Join Our Telegram channel to stay up to date on breaking news coverage

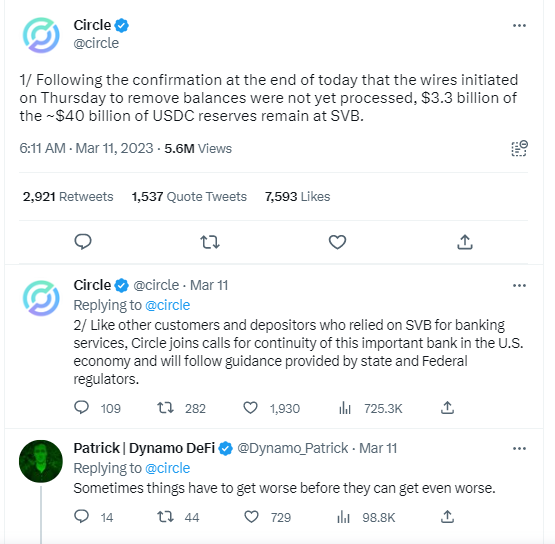

Circle Internet Financial has vowed to cover any shortfall in its stablecoin, USD Coin (USDC) after the cryptocurrency lost its dollar peg over the weekend. The company held $3.3 billion of its $40 billion USDC reserve at Silicon Valley Bank before it collapsed on Friday.

According to a blog post from Circle, the company will “stand behind” the stablecoin and use corporate resources, including external capital, to make up any shortfall. Circle also assured investors that USDC liquidity operations will resume as normal when banks open on Monday morning in the United States and that the stablecoin will remain “redeemable 1 for 1 with the U.S. dollar”.

Additionally, the company stated that it attempted to move its assets before the bank’s collapse, but it remains unclear whether it will return them. Joseph Edwards, an investment advisor at Enigma Securities, described the situation as “extremely serious” for USDC and said that “this sort of depeg on a stablecoin undermines confidence in it.”

“However, it is also possible that SVB may not return 100% and that any return might take some time, as the FDIC issues IOUs (i.e., receivership certificates) and advanced dividends to deposit holders,” Circle said.

The announcement sparked a rally in the stablecoin’s value, but the coin experienced a drop in value and broke its 1:1 dollar peg. USDC fell to an all-time low of $0.88 before rebounding to $0.97 and now sitting at $0.955.

Stablecoins are cryptocurrencies designed to maintain a constant exchange rate with fiat currencies, such as the U.S. dollar. USDC is the second-largest stablecoin with a market cap of $37 billion, but its price usually holds close to $1.

Regulators Urged to Find a Silicon Valley Bank Buyer

The sudden drop in its value over the weekend has led to concerns among traders, who fear the collapse of Silicon Valley Bank could have a contagion effect on the financial sector and beyond.

Regulators have been urged to find a buyer for Silicon Valley Bank, which collapsed in the largest U.S. bank failure since the 2008 financial crisis. The bank’s collapse has stranded billions of dollars belonging to companies and investors, and has led to concerns over the stability of the financial system.

Meanwhile, U.S. crypto exchange Coinbase has suspended the exchange of USDC for U.S. dollars over the weekend, citing “heightened activity,” and plans to resume swaps on Monday.

Circle’s pledge to cover any shortfall in USDC reserves has eased concerns among investors, but the situation remains uncertain until the outcome of Silicon Valley Bank’s collapse is clearer. Using stablecoins has surged in recent years, with USDC and Tether, the two largest stablecoins with a combined market cap of $72 billion, being used in cryptocurrency trading.

Despite the current uncertainty, Circle’s assurance that USDC will remain redeemable 1 for 1 with the U.S. dollar may help to restore confidence in the stablecoin, and the wider use of stablecoins in the cryptocurrency market.

More News:

There’s no need to panic about the USDC depegging

Circle finally assures investors that it will support USDC

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage