Join Our Telegram channel to stay up to date on breaking news coverage

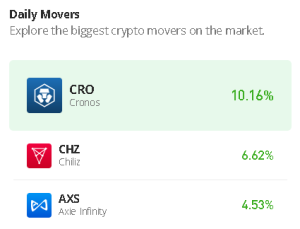

If the Cronos (CRO) price creates more additional uptrends, it will be technically and fundamentally ready to break above the $0.120 level.

CRO Prediction Statistics Data:

- CRO price now – $0.11

- CRO market cap – $2.9 billion

- CRO circulating supply – 25.2 billion

- CRO total supply – 30 billion

- CRO Coinmarketcap ranking – #27

CRO/USD Market

Key Levels:

Resistance levels: $0.140, $0.150, $0.160

Support levels: $0.090, $0.080, $0.070

Your capital is at risk

After crossing above the 9-day and 21-day moving averages, CRO/USD is trading above the 9-day and 21-day moving averages as the coin kick-starts an additional bullish run. The break towards the upside is the first signal needed for a bullish to press higher. Therefore, Cronos price has to break above $0.120 before hitting $0.130.

What to Expect from Cronos (CRO) as Tamadoge Follows the Positive Direction

According to the chart, if the buyers continue to grind higher, the first resistance level of Cronos price may come at $0.140 as this could also be followed by $0.150. However, additional resistance may also be found at $0.140, $0.150, and $0.160 respectively. On the other side, if the Cronos price moves below the lower boundary of the channel, it could hit the first support level at $0.100

Beneath this, staying below the moving averages may lead to the critical support levels at $0.090, $0.080, and $0.070. Meanwhile, the technical indicator Relative Strength Index (14) is moving to cross above the 50-level, which indicates that buyers are likely to gain control of the market momentum.

Against Bitcoin, the daily chart shows that the Cronos price is hovering above the 9-day and 21-day moving averages before crossing above the upper boundary of the channel. However, as soon as the coin crosses above the channel, there is a possibility that additional benefits could be obtained in the long term. Therefore, the next resistance key above this level is close to the 650 SAT level. If the price keeps rising, it could even break the 680 SAT and above.

However, if the bears regroup and slide below the moving averages, the support level of 550 SAT may play out before rolling to the critical support at 520 SAT and below. The Relative Strength Index (14) is moving to cross into the overbought region, suggesting more bullish signals.

The Tamadoge project has several new exchange listings planned however OKX will be its initial exchange offering (IEO), i.e. the first place to support trading of Tamadoge.

Related:

Join Our Telegram channel to stay up to date on breaking news coverage