Join Our Telegram channel to stay up to date on breaking news coverage

For the better part of a month, the Chinese government has come out on several occasions to endorse blockchain, with speech after speech promising to treat the technology as an integral part of the Xi administration’s vision of boosting the Chinese economy.

However, instead of just declaring support for emerging technology, Beijing is now backing its talk with some action. On November 6, the Hong Kong Monetary Authority (HKMA) announced via a news post that it had signed a Memorandum of Understanding (MoU) with the Digital Currency Institute, a subsidiary of the People’s Bank of China (PBoC), to help bolster trade relations between Hong Kong and mainland China.

Blockchain tech for Enhanced Trade Efficiency

As the news post reveals, the deal between the two parties will be geared towards the creation of Proof-of-Concept for a trading platform that will be launched in the first quarter of 2020. Essentially, this trading platform will help bolster trade finance operations, connecting the HKMA’s eTradeConnect and the PBoC’s Industry Finance Platform.

Established in October 2018, the eTradeConnect is an encompassing, blockchain-based trade platform that brings buyers and sellers together to create, exchange, and match trade invoices with purchase orders. As things stand, 12 banks have signed up to be members of the platform, including London-based banking giants HSBC and Standard Chartered.

According to the HKMA announcement, the new pact will provide a seamless experience to banks, which will include full-service trade finance services. It was billed to also “enable banks in Hong Kong to expedite the expansion of their trade finance business as soon as the connection has successfully been established.”

The announcement also included a commitment by the HKMA to use blockchain technology to digitize trade transactions on the Hong Kong-based Innovation Hub owned by the Bank of International Settlements.

As part of the MOU signing, HKMA CEO Eddie Yue called for a holistic approach to using blockchain and other technologies to lift Hong Kong’s FinTech development to new heights. He also praised the technological development that Hong Kong has seen, pointing to it as a sign of better things to come.

The Chinese Blockchain Hype Rolls On

Of course, this isn’t the only commitment by the Chinese government to optimize the economy with blockchain. On October 30, Dovey Wan, a Senior Executive at blockchain investment firm Primitive Ventures, announced via a tweet that Beijing had pledged a 10 billion RMB (~$150 million) fund, which will help enhance the development of several blockchain projects.

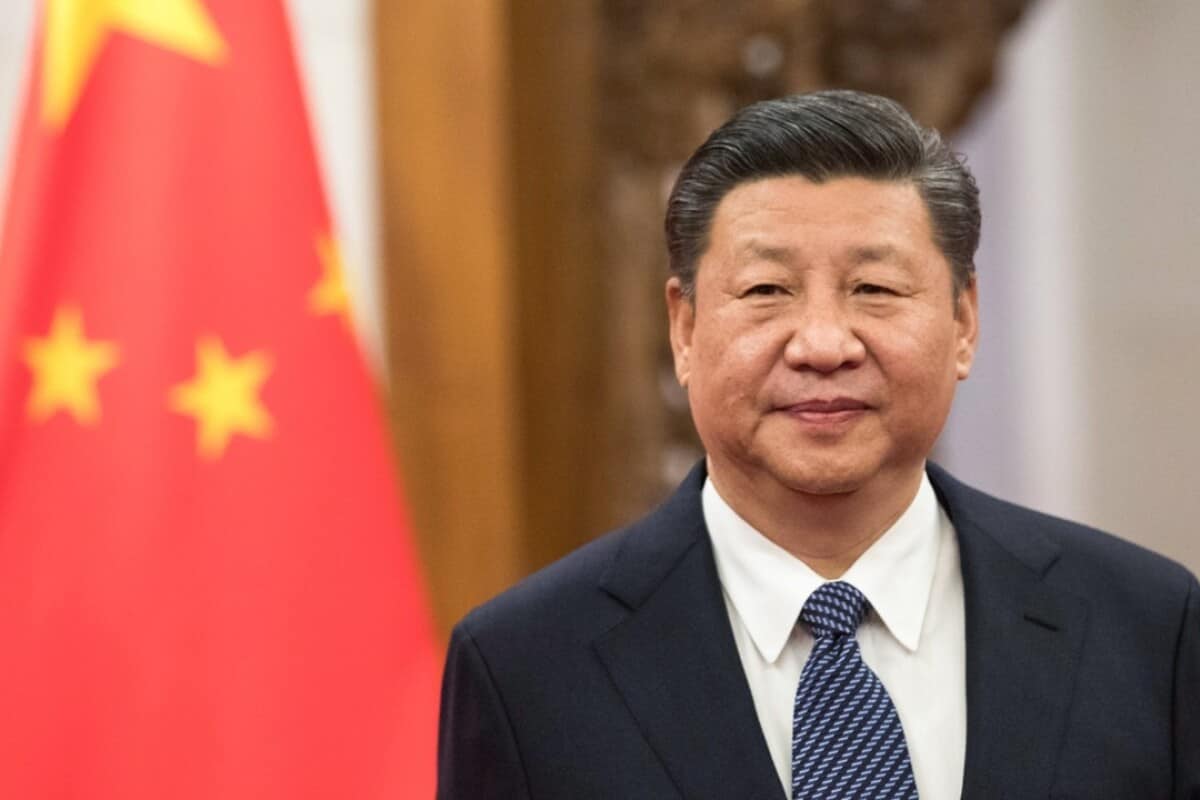

All of this is continuing a hype train that was set off by Chinese President Xi Jinping when he touted blockchain as a means of developing the country’s economy last month. Xi added that it wouldn’t be enough just to adopt the blockchain technology, calling for further support, research and investment to improve and increase the pace of development in China.

Join Our Telegram channel to stay up to date on breaking news coverage