Join Our Telegram channel to stay up to date on breaking news coverage

Cryptocurrency-related crimes saw a significant reduction in 2023, with stolen assets from scams dropping by almost one-third compared to the previous year, as per an upcoming Chainalysis report. The complete report is expected to be published in February, and it also highlights a substantial decline of over 54% in illicit revenue.

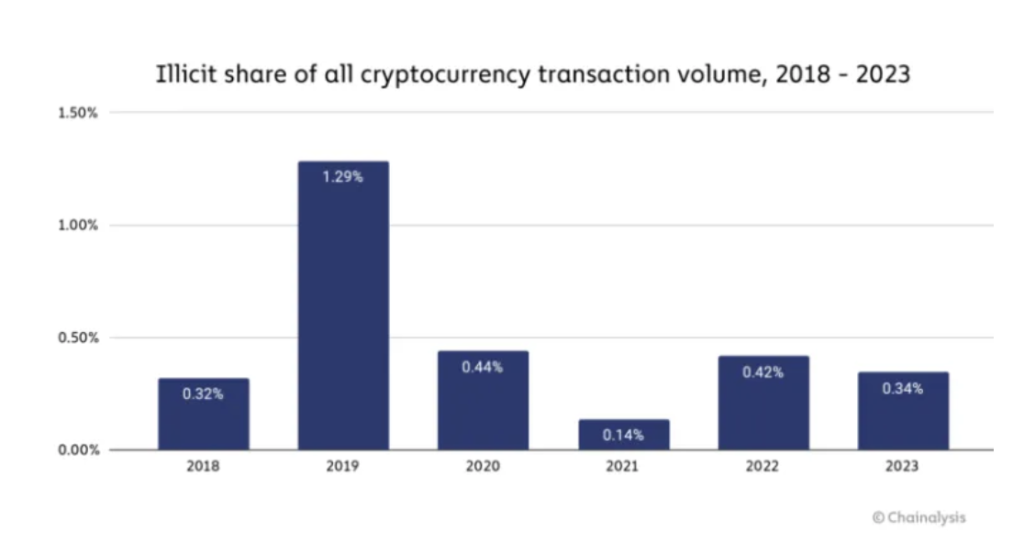

In 2023, stolen cryptocurrency made up just 0.34% of total on-chain transactions, amounting to $24.2 billion. This marks a noteworthy improvement from the prior year when it constituted 0.42% of transactions, translating to a substantial $39.6 billion. These statistics include funds sent to addresses categorized as “illicit” and assets stolen during various cyber hacks.

It’s essential to note that the unusually high figures in 2022 included $8.7 billion linked to FTX creditor claims. Chainalysis clarified its approach, stating, “In last year’s report, we chose to exclude transaction volumes associated with firms like FTX until legal processes concerning alleged fraudulent activities were resolved.” This change in methodology followed the legal verdict against FTX founder Sam Bankman-Fried, who was found guilty of seven fraud and conspiracy charges in November 2023.

Throughout the year, a credit market on the Optimism Network was hacked in August, resulting in the theft of 4,323.6 ETH, valued at approximately $7 million at the time. Furthermore, Canadian authorities reported that citizens lost over $22.5 million in cryptocurrency-related scams in October.

Last year, the U.S. Department of Justice pressed charges against three U.S. based individuals accusing them of laundering over $10 million in cryptocurrency. If convicted, they could face up to 30 years in federal prison. During the same period, Chainalysis collaborated with the DOJ to freeze $225 million in USDT linked to human trafficking.

Chainalysis also observed a shift in the tactics of cybercriminals. While Bitcoin remained the leading cryptocurrency, it was no longer the preferred choice among scammers. Stablecoins had gained prominence, primarily due to their high liquidity. The firm pointed out that stablecoins now accounted for the majority of illicit transaction volume, although this wasn’t the case for all cryptocurrency-related criminal activities.

Through 2021, Bitcoin reigned supreme as the cryptocurrency of choice among cybercriminals, likely due to its high liquidity. But that’s changed over the last two years, with stablecoins now accounting for the majority of all illicit transaction volume.

Despite the decrease in stolen cryptocurrency, the report highlighted a surge in criminal activities such as ransomware attacks and darknet market operations, which yielded significant revenues compared to the previous year.

Senator Elizabeth Warren of Massachusetts, a vocal critic of cryptocurrency, urged federal regulators to intensify their efforts to combat illegal activities involving digital currencies. She expressed concern that cryptocurrency lobbyists were undermining bipartisan initiatives aimed at preventing cryptocurrency from financing terrorism.

In a separate development, the United Nations Office on Drugs and Crime (UNODC) reported an increase in money laundering through online casinos in East and Southeast Asia. Transnational organized crime in the region has evolved rapidly, with a significant shift towards technology adoption, as highlighted by Jeremy Douglas, Regional Representative Southeast Asia and the Pacific, in the UN’s report.

TRON Blockchain Used for Money Laundering?

Additionally, the UN report emphasized the role of USDT stablecoin, particularly on the Tron blockchain, in money laundering activities in Southeast Asia due to its stability, transaction anonymity, and low fees. It’s worth noting that the United States has pledged to crack down on crypto firms that fail to prevent and report illicit money flows, with recent legal actions against prominent figures in the crypto industry.

Blockchain security firm CertiK also reported a positive trend in 2023, with crypto hack revenue decreasing by over 51%. This development marked a significant improvement in blockchain security, as noted by CertiK co-founder Ronghui Gu.

Related News

- Tether CEO’s Letter Highlights Collaboration with Law Enforcement and Stablecoin Stability

- Chainalysis: A startup that helps governments trace crypto

- Tether’s Ascent: The 11th Largest Bitcoin Holder and Its Potential Impact on the Crypto Market

- Why The Humbling Of Binance And CZ Is A Boon For BlackRock, Spot Bitcoin ETFs And New $BTCETF Token That’s Raised $1.34m

Best Wallet - Diversify Your Crypto Portfolio

- Easy to Use, Feature-Driven Crypto Wallet

- Get Early Access to Upcoming Token ICOs

- Multi-Chain, Multi-Wallet, Non-Custodial

- Now On App Store, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Monthly Active Users

Join Our Telegram channel to stay up to date on breaking news coverage