Join Our Telegram channel to stay up to date on breaking news coverage

Facebook is being put under some serious pressure to appear before regulators over the prospective launch of its Libra stablecoin. However, instead of getting David Marcus or some other official at the firm, the company’s top executives are now being called out.

Regulators want to talk

Earlier this week, news medium The Information reported that the United States House Financial Services Committee has called on Facebook Chief Operating Officer Sheryl Sandberg to testify before it concerning the social media giant’s plan for Libra.

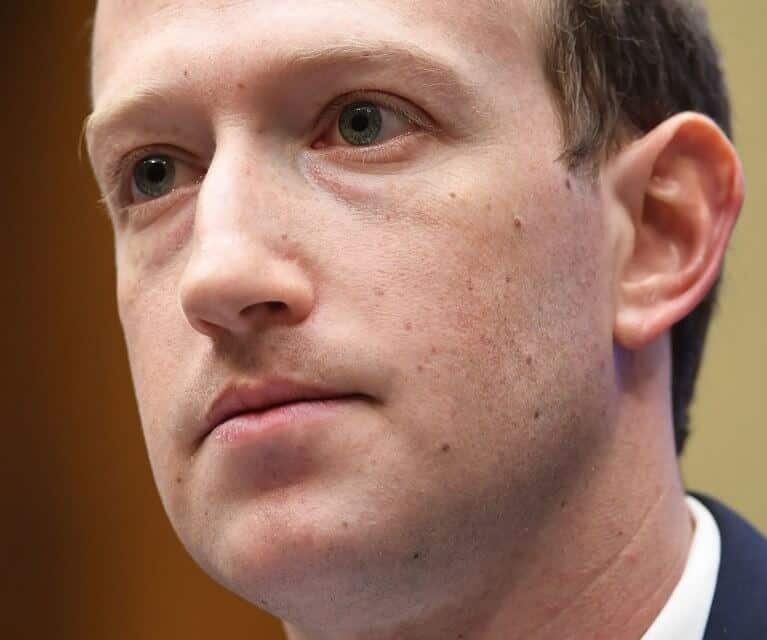

However, the invitation is also coming with a significant condition; chief executive Mark Zuckerberg must also provide his consent to appear before the Committee sometime before January 2020. Ever since Facebook dropped the whitepaper for Libra in June, lawmakers have made it their mission to scrutinize the asset in every way they possibly can. However, no other body on Capitol Hill has paid as much attention to Libra as the Financial Services Committee has.

The Committee was the first to sound off on Libra, with Chairperson Rep. Maxine Waters (D-CA) calling for Facebook to halt the development of the stablecoin a few days after the whitepaper was published.

Should this testimony with Sandberg take place, sources close to The Information claim that the COO is set to be grilled over Libra and the advertising policies employed by the social media giant.

The hearing will also make Sandberg the second executive from Facebook to testify before Congress concerning Libra. Back in July, David Marcus, the Blockchain Head of the company and head of its Calibra division, spoke on the fine details of the asset, including its Anti-Money Laundering (AML) and other compliance measures, as well as on the topic of government and public trust in Facebook’s customer surveillance and data collection measures.

In truth, Marcus’ session before Congress did little to convince lawmakers on whether Libra will be more of an asset than a threat. If the head of Calibra himself couldn’t sell Congress on Libra, then Sandberg and Zuckerberg really are the only two people who will be able to get that done.

A different approach

It definitely is helpful that Zuckerberg seems ready to accept oversight and play by the rules as they gear up for Libra. Earlier this week, tech news medium The Verge published an audio text from two internal meetings held at Facebook in July.

Along with the potential for lawmakers to order the breakup of the social media company, Zuckerberg shared a bit of their strategy for Libra. He claimed that they would be holding a consultative approach around Libra, claiming that Facebook and the Libra Association will work towards solving certain issues before the stablecoin is launched.

“We want to make sure. We get that there are real issues. Finance is a very heavily regulated space. There’s a lot of important issues that need to be dealt with in preventing money laundering, preventing financing of terrorists, and people whom the different governments say you can’t do business with. There are a lot of requirements on knowing who your customers are,” he said.

Join Our Telegram channel to stay up to date on breaking news coverage