bitcoin was considered a store of value similar to gold, as its programmed code reduced the rate of supply expansion by 50% every four years. Jones had previously made a compelling case for using Bitcoin as a hedge against inflation in a widely recognized investor letter published in 2020.

Despite his diminished enthusiasm, Jones still maintains a minor allocation in Bitcoin. As the head of a company managing around $40 billion in assets, his continued interest in cryptocurrency demonstrates that he has not entirely abandoned it.

Jone’s History With Bitcoin – From Attractive Investment to Fading Appeal

Paul Tudor Jones has a noteworthy history with Bitcoin that has captivated the attention of the financial world. His first public mention of the cryptocurrency came in May 2020 when he revealed his investment in Bitcoin futures as a hedge against the potential inflationary impact of the unprecedented monetary stimulus measures implemented by central banks in response to the COVID-19 pandemic.

Jones’s investment in Bitcoin was seen as a significant endorsement of the cryptocurrency, given his reputation as a successful investor with a keen eye for market trends.

He compared Bitcoin to investing in early-stage tech companies like Apple and Google, emphasizing its potential for significant upside growth. His bullish outlook on Bitcoin brought mainstream attention and credibility to the cryptocurrency, further fueling its popularity and adoption.

Jones’s rationale for investing in Bitcoin centred around its scarcity and its potential as a store of value akin to gold. He praised Bitcoin’s finite supply and highlighted the halving event, which reduces the rate of new supply entering the market every four years, as a catalyst for increased demand and potential price appreciation.

Since his initial investment, Jones has remained an advocate for Bitcoin, frequently discussing the cryptocurrency in interviews and public appearances. However, his views on Bitcoin have evolved over time.

In 2021, he expressed concerns about Bitcoin’s regulatory challenges in the United States and the potential impact of government intervention on its value. In his most recent remarks, Jones suggested that Bitcoin has lost some of its allure, citing the challenging regulatory environment and the slowdown of inflation as key factors as mentioned above.

Paul Tudor Jones’s involvement with Bitcoin has had a significant impact on the perception and acceptance of cryptocurrencies within traditional finance circles. His endorsement and ongoing interest in Bitcoin have helped legitimize it as an investment asset class and have sparked discussions about its role in diversified portfolios.

Jones on Fed’s Interest Rates and Stock Market

Jones recently shared his perspective on the Federal Reserve’s interest rate policy and its implications for the stock market, apart from sharing his reversed stance on Bitcoin’s future.

In the interview on CNBC’s “Squawk Box,” Jones shared his view that the Fed could declare victory in its fight against inflation, pointing to the Consumer Price Index (CPI) declining for 12 consecutive months, an unprecedented occurrence.

Drawing parallels with the market conditions of mid-2006, before the onset of the global financial crisis, Jones noted a sustained upward trajectory in stock prices for more than a year following the conclusion of the Federal Reserve’s tightening of monetary policy.

Based on this historical context, he expressed his anticipation of continued growth in equity prices throughout the year, albeit at a moderate pace. Importantly, he emphasized a cautious approach, clarifying that he held a more reserved outlook and anticipated a gradual and steady rise instead of excessive optimism.

Jones also acknowledged the potential for short-term market volatility due to the U.S. debt ceiling issue. However, he saw this as an opportunity to buy the dip, suggesting that he would take advantage of any political volatility to make strategic investments.

Jones also observed a lack of initial public offerings (IPOs), secondary offerings, and deal-making activities in the market. Despite valuations reaching 19, he found it notable that there was no rush to offer securities, suggesting an internal shift within the stock market.

He interpreted this as a constructive sign from a flow standpoint, indicating the presence of untapped potential and “dry powder” waiting to be deployed for future investments.

Renowned for his successful prediction and profit from the 1987 stock market crash, Jones carries significant credibility in the financial industry. In addition to his hedge fund management, he is the chairman of Just Capital, a nonprofit organization that evaluates U.S. companies based on social and environmental metrics.

Jones’s insights and predictions carry weight due to his successful track record and expertise in financial markets. While he sees positive prospects for the stock market, he remains cautious and expects a slow and gradual ascent rather than an abrupt surge.

Read More:

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage