Join Our Telegram channel to stay up to date on breaking news coverage

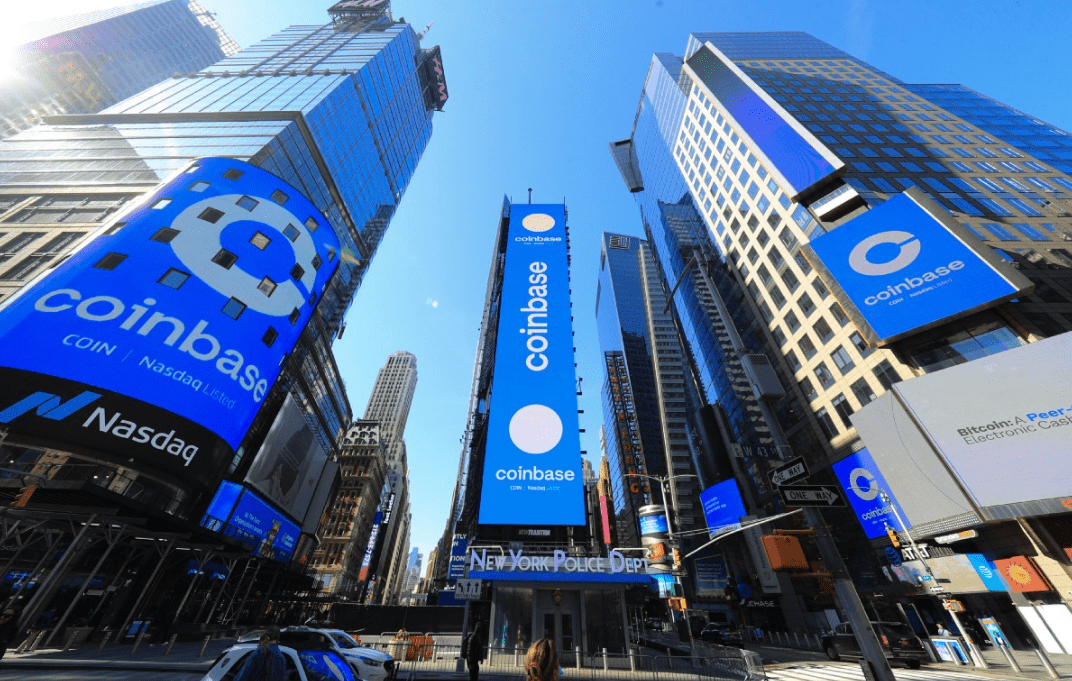

Leading cryptocurrency exchange Coinbase has announced the launch of Ether (ETH) staking service for institutional investors in the US. This comes as the Ethereum network approaches its long-awaited proof-of-stake (PoS) network transition.

Following the launch, US institutional investors can now stake ETH with Coinbase Prime accounts and participate in the yield sharing after the PoS transition, expected before the end of the year.

Coinbase Prime Gives Investors Access To Several Services

The new Coinbase Prime account gives institutional investors access to different services such as advanced trading, staking, and offline storage. The new account allows customers to stake their ETH on Coinbase with ETH2 used to represent the staked crypto asset.

Both the ETH2 and ETH prices are identical. Coinbase stated that after the completion of the Ethereum PoS upgrade, both tickets ETH and ETH2 will merge into one ticker: ETH.

Your capital is at risk.

Coinbase added that the institutional clients with Coinbase Prime have several options when accessing other crypto assets. They can access staked services for Polkadot, Solana, Tezos, Cosmos, Celo, and other assets.

The Merge Is Expected To Improve Scalability

Ethereum’s transition to proof-of-work (PoS), also called The Merge, is one of the most eagerly anticipated upgrades in the crypto industry.

The proof-of-work (PoW) consensus algorithm has been criticized for its numerous issues, including high cost and energy consumption. But the PoS network will bring a lot of benefits. It is expected to significantly reduce the energy consumption of the Ethereum blockchain, and improve scalability, as well as security.

It will represent a formal adoption of the Beacon Chain, the backbone of the ETH 2.0 architecture. The Merge has gone through several testing stages and is currently under its last testing phase before being launched.

Last week, the network developers stated that the final testnet will roll out between August 6 and 12. After completing the testnet with no serious issues, the developers expect to implement the Merge on September 19.

In anticipation of the Merge, Ether holders have deposited over 13.8 million ETH on the Beacon Chain. The total amount now staked is 13,877,800 ETH, valued at $21.9 billion at the time of writing.

Read more:

Join Our Telegram channel to stay up to date on breaking news coverage