Join Our Telegram channel to stay up to date on breaking news coverage

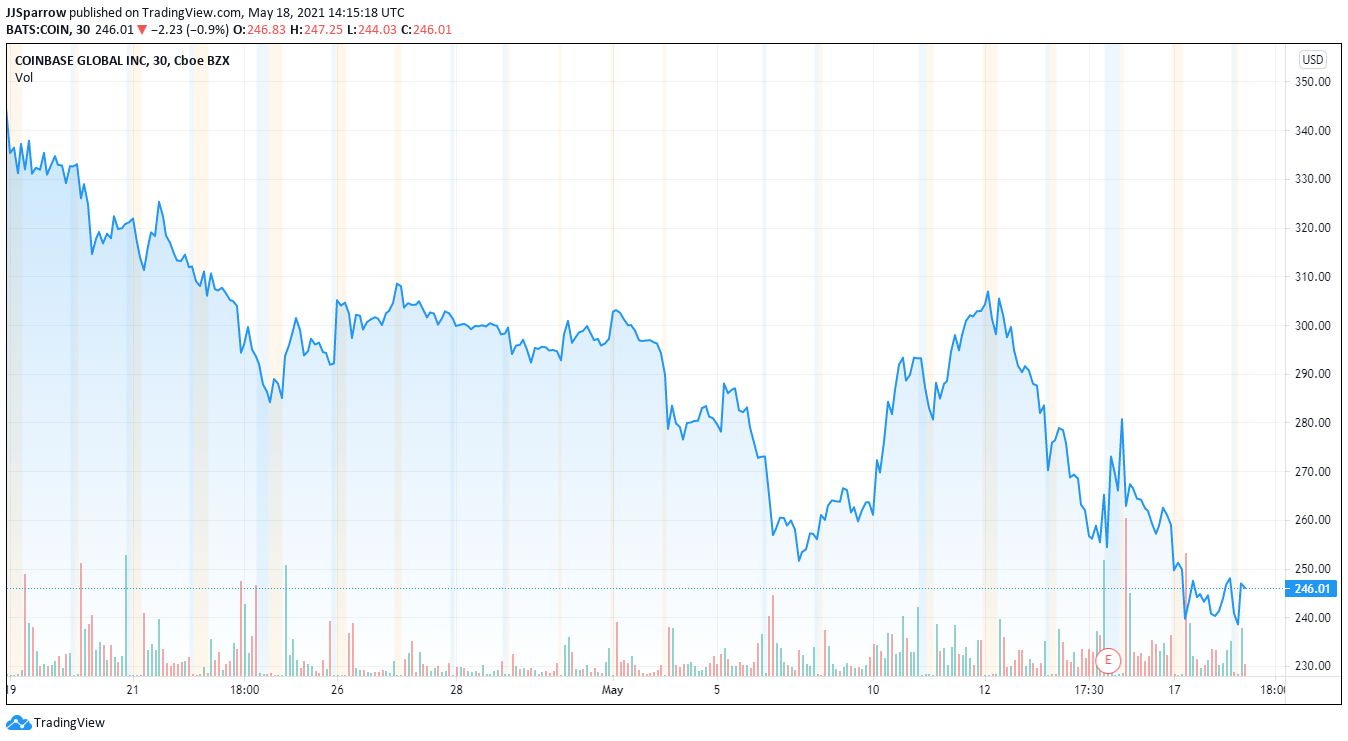

Despite what was a strong earnings performance for crypto exchange Coinbase (COIN) in its first report as a publicly-traded company, the stock hasn’t stopped falling since its direct listing.

In its Q1 2021 earnings report, the Bitcoin exchange revealed a total revenue of $1.8 billion, compared with $585 million in Q4 2020. In addition, Coinbase reported that its total trading volume stood at $335 billion, with institutional investors trading the most, at $215 billion. Retail investors contributed $120 billion in the first three months of the year.

Bitcoin is a Double-Edged Sword for Coinbase

Coinbase said that Bitcoin accounted for 39% of trades by value 39, Ethereum at 21%, and other altcoins making up the remaining 40%. The exchange also said that it took in $1.5 billion in retail transaction revenue i the highlighted period.

The shares performance since listing on Nasdaq has been dire, seeing it drop from $328 on the opening day to $248, falling 10.13% in the last 24hrs.

The bearish price action is primarily because Coinbase’s stock is tied to the success of the crypto market, especially Bitcoin. And with the broader crypto market suffering a major relapse since Tesla’s decision to stop accepting BTC for its electric sedan, Coinbase stock value has tanked along with Bitcoin’s.

The wider crypto market is showing signs of panic – at least among newer investors. The total market cap of the crypto market has fallen from the highs of $2.3 trillion to $2.12 trillion.

New Funds Should Be Used For Diversification

Still, Coinbase is raising more funds. The exchange revealed in a Monday release that it intends to offer $1.25 billion of convertible debt to qualified institutional buyers. According to Coinbase, this debt will mature in 2026 and be converted to its Class A common stock.

Many financial experts see this as an opportunity for the crypto exchange to grow. Industry experts are urging the crypto exchange to diversify its offerings to arrest its dependence on Bitcoin price action. According to them, the expected funds should create more revenue sources around the crypto space.

Speaking to news outlet MorningStar, Chief Investment Officer of crypto hedge fund Tradecraft Capital, Jake Ryan said Coinbase’s revenue dried up during the crypto bear market of 2018. He also recommended that new funds raised from the convertible debt be channeled towards acquisitions and beefing up its crypto financial services.

Staking could be big revenue stream for Coinbase

Others such as Kyle Voigt of Keefe, Bruyette & Woods have called on the crypto exchange to create other revenue sources. Coinbase can look to staking to monetize its already large customer base, according to the Wall Street analyst.

Although Coinbase said in its Q1 earnings call that it made about $10.3 million as staking revenue, Voigt believes the hype surrounding Ethereum’s migration to proof-of-stake (PoS) could net the exchange over $100 million in revenues in 2023.

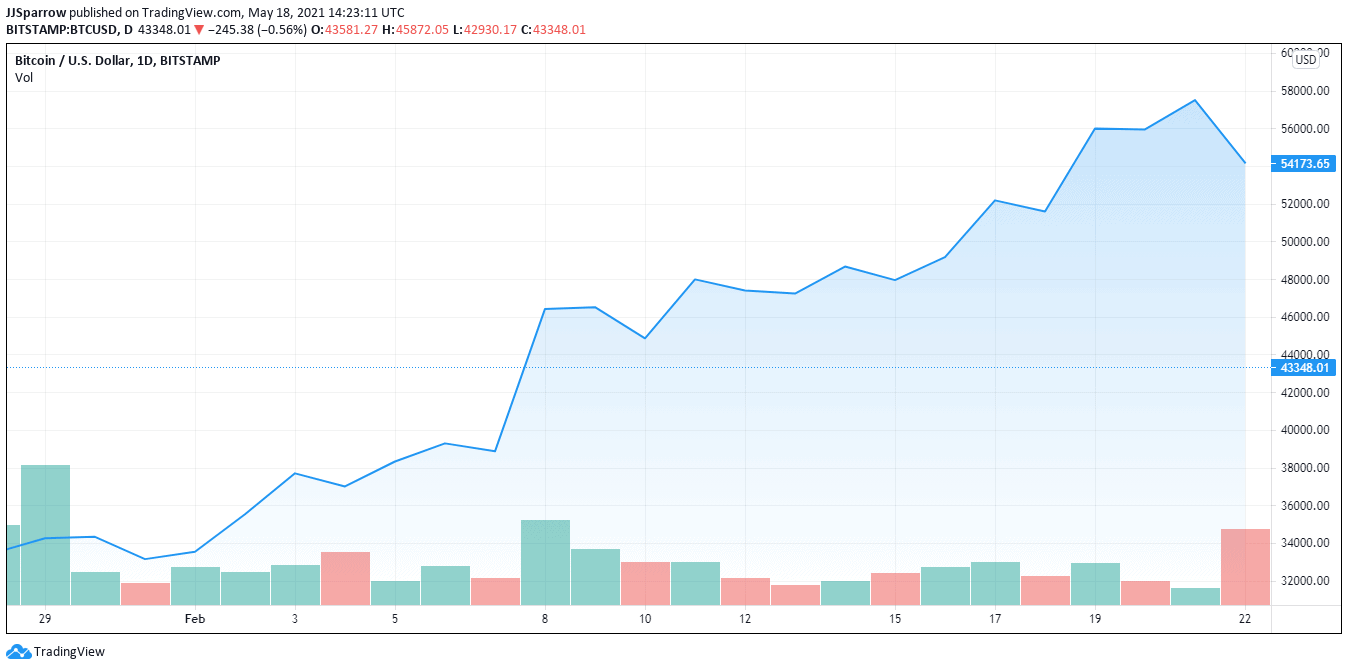

Cryptocurrencies have grown in the last few months due to several reasons, namely their massive returns on investments and the growing belief that digital assets, like Bitcoin, are a store of value.

An announcement by electric car company Tesla Inc. on Feb. 28 saw a wider adoption of Bitcoin, subsequently leading to BTC surging beyond the $50,000 mark.

This momentous adoption saw more engagements with the crypto space, and the burgeoning industry became a trillion-dollar industry in just a dozen years.

Bitcoin has continued to surge, reaching a new all-time high of $65,000 before the market correction, and one of the beneficiaries of the bullish crypto run has been Coinbase.

Could Coinbase Stock Slide Further?

Coinbase may have risen on the wings of the Bitcoin boom, but the market sentiment seems to be taking a turn for the worse following Tesla’s BTC snub.

According to a Markets Insider report, many Bitcoin traders plan to short the world’s largest cryptocurrency. This has seen many Bitcoin traders assume bearish positions, predicting that the BTC price may fall below the $40,000 mark.

Data from bybt.com notes that over $3 billion worth of open interest in BTC put options are currently in the crypto market.

Put options signal more bitcoin selling pressure

Commenting on the market reaction, Pankaj Balani of crypto derivatives exchange Delta, noted that the growing volume of put options indicates pessimism on the general outlook of Bitcoin.

Even though crypto stalwarts like Square’s Jack Dorsey have come out to defend the embattled crypto asset, the continued decline in its price could see Coinbase’s stock price plummet alongside.

Speaking on Coinbase’s valuation, InvestorPlace’s Josh Enomoto noted that cryptocurrencies could not continue to support Coinbase’s market valuation.

He also pointed out that regulatory challenges could further see the company have a hard time in achieving its aim of becoming the biggest crypto exchange given its high fees.

Get Free Crypto Signals – 82% Win Rate!

3 Free Crypto Signals Every Week – Full Technical Analysis

Join Our Telegram channel to stay up to date on breaking news coverage